Dogecoin Hits 40-Day Low Amid Mid-Range Meme Coin Surge: On-Chain Data Signals Cooling Selling Pressure

Dogecoin on-chain data indicates a decrease in selling pressure, suggesting a potential shift in market sentiment. The DOGE price has bounced back strongly amid the broader market recovery following the release of the US CPI data. On June 11th, Dogecoin’s price dipped below the $0.14 mark, reaching lows not seen in 40 days. However, despite [...]

- Dogecoin on-chain data indicates a decrease in selling pressure, suggesting a potential shift in market sentiment.

- The DOGE price has bounced back strongly amid the broader market recovery following the release of the US CPI data.

On June 11th, Dogecoin’s price dipped below the $0.14 mark, reaching lows not seen in 40 days. However, despite this downtrend, on-chain data suggests a decrease in selling pressure.

In recent weeks, the global memecoin markets have seen notable activity. Interestingly, a trading pattern has emerged where investors are shifting their focus away from mega-cap assets like Dogecoin (DOGE) and Shiba Inu (SHIB) towards mid-range memes.

The downtrend in Dogecoin’s price is becoming concerning, with a loss of 22.54% since the decline began around May 26th. As of June 11th, DOGE’s price had fallen below $0.137.

Similar to SHIB, Dogecoin has been experiencing a downward trajectory since late May. Meanwhile, other meme tokens like PEPE have reached new all-time highs, and Floki Inu (FLOKI) has seen significant gains following the approval of the Ethereum ETF.

Despite the struggle for momentum in Dogecoin’s price, on-chain data indicates that existing holders are becoming increasingly reluctant to sell.

Dogecoin Selling Pressure Drops 98% In A Week

Following nearly two weeks of persistent bearish pressure, recent on-chain data indicates signs of exhaustion among DOGE sellers. Should this trend persist, it could potentially trigger a rebound phase in the coming days.

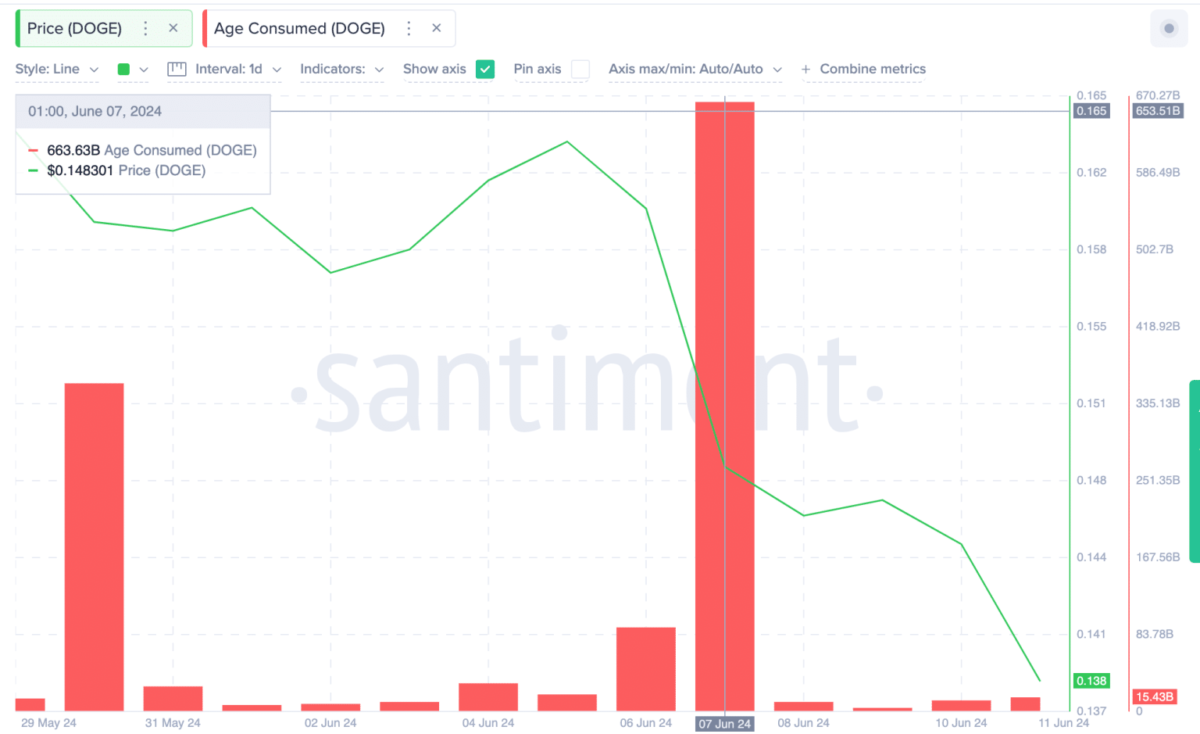

Santiment’s Age Consumed chart monitors the intensity of selling pressure originating from long-term investors. This metric calculates the total daily number of DOGE coins traded multiplied by the number of days since they were last moved. Typically, the Age Consumed metric spikes when a significant number of long-term holders are actively selling, and it decreases when selling pressure diminishes.

On June 7, Dogecoin Age Consumed surged to 663 billion, coinciding with the recent price dips observed during the crypto market crash following the release of US Non-Farm Payrolls data.

However, the selling pressure on Dogecoin has notably subsided this week. Recent data indicates that DOGE Age Consumed only reached 11 billion on June 11, marking a substantial 99% decline from last week’s peak selling activity. This suggests that with Dogecoin prices currently at 40-day lows, the majority of long-term holders are hesitant to sell at the current unfavorable prices.

DOGE Price Action

On Tuesday, the Dogecoin (DOGE) price dropped under the crucial support level of $0.14, however, it has recovered pretty fast since then. As of press time, Dogecoin is trading 3.38% up at $0.1454 amid the broader crypto market recovery following the favorable numbers for the US CPI.

As reported by Crypto News Flash, the Dogecoin whale accumulation and technical indicators like RSI flashed a buy signal.

What's Your Reaction?