5 Million Strong: Active Ethereum Wallets Drive Strong Momentum

According to veteran trader Peter Brandt, Ethereum might have just seen its future looking brighter. Known for his technical forecasts, Brandt feels the altcoin is on the verge of a bullish turnaround. He’s identified an inverted Head and Shoulders formation on the daily chart of Ethereum. This is one of the most classic buy signals in technical analysis. If ETH can hold above that neckline at $2,745, we could be looking at a breakout. The most interesting chart developments I see right now See thread #1$ETH closing price chart inverted H&S pattern I am flat in ETH pic.twitter.com/OCG0GcTdxF — Peter Brandt (@PeterLBrandt) October 21, 2024 Related Reading: ApeCoin Climbs Over 100% On Major Tech Advancements – Details But the excitement doesn’t stop there. Data from IntoTheBlock shows that Ethereum’s network is stronger than ever, boasting over 5 million active addresses across its mainnet and Layer 2 networks. Though market mood is still mixed, this statistic confirms Ethereum’s importance in the crypto ecosystem. Although some investors see Ethereum’s long-term future improving, others are worried by the short-term hazards. There are now over 5 million active $ETH addresses across the Ethereum mainnet and leading L2 networks, outpacing any other Layer 1 asset by a significant margin. pic.twitter.com/W6JaauNvhV — IntoTheBlock (@intotheblock) October 21, 2024 A Long-Term Play Ethereum definitely had its ups and downs. From a price tag as low as $10 to nearly $4,900 in the past, it’s very obvious that ETH has made quite a few early believers. And while taking such wild rides can be full of gut-wrenching moments, Ethereum never failed to ensure that its core strength lies in the facilitation of smart contracts and decentralized applications in the blockchain space. However, Ethereum’s cost basis for many investors has risen as the market has matured. This has made short-term gains more elusive, leading some traders to approach the market cautiously. But for those with a long-term view, Ethereum’s ambitious roadmap and history of overcoming challenges continue to make it an attractive option. Ethereum: The Next Path Ethereum’s present pricing behavior has one of more fascinating technical aspects: its interaction with the Point of Control (POC). Often considered as a significant support or resistance, this level could be crucial in deciding Ethereum’s next direction. As ETH’s price hovers near this point, it suggests a possible buying opportunity for those looking at the long term. If the POC holds, Ethereum could build a solid foundation for future growth. But a break below this level might signal trouble ahead, so investors should stay cautious. Related Reading: Shiba Inu Soars: Analyst Predicts 71% Rally In ‘Meme Super Cycle’ – Details Will The Bullish Reversal Hold? Brandt’s bullish prognosis gives ETH fans optimism. If Ethereum maintains over $2,745 and the inverted Head and Shoulders pattern persists, it might climb significantly. Yet, as always, it’s essential to consider other market factors—broader trends, technical indicators, and market sentiment all play a role in shaping the future of Ethereum. While Ethereum has its challenges, the potential for a bullish breakout is hard to ignore. Whether you’re in it for the long game or watching closely for short-term gains, Ethereum’s next move could be a significant one. Featured image from AFP/Finance Magnates, chart from TradingView

According to veteran trader Peter Brandt, Ethereum might have just seen its future looking brighter. Known for his technical forecasts, Brandt feels the altcoin is on the verge of a bullish turnaround.

He’s identified an inverted Head and Shoulders formation on the daily chart of Ethereum. This is one of the most classic buy signals in technical analysis. If ETH can hold above that neckline at $2,745, we could be looking at a breakout.

The most interesting chart developments I see right now See thread #1$ETH closing price chart inverted H&S pattern I am flat in ETH pic.twitter.com/OCG0GcTdxF

— Peter Brandt (@PeterLBrandt) October 21, 2024

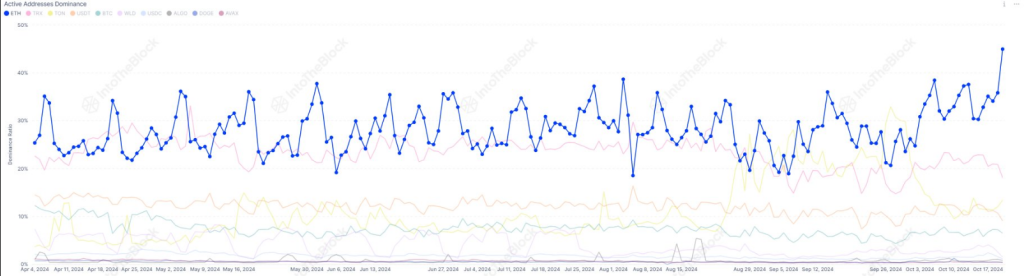

But the excitement doesn’t stop there. Data from IntoTheBlock shows that Ethereum’s network is stronger than ever, boasting over 5 million active addresses across its mainnet and Layer 2 networks.

Though market mood is still mixed, this statistic confirms Ethereum’s importance in the crypto ecosystem. Although some investors see Ethereum’s long-term future improving, others are worried by the short-term hazards.

There are now over 5 million active $ETH addresses across the Ethereum mainnet and leading L2 networks, outpacing any other Layer 1 asset by a significant margin. pic.twitter.com/W6JaauNvhV

— IntoTheBlock (@intotheblock) October 21, 2024

A Long-Term Play

Ethereum definitely had its ups and downs. From a price tag as low as $10 to nearly $4,900 in the past, it’s very obvious that ETH has made quite a few early believers. And while taking such wild rides can be full of gut-wrenching moments, Ethereum never failed to ensure that its core strength lies in the facilitation of smart contracts and decentralized applications in the blockchain space.

However, Ethereum’s cost basis for many investors has risen as the market has matured. This has made short-term gains more elusive, leading some traders to approach the market cautiously. But for those with a long-term view, Ethereum’s ambitious roadmap and history of overcoming challenges continue to make it an attractive option.

Ethereum: The Next Path

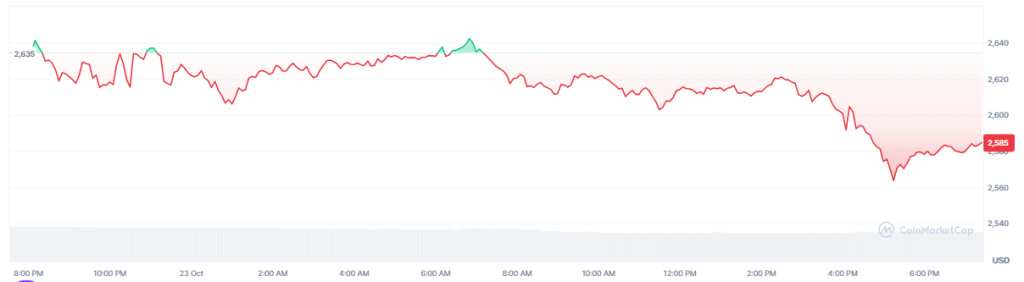

Ethereum’s present pricing behavior has one of more fascinating technical aspects: its interaction with the Point of Control (POC). Often considered as a significant support or resistance, this level could be crucial in deciding Ethereum’s next direction.

As ETH’s price hovers near this point, it suggests a possible buying opportunity for those looking at the long term. If the POC holds, Ethereum could build a solid foundation for future growth. But a break below this level might signal trouble ahead, so investors should stay cautious. Will The Bullish Reversal Hold?

Brandt’s bullish prognosis gives ETH fans optimism. If Ethereum maintains over $2,745 and the inverted Head and Shoulders pattern persists, it might climb significantly.

Yet, as always, it’s essential to consider other market factors—broader trends, technical indicators, and market sentiment all play a role in shaping the future of Ethereum.

While Ethereum has its challenges, the potential for a bullish breakout is hard to ignore. Whether you’re in it for the long game or watching closely for short-term gains, Ethereum’s next move could be a significant one.

Featured image from AFP/Finance Magnates, chart from TradingView

What's Your Reaction?