What to Watch for: 5 Must-Have Elements in Crypto Whitepapers

'Whitepaper' is a detailed report or guide that explains a problem and proposes a solution. In crypto, it works to present and describe new decentralized projects and coins. It may seem boring or too complex for average users, but it’s important to read it anyway.

The word ‘whitepaper’ surely rings a bell if you’ve been around in crypto enough time. The concept isn’t native or exclusive of cryptocurrencies, though. It refers to a detailed report or guide that explains a problem and proposes a solution, often used by businesses or governments to inform and persuade readers about new ideas, products, or strategies. In crypto, it works to present and describe new decentralized projects and coins.

\ This document is often long, and it comes in an academic style, containing very technical information. It may seem boring or too complex for average users, but it’s important to read it anyway if you’re thinking of investing or becoming a part of any crypto project around.

\ This report is the original source of every cryptocurrency or decentralized platform, describing all things about their inner workings, potential use cases, security, and more.

\ Even if you’re not an engineer, coder, or scientist, there are still some important things you can gather from an original whitepaper —things that should be there. If most of these important items aren’t there to be found by anyone interested, the project could be considered suspicious.

Problem & Solution Statement

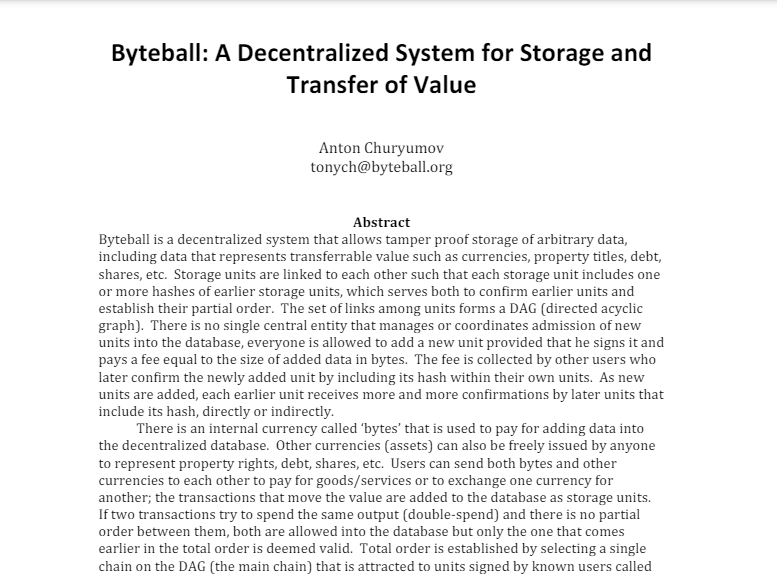

Since the document is often long and detailed, a little TL;DR almost always appears before anything. It’s called an ‘Abstract’, and it should clearly and briefly summarize the project's main goal, the problem it solves, its key features, and how it works. It gives readers a quick overview of the project’s purpose and value.

\

\ Anyone should be able to read and understand this part of the whitepaper, which should be the clearest and most concise. Its length varies from project to project, though, depending on how long and detailed the whole report is. In Bitcoin, for instance, the Abstract and Intro occupy only one page. In Obyte, both sections occupy three pages. They both do the job for their respective platforms in their own way.

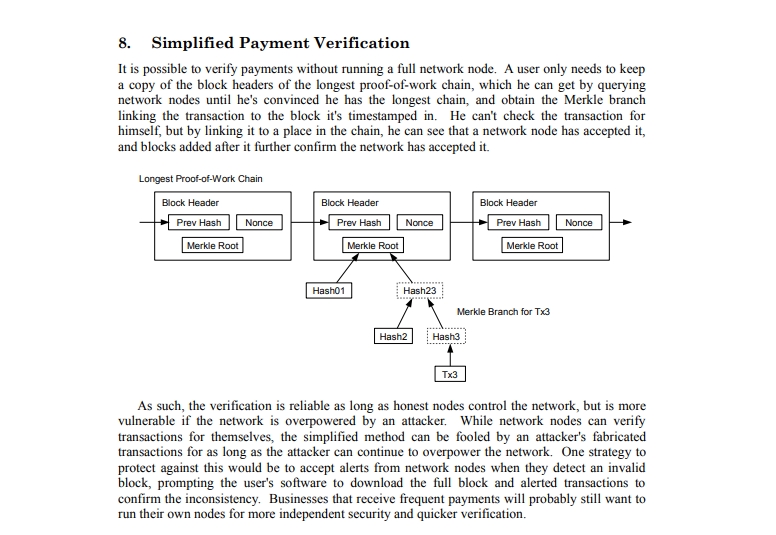

Technical Overview

This is the longest and potentially most difficult-to-understand part of the entire document. However, it can also be said that it’s the most important part too. It should provide a thorough explanation of the project’s underlying technology. This includes the architecture (such as whether it uses blockchain, Directed Acyclic Graph, or another system), how transactions are verified, and the consensus mechanism (e.g., Proof of Work, Proof of Stake, or another).

\ It should also outline how the network or platform ensures decentralization and scalability if they’re offering it. For projects with smart contracts, this section should explain the programming languages used and any unique features, such as the ability to automate complex financial operations. Criteria to run network’s nodes, customized tokens if any, decentralized applications (Dapps), and decentralized finance (DeFi) features; all of this along with its inner workings should be described in this section if there’s any of it.

\

\ On the other hand, if you’re not able to read this part or fully understand it, you can rely on some trustworthy reviews and guides around, as long as the original whitepaper is cited and those sources agree with others. Just duly note that a technical overview is a required part of any legitimate whitepaper.

Tokenomics

This part of the document explains how the project’s token works and how it’s distributed (if the project has a token). It should include details on how many tokens will be created (supply), how they will be allocated (e.g., to the team, investors, community rewards), and whether more tokens can be minted in the future. This section also describes the token’s purpose within the ecosystem, such as being used for transactions, governance, or incentivizing certain behaviors like staking or securing the network.

\

To understand if the tokenomics are viable, look at the total supply and distribution. If too many tokens are given to the project team or early investors, it can lead to unfair control or price manipulation.

\ A fair distribution usually includes a portion for the community or development fund to encourage long-term growth.

\ Additionally, check if there are mechanisms in place, like vesting schedules, to ensure the team can’t immediately sell their tokens, which could cause a price crash.

\ Finally, a viable tokenomics model should balance supply and demand to support the token’s value over time. For example, deflationary-like mechanisms like token burns (where tokens are permanently removed) and a fixed supply can help to stabilize or increase its value over time. The native cryptocurrency of Obyte, for instance, is built with a fixed supply. Also, look for real-world utility, where the token plays a meaningful role in the project’s ecosystem, as this increases its demand and long-term sustainability.

Security & Governance

These actually could be two separate sections, depending on the whitepaper and project, but they also should appear somewhere in the document. They need to explain how the project plans to keep the network safe from attacks and how general decisions about it will be made in the future.

\ On the security side, this includes details on how the system prevents common attacks, such as 51% attacks (where one party or group controls most of the network), Sybil attacks (where fake identities flood the network), or vulnerabilities in smart contracts. The whitepaper could also describe any audits the code has undergone and if the project uses encryption or other methods to secure transactions and user data.

\

For governance, this section outlines how changes to the protocol are decided. Some projects use on-chain governance, where token holders can vote on proposals, while others rely on a core development team or community-driven processes.

\ The whitepaper should explain how votes are counted, what kind of proposals can be made, and who has the power to implement changes. Strong governance mechanisms help ensure the project can evolve and fix issues over time without centralizing control.

\ To know if their descriptions of these matters are viable, look for transparency and decentralization. Security should be backed by thorough audits or testing, and the governance model should prevent any single party from having too much control.

\

Bad Signs

When reviewing a crypto whitepaper, there are several red flags to watch for that may indicate a project isn’t trustworthy or viable. One major warning sign is promises of high returns with little explanation of how they’ll be achieved. Legitimate projects focus on solving real problems and building solid technology, not guaranteeing profits. If a whitepaper emphasizes getting rich quickly or uses flashy, marketing-style language richly spiced with the most recent buzzwords, it’s often more focused on hype than delivering long-term value.

\ Another bad sign is vague statements and a lack of clear details. If the whitepaper doesn’t explain how the technology works, how the project plans to achieve its goals, or skips important technical details, that’s a red flag. Legitimate projects are transparent and provide enough information for both technical and non-technical readers to understand the core concepts.

\ Watch out for buzzwords like “revolutionary” or “game-changing” without concrete explanations—this can indicate the project is relying on hype instead of solid foundations.

\ Besides, a whitepaper that’s overly flashy or full of marketing elements, like bright colors, bold fonts, or overly emotional writing, can also be a warning sign. While some design is okay, a whitepaper should be professional and focused on the technical and business aspects of the project.

\ If it feels more like a sales pitch than an informative document, it’s wise to dig deeper and look for additional sources of information. A credible project should focus more on substance than style.

\ Good examples of whitepapers include the ones of Bitcoin, Ethereum, and Obyte. Such as these, legitimate whitepapers often start with a technical title, author’s name or pseudonym, and abstract.

\ Likewise, they end with proper references to support most of their claims and give credit to previous important works related to it. Remember that staying mindful of these signs can help you separate promising projects from those that are all flash and no substance.

\

Featured Vector Image by Freepik

What's Your Reaction?