U.S. Leads Bitcoin Adoption as Entities Control Record BTC Reserves

U.S.-based Bitcoin reserves now exceed international holdings by 65%, driven by rising institutional and retail interest since late 2024. Corporate players like MicroStrategy and smaller firms fuel Bitcoin’s growth, even as prices correct from peaks above $100,000. U.S. entities now dominate Bitcoin adoption, holding a record share of the crypto reserves. Ki Young Ju, CEO [...]

- U.S.-based Bitcoin reserves now exceed international holdings by 65%, driven by rising institutional and retail interest since late 2024.

- Corporate players like MicroStrategy and smaller firms fuel Bitcoin’s growth, even as prices correct from peaks above $100,000.

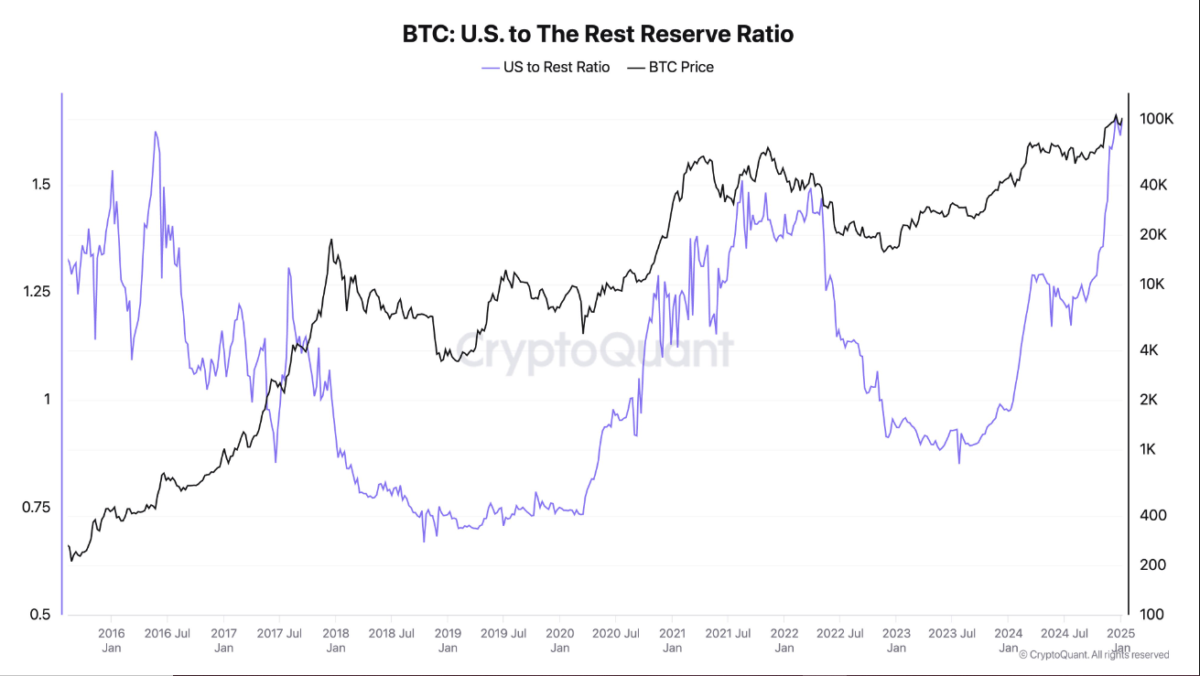

U.S. entities now dominate Bitcoin adoption, holding a record share of the crypto reserves. Ki Young Ju, CEO of CryptoQuant, highlighted that U.S.-based reserves surpass international holdings by an impressive 65%. America’s increasing institutional and retail interest in Bitcoin enhances its role in the global cryptocurrency market.

From September 2024 to January 2025, the ratio of U.S. to non-U.S. Bitcoin reserves grew substantially. It rose from 1.24 in September to 1.66 by December 16, stabilizing at 1.65 as of January 6, 2025. This dramatic increase reverses the 2023 trend when offshore entities held a dominant position, particularly during Bitcoin’s sub-$30,000 trading phase.

Bitcoin’s Record High Spurs Corporate Rush

The increase in U.S.-based reserves aligns with major developments shaping the crypto landscape. Donald Trump, re-elected in November 2024, proposed a national Bitcoin reserve as part of pro-crypto policies. Meanwhile, Bitcoin surged to a record high of $108,268 on December 17, driven by institutional adoption. Spot Bitcoin ETFs launched in January 2024 attracted $106.82 billion in inflows, according to SoSoValue.

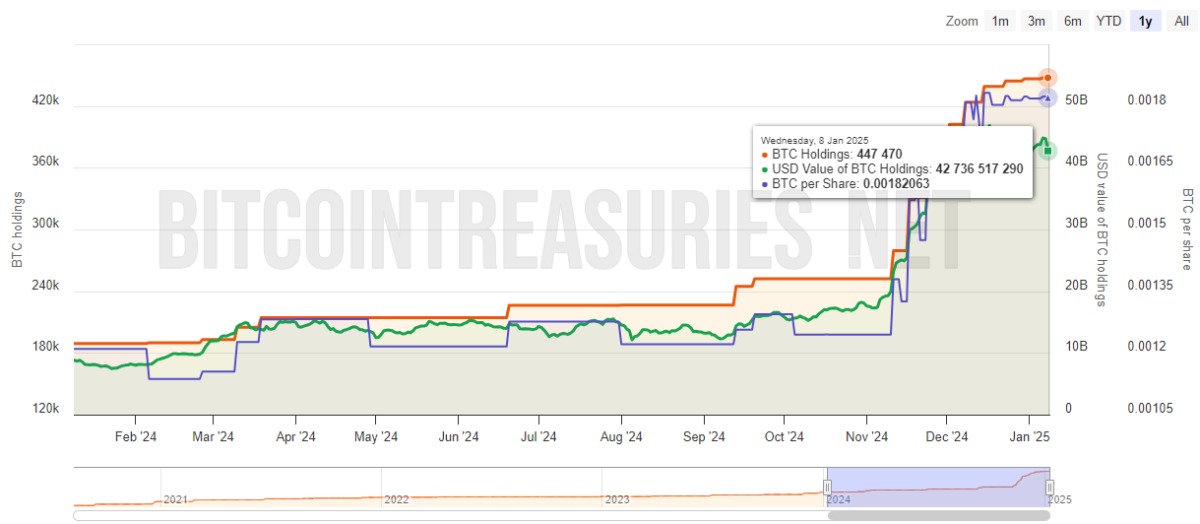

Corporate leaders have significantly contributed to this momentum. MicroStrategy expanded its Bitcoin holdings by purchasing 1,070 BTC between December 30 and 31, 2024, at an average price of $94,004 per Bitcoin. This acquisition increased the company’s total holdings to 447,470 BTC, valued at approximately $28 billion. With plans to raise $42 billion over three years, the company remains steadfast in its Bitcoin investment strategy.

Smaller companies are also entering the Bitcoin market. Thumzup Media Corporation acquired 9.783 BTC for $1 million in November 2024, marking its initial foray into cryptocurrency. Solidion Technology and Genius Group similarly allocated portions of their cash reserves to Bitcoin, reflecting broader corporate confidence in the asset’s potential.

Bitcoin Peaks over $100K—Correction Follows

The U.S.’s dominance in Bitcoin holdings is intertwined with the cryptocurrency’s price trajectory. In September 2024, Bitcoin traded at $60,000, with offshore entities holding the majority of reserves. By January 2025, Bitcoin surpassed $100,000, briefly peaking over $108,000. However, the market experienced a correction, bringing Bitcoin back to $93,000. Julio Moreno, head of research at CryptoQuant, stated:

Trader’s onchain unrealized profit margins have declined significantly amid the ongoing Bitcoin price correction. This is healthy after a rally that got us above $100k,

The correction comes amid fears over tighter monetary policy and stronger-than-expected U.S. labor data. Analysts at QCP shared, “Bitcoin has retraced to the $95K support level following hotter-than-expected U.S. job data,” attributing the sell-off to rising bond yields and risk-averse sentiment.

At the time of press, BTC trades for just under $95,000 after a marginal positive change in the last 24 hours.

What's Your Reaction?