The Golden Ratio Multiplier Mathematically Reveals Next Bitcoin Price Target

The Golden Ratio Multiplier, a Bitcoin-specific indicator created by Philip Swift, highlights $100,000 as a critical resistance level. This analysis explores how Fibonacci multiples of the 350-day moving average provide key insights into Bitcoin's price cycles, with $127,000 emerging as the next major target if this barrier is broken.

The Bitcoin market has long been characterized by cyclical movements and adoption-driven growth, and investors frequently seek tools to better understand and anticipate these cycles. One such tool is the Golden Ratio Multiplier—a Bitcoin-specific indicator developed by Philip Swift, Managing Director of Bitcoin Magazine Pro. This article delves into the intricacies of the indicator and analyzes the recent Chart of the Day, which provides a data-driven outlook on Bitcoin’s price trajectory.

The #Bitcoin Golden Ratio Multiplier 1.6x level, currently at ~$100,000, has once again acted as resistance for #BTC price action! ????

If we can rally through this level, then ~$127,000 is our next major target! ???? pic.twitter.com/RCRKYFDAZt— Bitcoin Magazine Pro (@BitcoinMagPro) December 10, 2024

Click here to view the live Golden Ratio Multiplier chart on Bitcoin Magazine Pro for free.

Understanding the Golden Ratio Multiplier

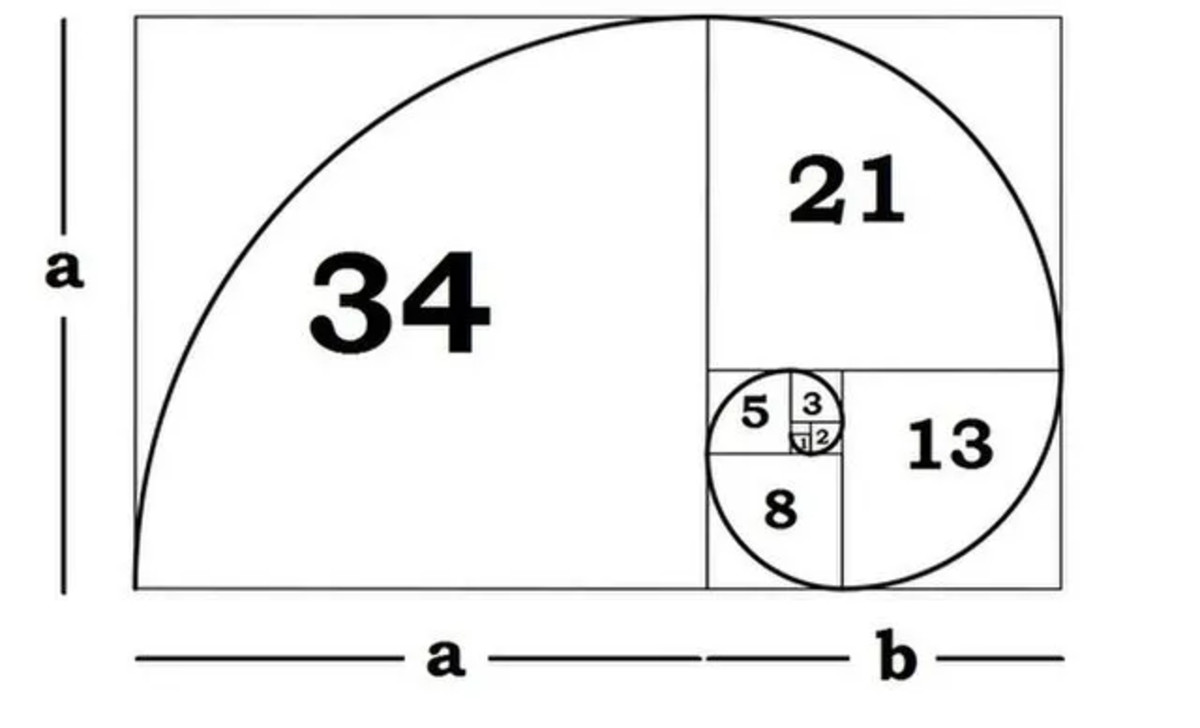

The Golden Ratio Multiplier is a charting tool designed to examine Bitcoin's long-term adoption curve and market cycles. At its core, the indicator utilizes multiples of the 350-day moving average (350DMA) to pinpoint areas of significant price resistance or market cycle peaks. These multiples are based on two foundational mathematical principles:

- The Golden Ratio (1.6)

- The Fibonacci Sequence (0, 1, 1, 2, 3, 5, 8, 13, 21, etc.)

The Golden Ratio and Fibonacci sequence have consistently shown relevance in nature, finance, and trading, making them ideal for modeling Bitcoin's logarithmic price growth over time. Historically, Bitcoin’s price intracycle highs and major market cycle peaks align with Fibonacci-based multiples of the 350DMA. This makes the Golden Ratio Multiplier an invaluable tool for identifying points of price resistance as Bitcoin’s adoption progresses.

How It Works

The chart plots Bitcoin’s price against key Fibonacci multiples of the 350DMA, such as 1.6x (the golden ratio), 2x, and 3x. These levels have proven effective at indicating:

- Intracycle highs: Points where Bitcoin’s price experiences short-term resistance during a market cycle.

- Major cycle peaks: Long-term market tops that signal the end of a bull run.

The decreasing Fibonacci sequence multiples reflect Bitcoin’s maturing market. As adoption expands and Bitcoin's market capitalization grows, its price volatility and exponential growth naturally diminish. Consequently, the highest Fibonacci multiples (e.g., 21x) are less relevant in today’s market, while lower multiples like 2x and 3x become more critical for analysis.

Chart of the Day Analysis: $100,000 Resistance

The Chart of the Day, published on Bitcoin Magazine Pro’s X profile, highlights Bitcoin’s current interaction with the 1.6x multiple of the 350DMA, which is approximately $100,000. As seen in the chart, this level has repeatedly acted as a strong resistance zone for Bitcoin’s price.

Key Observations from the Chart

- Historical Significance of the 1.6x Level: This level has served as a critical resistance point in past cycles, and its current status as a psychological milestone ($100,000) further reinforces its importance.

- Potential for Breakout: If Bitcoin manages to rally above the 1.6x level, the next significant target is the 2x multiple, around $127,000. This aligns with the Golden Ratio Multiplier’s long-term prediction of decreasing Fibonacci-level peaks.

Why $100,000 Matters

The $100,000 mark not only represents a significant Fibonacci multiple but also a major psychological barrier in the market. Breaking through this level could reignite bullish sentiment, drawing in new investors and potentially leading to a parabolic price move toward the $127,000 resistance.

What Makes This Indicator Unique?

The Golden Ratio Multiplier stands out because it integrates Bitcoin's adoption curve into its calculations. As a tool tailored for Bitcoin’s early adoption phase, it accounts for the logarithmic nature of Bitcoin’s price growth. By identifying price levels that align with natural adoption dynamics, the indicator offers:

- Clarity on Market Cycles: Helps investors identify intracycle highs and cycle peaks.

- Risk Management Guidance: Provides a framework for understanding when the market may be overstretched and where investors might consider adjusting their strategies.

As adoption progresses, the Fibonacci multiples continue to taper downward, suggesting the indicator’s utility will diminish once Bitcoin achieves mainstream adoption.

Implications for Investors

For investors, the Golden Ratio Multiplier provides actionable insights into where Bitcoin’s price may encounter resistance or consolidation. Here’s what the data suggests:

- Short-Term Outlook: The $100,000 level is a critical resistance. If Bitcoin fails to clear this barrier, a period of consolidation may follow.

- Medium-Term Outlook: Successfully breaking $100,000 could set the stage for a rally to $127,000, the 2x multiple. Historically, such breakouts have been accompanied by significant volume and renewed investor interest.

- Long-Term Perspective: While the Golden Ratio Multiplier remains effective for analyzing Bitcoin’s adoption phase, its predictive power may wane as Bitcoin matures into a stable asset class.

Conclusion

The Golden Ratio Multiplier, created by Philip Swift in 2019, has consistently demonstrated its value as a predictive tool for Bitcoin’s price movements. By analyzing Fibonacci multiples of the 350DMA, the indicator offers a roadmap for understanding Bitcoin’s long-term price trajectory and identifying key resistance levels.

As the Chart of the Day reveals, Bitcoin is once again testing the $100,000 resistance level. A successful rally through this barrier could pave the way for a move toward $127,000, offering significant opportunities for investors who understand the dynamics at play.

To explore live data and stay informed on the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

What's Your Reaction?