The Bitcoin (BTC) Bull Run Could End Sooner Than You Think: Analyst

One popular analyst suggests that the bull run could be over in Q1, 2025.

TL;DR

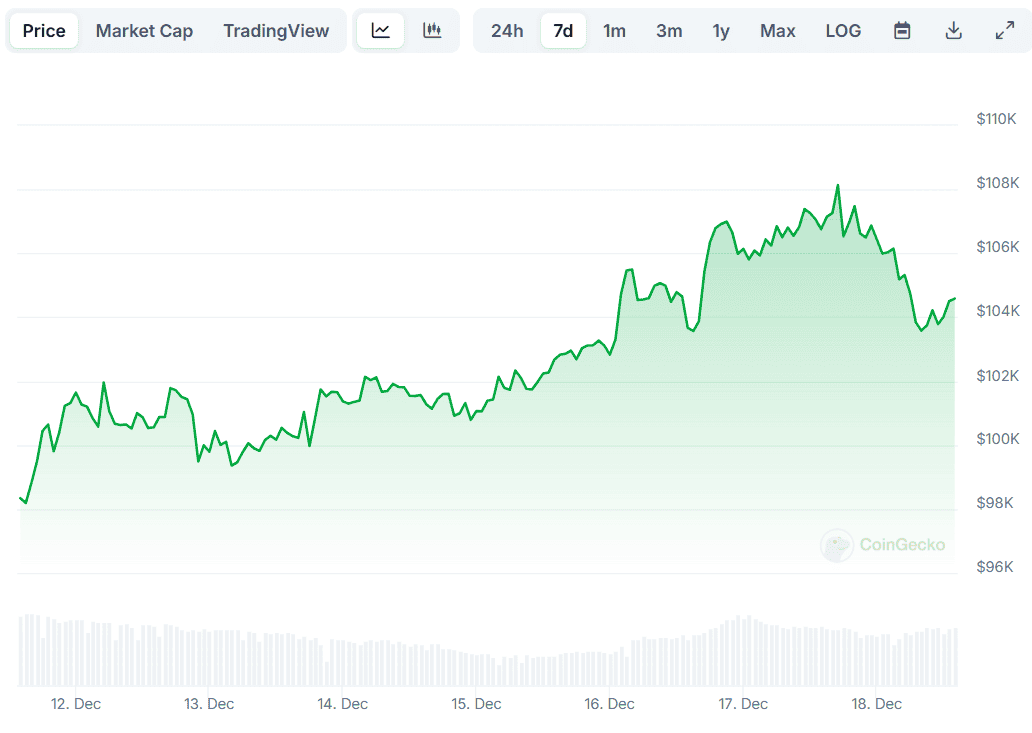

- Bitcoin (BTC) surpassed $108,000 on December 17, with predictions of a possible $220,000 peak by March 2025.

- Bitfinex analysts foresee the bull run lasting until late 2025, with the price potentially hitting $339,000.

Just a Few More Months?

2024 (so far) has been more than successful for Bitcoin (BTC), whose price has exploded by approximately 150%. Although BTC was going relatively strong at the start of the year, the actual resurgence seems to have started shortly after Donald Trump (who presented himself as the right choice for pro-crypto voters) won the presidential elections in America.

Before the voting on November 5, BTC was trading at around $67,000, while approximately a month later, it surpassed the $100,000 psychological level. Earlier this week, the asset hit a new all-time high of over $108,000. In the past several hours, it experienced a correction and is now trading at around $104,600 (per CoinGecko’s data).

Numerous analysts suggest there is much more room for growth, while others believe the bull run will not last long. The X user Ali Martinez, for instance, predicted that BTC could climb to as high as $220,000 in March next year, which could mark the end of the bull market. He based the forecast on the asset’s historical performance in 2017 and 2020. Martinez also assumed that the ride to the aforementioned peak might be a bumpy one:

“If Bitcoin behaves like in 2017 and 2020, then there will be a brief correction after reaching $110,000, a steep correction after hitting $125,000, a big correction at $150,000, and the end of the bull market at $220,000.”

Still Away From the Euphoria Zone?

Contrary to the aforementioned prediction, analysts at the crypto exchange Bitfinex think the asset has not yet reached “euphoric peaks.” According to them, the crypto market might be in the middle of the bull run, with its cycle top expected in the second half of 2025.

The analysts envisioned a BTC price rally to as high as $339,000, fueled partially by the success of spot Bitcoin ETFs. The financial products “have emerged as a dominant force” and hold over 1.13 BTC.

“While volatility is expected in Q1 2025, the broader trend points to further price appreciation, supported by ETFs, institutional adoption, and Bitcoin’s increasing prominence as a global asset. Investors should, however, remain vigilant for signs of overbought conditions as Bitcoin approaches its cycle top,” the research reads.

The post The Bitcoin (BTC) Bull Run Could End Sooner Than You Think: Analyst appeared first on CryptoPotato.

What's Your Reaction?