Spot Ethereum ETF S-1 Amendments Due Today, SEC Approval Expected Soon

The amendments to the S-1 forms that the SEC turned back to the Ethereum ETF applicants are due today, and the market is hopeful that this will be the last hurdle before the SEC’s green light. Most ETF experts hold firm to their prediction of an Ether ETF launching before the end of the month, [...]

- The amendments to the S-1 forms that the SEC turned back to the Ethereum ETF applicants are due today, and the market is hopeful that this will be the last hurdle before the SEC’s green light.

- Most ETF experts hold firm to their prediction of an Ether ETF launching before the end of the month, which could boost ETH, which has lost over 16% in the past seven days.

Today marks an important day in the journey towards Ethereum spot ETFs as the applicants return the S-1 forms to the SEC after attending to the minor tweaks suggested by the agency.

The Ether ETF campaign seemed to be gaining momentum as we entered July, which was the month most analysts had predicted they would launch. However, the SEC threw the industry a curveball towards the end of June, returning the applications to the applicants with some minor suggestions and recommendations, as Crypto News Flash reported.

The applicants had a week to attend to the changes, and today, July 8, marks the deadline for these firms to return the applications to the regulator. Many hope that is the final hoop before Gary Gensler gives his nod, with one source stating that because the changes were so light, “the SEC could contact issuers at any point w/ date as to when funds can launch.”

However, sources within the agency say that there could be at least one more round or changes and amendments to be attended to by the applicants before the ETFs can proceed to the final stage.

Still, experts like Nate Geraci are holding out hope that all this will happen this month. Geraci, who is the president of the ETF Store, an ETF-focused investment advisor, stated on X on Sunday:

Spot eth ETF S-1 amendments supposedly due tomorrow… How quickly will SEC turn these around? Again, the main item I’m watching for is fees (which won’t be required w/ these amendments). Otherwise, assume issuers gearing up for launch in the next week or two.

Ethereum Dips 16% as ETF Wait Continues

As Ethereum continues to await Gensler’s final word, its fortunes on the price charts have been bleak in the past ten days. Overnight, ETH lost 2.66% to trade at $2,924 at press time. Ether first dipped below the critical $3,000 level on Friday but managed to stage a small comeback to regain this level on Sunday. However, it has opened the week with a dip.

In the past week, Ethereum has lost over 16%, amid a broader market correction that has wiped out over $300 billion in seven days.

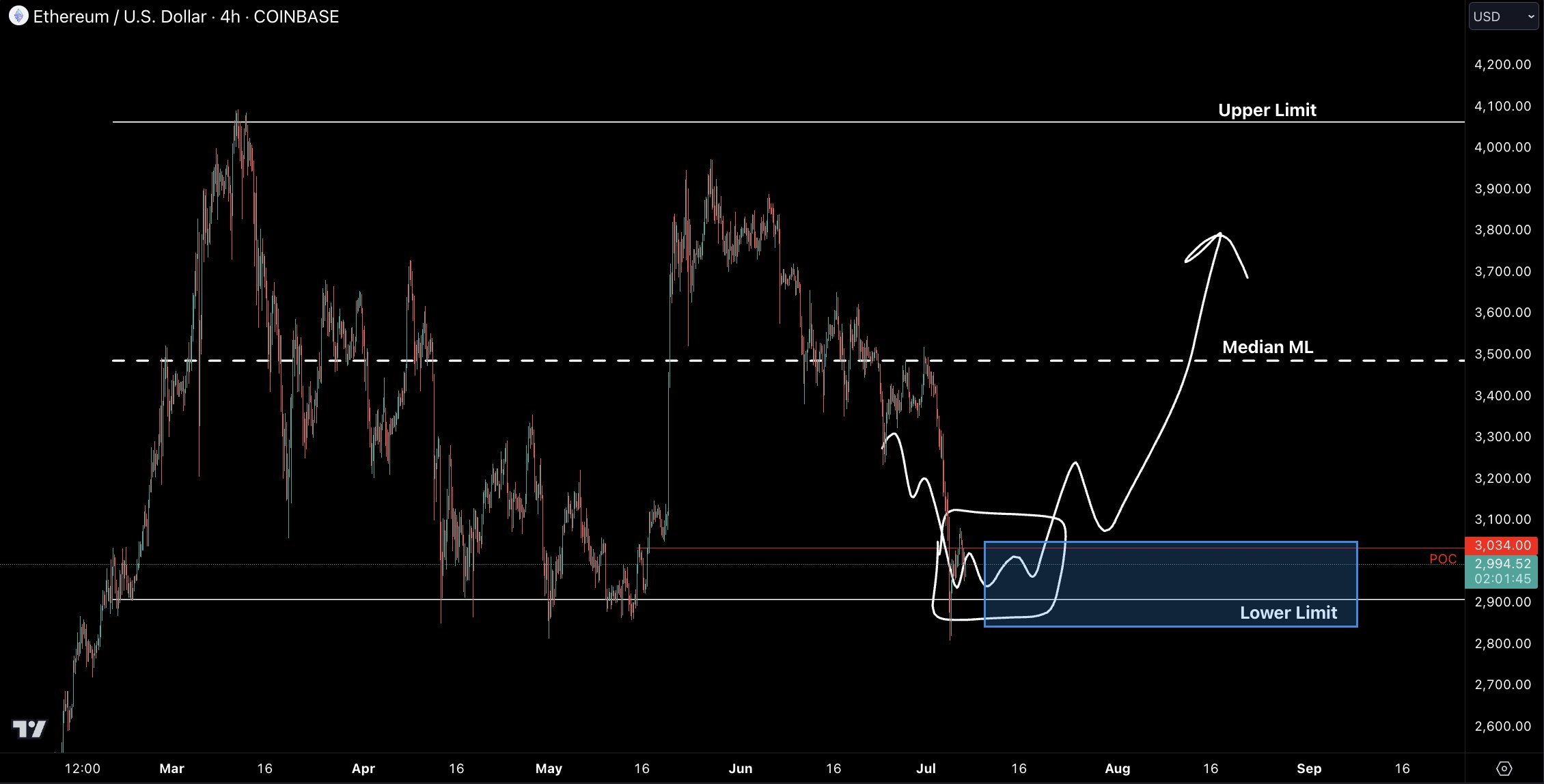

According to one analyst, Ether needs to hold above $2,900, which has been its lower limit since the March market spike that took Bitcoin to a new all-time high. ETH surged above $4,000 at the time, but the bullish momentum was shortlived and by mid-April, it was testing the $3,000 level again. The analyst, known to his 76,000 X followers as Castillo, believes that if the top altcoin can hold above this lower limit, it is headed for a turn of fortunes.

(Image courtesy of Castillo Trading on X).

What's Your Reaction?