Solana’s (SOL) Rally Set to Extend as RSI and Pump.fun Activity Support Gains

Solana-based application Pumpfun is driving user engagement and transaction volume, now accounting for nearly 50% of Solana’s daily DEX transactions. If SOL breaks past $182.46, it could test $194.04, with crucial support at $165.37 and $147.55 helping to sustain the uptrend. Solana has been outperforming the broader cryptocurrency market with more than 10% gains over [...]

- Solana-based application Pumpfun is driving user engagement and transaction volume, now accounting for nearly 50% of Solana’s daily DEX transactions.

- If SOL breaks past $182.46, it could test $194.04, with crucial support at $165.37 and $147.55 helping to sustain the uptrend.

Solana has been outperforming the broader cryptocurrency market with more than 10% gains over the past week. Despite this SOL price run-up, market analysts say that altcoin still has more scope to surge ahead based on its technical indicators.

Firstly, Solana’s Relative Strength Index (RSI) has cooled enough dropping from its overbought territory to 61, hinting that there’s no massive selling pressure ahead. Furthermore, one of the biggest Solana-based applications Pumpfun is fueling ecosystem growth and further user engagement.

The combination of a cooling RSI and a surge in Pumpfun metrics could be significant factors driving further price increases in the days ahead. As said, the RSI has dropped from over 70 to 61 just in the last two days. An RSI above 70 suggests that the asset is in an overbought condition and a pullback is likely ahead.

With the RSI now below the critical threshold, it suggests there may be room for the price to continue its upward movement without encountering immediate selling pressure.

Thus, despite the SOL price gaining 10% in the past seven days, investors need not worry much as the recent surge doesn’t seem to be overextended. As reported by CNF, Solana recently overtook Ethereum in economic value.

Will Pumpfun Fuel another Solana Rally?

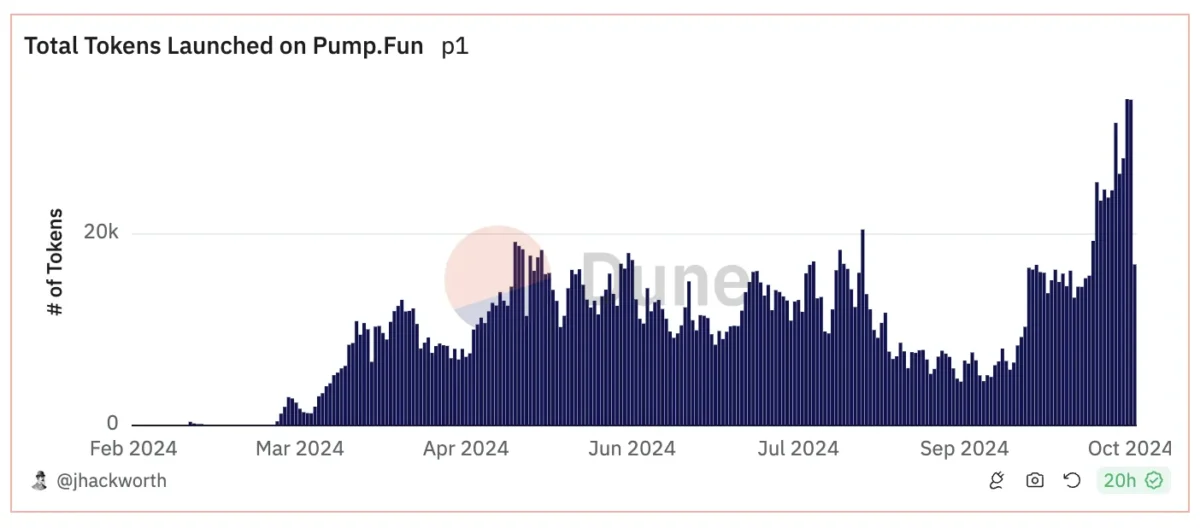

Pumpfun is currently one of the largest applications within the Solana ecosystem as it continues to hit new milestones. Since October 14, the platform has experienced over 20,000 coin launches daily, reaching a record high of 34,094 coins on October 22.

The surge in coin launches is a major milestone as Pumpfun now accounts for nearly 50% of daily DEX transactions and volume in the Solana ecosystem. This high level of engagement can trigger a new price surge for SOL, similar to what happened in the March-April period.

Earlier this year during the March-April period, the exponential growth in the coins launched on Pumpfun coincided with a nearly 100% SOL price rally from $107 to $209, within a matter of just three weeks. Thus, if Solana replicates this performance again, investors might be looking forward to another major rally.

SOL Eyeing $200 Soon

Currently, the SOL price is trading above all the EMA lines reflecting strong bullish momentum. Currently, the short-term EMA is acting as an immediate support which shows that buyers are actively stepping in during minor pullbacks. Also, talks of Solana flipping Ethereum are on the rise, per the CNF report.

The alignment of the EMA lines, with shorter-term EMAs positioned above the longer-term ones, reinforces the positive trend and indicates strong potential for continued growth.

If SOL breaks above $182.46, it could soon target $194.04, marking its highest price since July. Key support levels are at $165.37 and $147.55, both essential for sustaining the current uptrend.

The EMA configuration, together with these support and resistance zones, indicates that the bullish trend remains intact, with further upside potential if buying momentum holds.

What's Your Reaction?