Solana’s High Transaction Fees: Threat or Triumph for Network Activity?

Solana’s market cap and transaction activity remain high despite increased fees. Development efforts continue as SOL’s DeFi sector reaches a $2 billion TVL. As we step into 2024, the cryptocurrency landscape is witnessing a remarkable surge, with Solana (SOL) leading the forefront. The blockchain has experienced a significant uptick in market capitalization, showcasing a robust [...]

- Solana’s market cap and transaction activity remain high despite increased fees.

- Development efforts continue as SOL’s DeFi sector reaches a $2 billion TVL.

As we step into 2024, the cryptocurrency landscape is witnessing a remarkable surge, with Solana (SOL) leading the forefront. The blockchain has experienced a significant uptick in market capitalization, showcasing a robust start to the year.

This optimistic outlook is buoyed by a more than 17% increase in SOL’s price over the last 30 days, placing its trading value at a commendable $102.91. With a market capitalization surpassing $45.3 billion, Solana has firmly positioned itself as the fifth-largest cryptocurrency in the global market.

The Challenge of Rising Fees

However, this growth spurt is not without its challenges. Recent data highlights a sharp increase in Solana’s average transaction fees, now exceeding $0.03. This spike places the blockchain’s fees well above the average of Layer 2 solutions, raising concerns about potential impacts on network activity. High transaction costs often deter users from executing transactions, which could, in theory, slow down the blockchain’s momentum.

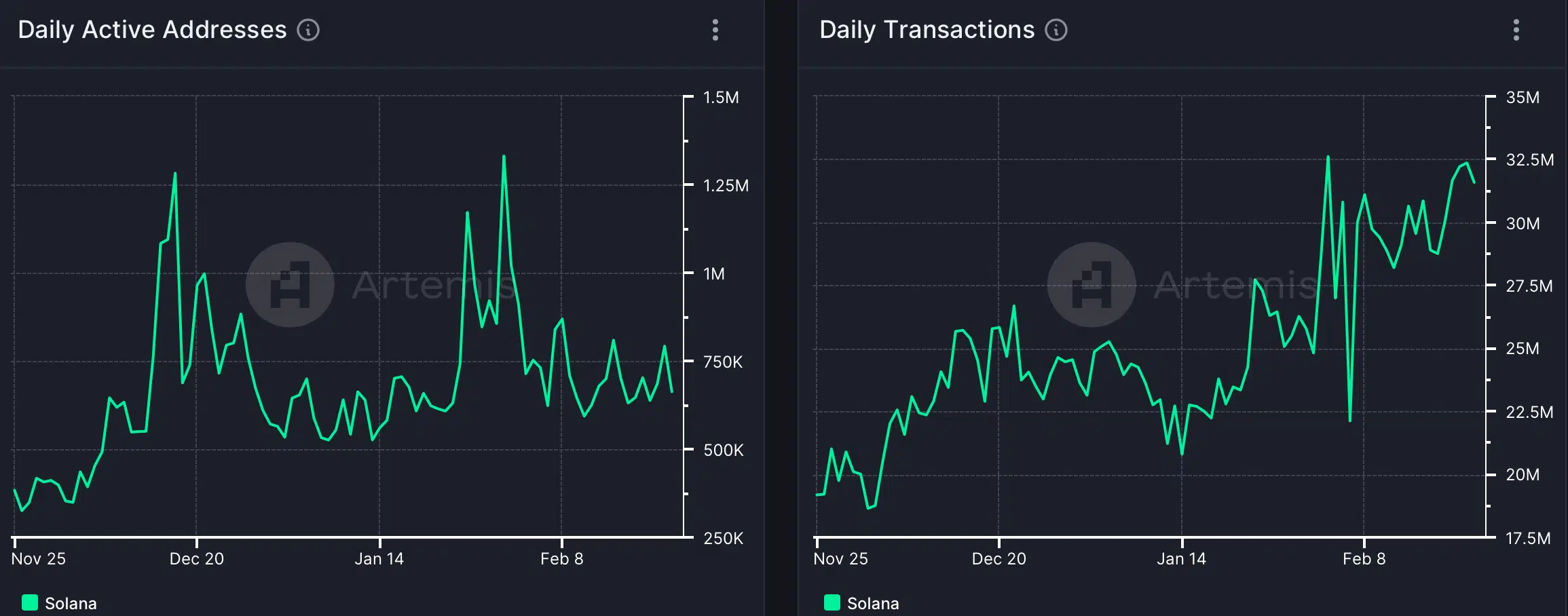

Contrary to expectations, Solana’s network activity tells a story of resilience and unwavering user loyalty. Analysis of Artemis’ data reveals that despite the hike in transaction fees, Solana’s daily active addresses have remained impressively high over the past three months.

This trend is mirrored in the blockchain’s daily transaction count, suggesting that users are willing to shoulder the increased costs for the benefits Solana offers. For a deeper dive into these advancements, you can find a detailed explanation in this Youtube video.

Revenue and DeFi Growth

The increased transaction fees have also translated into a significant revenue boost for Solana, particularly noted with a sharp revenue spike on January 31st. This financial upturn, however, saw a subsequent decline in the days that followed. On a brighter note, the DeFi sector within Solana has shown promising growth, with the Total Value Locked (TVL) reaching the $2 billion mark, indicating sustained progress since December 2023.

Amidst the financial achievements, Solana’s development activity has not taken a backseat. The blockchain boasts high development activity, reflecting the relentless efforts by developers to enhance its capabilities.

At the time of writing, the price of Solana’s native cryptocurrency, SOL, has slightly recovered 0.91% in the last 24 hours to $104.10, after experiencing a fairly sharp 7-day slump of 7.87%.

What's Your Reaction?