Saifedean Ammous: “Nothing Stops This Train” – Tether, Bitcoin, and the Endgame for the Dollar

Bitcoin Magazine Saifedean Ammous: “Nothing Stops This Train” – Tether, Bitcoin, and the Endgame for the Dollar Saifedean Ammous, CEO of Saifedean.com and author of The Bitcoin Standard, delivered a data-driven keynote at the Bitcoin 2025 Conference, warning of inevitable U.S. dollar decline and positioning Bitcoin as the only rational hedge. “Default, devaluation, or default by devaluation are inevitable,” Ammous declared, adding pointedly, “Tether can’t fix what a century of fiat democracy […] This post Saifedean Ammous: “Nothing Stops This Train” – Tether, Bitcoin, and the Endgame for the Dollar first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

Bitcoin Magazine

Saifedean Ammous: “Nothing Stops This Train” – Tether, Bitcoin, and the Endgame for the Dollar

Saifedean Ammous, CEO of Saifedean.com and author of The Bitcoin Standard, delivered a data-driven keynote at the Bitcoin 2025 Conference, warning of inevitable U.S. dollar decline and positioning Bitcoin as the only rational hedge. “Default, devaluation, or default by devaluation are inevitable,” Ammous declared, adding pointedly, “Tether can’t fix what a century of fiat democracy ruined.”

Focusing on Tether (USDT), Ammous explained that devaluation is not a threat to the stablecoin since its liabilities devalue alongside the dollar. “Default is the main risk to Tether,” he said, “but they are protecting against it by buying Bitcoin.” He discussed how Tether currently holds over 100,000 BTC, worth more than $10 billion, alongside approximately $120 billion in USD reserves. “Tether reserves are devaluing USD and appreciating BTC,” he noted.

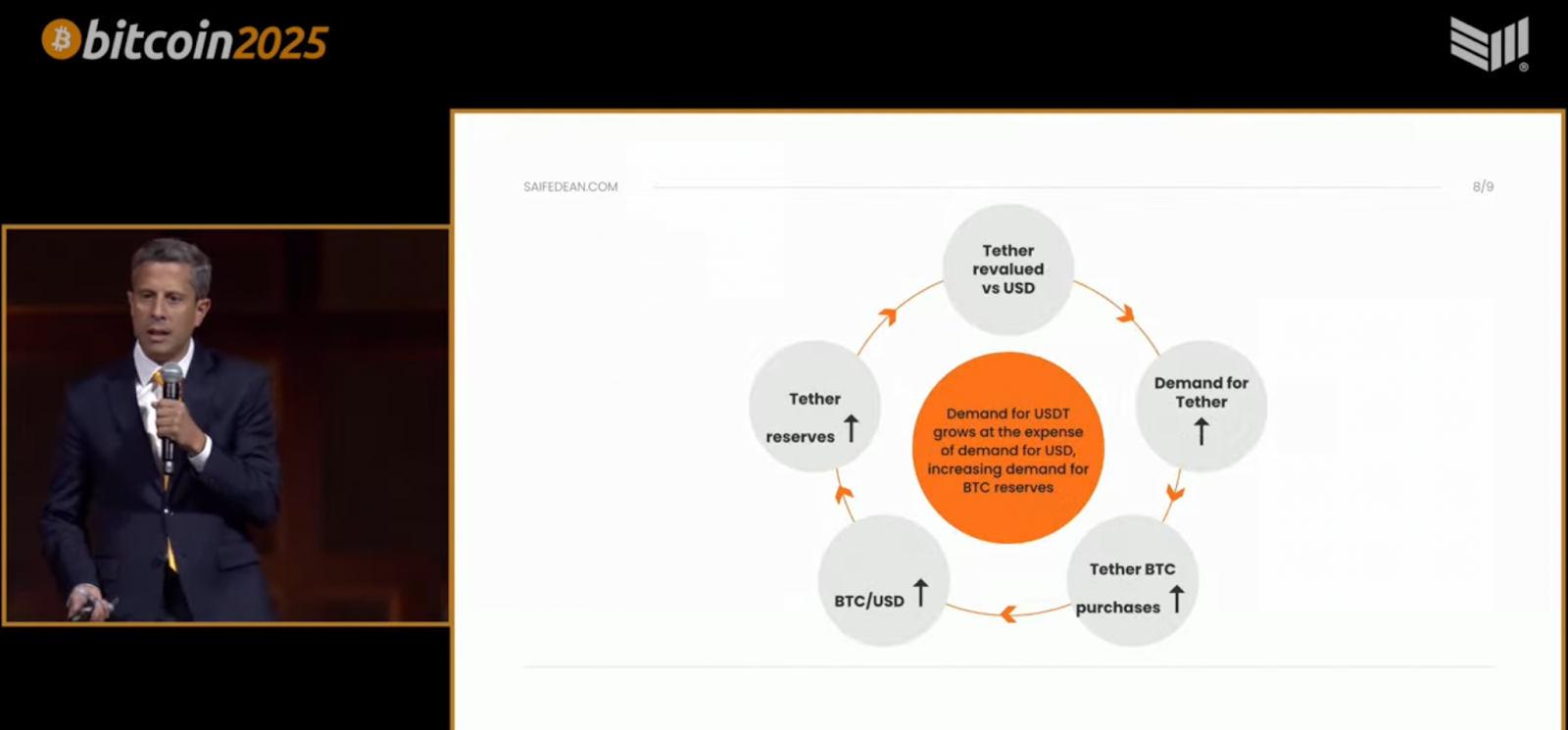

Using projections and flow charts, Ammous argued that Tether’s Bitcoin strategy could soon outpace its U.S. dollar reserves. “Then Tether will break the peg upwards,” he said, predicting a scenario where 1 USDT could equal 1.02 USD and continue revaluing as the dollar weakens. “Tether becomes a relatively stablecoin as the dollar declines.”

The talk emphasized what Ammous described as a self-reinforcing loop: as USDT demand rises, so does Tether’s need for BTC reserves, which drives up Bitcoin prices—leading to even more revaluation. “This is a significant impact on the market,” he said. “Buying bitcoin is the smartest thing anybody could do.”

In a final sweeping statement, Ammous forecasted the end of the USD era. “Eventually, USD reserves go to zero next to BTC reserves,” he said. “USDT keeps getting revalued upward until it is redeemable in bitcoin. USDT → BTCT.” He called Tether a “transition monetary system” and concluded, “Even the most bullish scenario for USD is much more bullish for BTC.”

To Ammous, the dollar is locked in a downward spiral while Bitcoin, with its “number go up technology,” continues rising. “The thing that goes up is going to overtake the thing that goes down,” he said—summarizing his entire argument in one sentence.

This post Saifedean Ammous: “Nothing Stops This Train” – Tether, Bitcoin, and the Endgame for the Dollar first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

What's Your Reaction?