Ripple’s Rise to the Top: World Bank Classifies XRP as Stablecoin for Lightning-Fast Payments

The World Bank just recognized Ripple Labs’ role in the payments ecosystem with XRP’s categorization as stablecoin. The price of XRP shows bullish momentum with several forecasts of a potential breakout. San Francisco-based Ripple Labs Inc has emerged as a standout player in the crypto market after the World Bank validated its associated cryptocurrency, XRP, [...]

- The World Bank just recognized Ripple Labs’ role in the payments ecosystem with XRP’s categorization as stablecoin.

- The price of XRP shows bullish momentum with several forecasts of a potential breakout.

San Francisco-based Ripple Labs Inc has emerged as a standout player in the crypto market after the World Bank validated its associated cryptocurrency, XRP, as a stablecoin for lightning-fast payments.

World Bank’s Classification of XRP as a Stablecoin

This recognition, outlined in a November 2021 research paper titled “Central Bank Digital Currencies for Cross-Border Payments,” highlights Ripple’s growing influence and the utility of XRP in the global payment ecosystem.

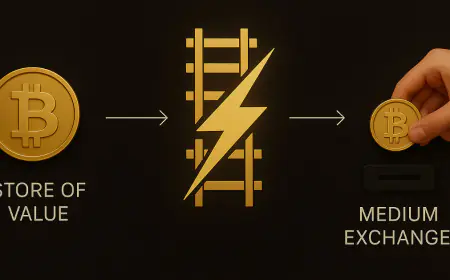

The research paper highlighted the need for efficient and cost-effective cross-border payments, acknowledging stablecoins as a digital currency category that offers instantaneous processing and secure transactions.

With a focus on stability relative to fiat currencies, the World Bank identified XRP, along with the native asset of the Stellar network, XLM, as virtual assets fitting the stablecoin category. Furthermore, the report emphasized that XRP and XLM enable faster and more efficient cross-border payments compared to traditional correspondent banking methods, highlighting their utility and potential impact on the global financial ecosystem.

Following the World Bank’s classification, discussions within the crypto community have centered on the implications for Ripple and XRP’s future. Notably, former director of Global Talent Acquisition at Ripple, Sean McBride, drew attention to the World Bank’s classification amid speculation about Ripple potentially issuing its own stablecoin.

McBride engaged in a conversation with renowned XRP community figure WrathofKahneman, who speculated on the possibility of Ripple integrating stablecoin functionality via Automated Market Makers (AMMs).

While McBride questioned the rationale behind moving away from XRP’s utility, emphasizing its recognition as a stablecoin, discussions within the community remain speculative, with varying perspectives on XRP’s stability and potential use cases.

XRP Outlook and Price Analysis

Despite these debates, XRP’s market performance remains robust. As of the time of writing, XRP is trading at $0.5523, with a market cap of $30.1 billion. Notably, XRP has shown a 5.6% increase in the past week joining the visible altcoin rally.

Market analysts like Elodie have expressed optimism about XRP’s future, citing technical indicators such as the falling wedge pattern on the 6-hour chart, which often precedes upward momentum.

Elodie has identified key price targets for XRP in the short to medium term, with the potential for a breakout beyond the current levels. These targets include $0.5557, $0.6237, and even $0.6957, representing notable potential gains from its current position.

Similarly, other analysts, like JayDee, foresee substantial growth for XRP soon, projecting a potential surge of up to 650 times its current value. Such a surge could drive XRP’s price to as high as $357.24 per coin, suggesting a remarkable milestone for the cryptocurrency.

Looking ahead, Ripple’s rise to the top appears ready to continue as it expands its reach and solidifies its position in the global payments industry. With the World Bank’s classification of XRP as a stablecoin, coupled with ongoing efforts to enhance its technology and partnerships, Ripple is well-positioned to transform cross-border payments on a scale never seen before.

What's Your Reaction?