President Bukele Announces Self-Financed Budget for 2025: A Move Towards Financial Autonomy

El Salvador’s Bitcoin Fund Management Agency accrued only $235 in 2024, far below the $7.4 million target. Despite AAB’s revenue issues, El Salvador provided over $11 million in government funds, a 1425% increase over budget. In 2024, El Salvador’s Bitcoin Fund Management Agency (AAB) has fallen short of its financial targets. Despite plans to generate [...]

- El Salvador’s Bitcoin Fund Management Agency accrued only $235 in 2024, far below the $7.4 million target.

- Despite AAB’s revenue issues, El Salvador provided over $11 million in government funds, a 1425% increase over budget.

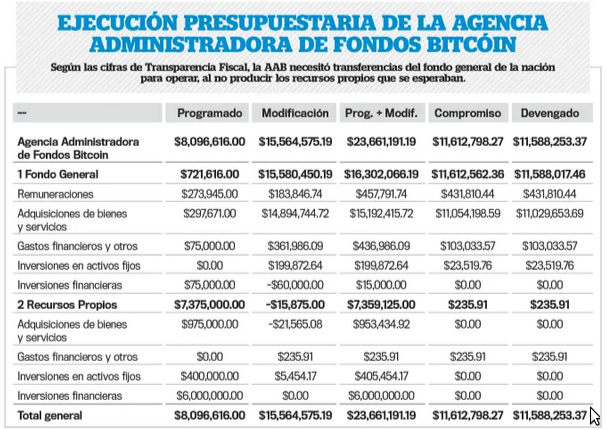

In 2024, El Salvador’s Bitcoin Fund Management Agency (AAB) has fallen short of its financial targets. Despite plans to generate $7.4 million in revenue from January to July, the agency has only accrued $235. This outcome starkly contrasts with the ambitious annual budget of $13 million intended for the agency, reflecting a concerning financial performance.

The AAB was projected to receive $1 million from El Salvador’s general fund and generate an additional $12 million from managing digital assets. However, the actual revenues are drastically lower than anticipated, highlighting a gap between projected and actual financial performance. This shortfall could pose serious implications for future crypto investments within the country.

The situation has prompted public discourse about the effectiveness of the AAB. Ricardo Valencia, an analyst, expressed his views on X (formerly Twitter), describing the AAB as a “bureaucratic entity.” He highlighted that Congress had expected the AAB to collect $7.3 million by providing services to Bitcoin businesses interested in investing in El Salvador’s government. The actual collection of just $236 underscores a lack of interest in partnering with the government.

Despite the AAB’s underperformance in generating its own income, it has received a substantial increase in government funding. The agency received over $11 million from the general fund, which is a 1,425% increase over the initially budgeted $700,000. This reliance on public funds to sustain the agency’s operations has sparked concerns about the sustainability of this funding model.

As we have already reported on the debt in El Salvador, the Salvadoran government continues its Dollar-Cost Averaging (DCA) strategy to purchase Bitcoin. As of the latest update, El Salvador holds 5,877.76 BTC valued at approximately $367.6 million.

In a recent address during El Salvador’s Independence Day celebrations, President Nayib Bukele announced plans to present a self-financed budget proposal to the Legislative Assembly. For the first time in decades, this budget will be fully funded without the need to incur new debt for operational expenses.

President Bukele emphasized this as a landmark move towards financial independence and self-sufficiency for the country.

What's Your Reaction?