Polygon Active Addresses Jump 227% in 2024: Records Daily User Peak

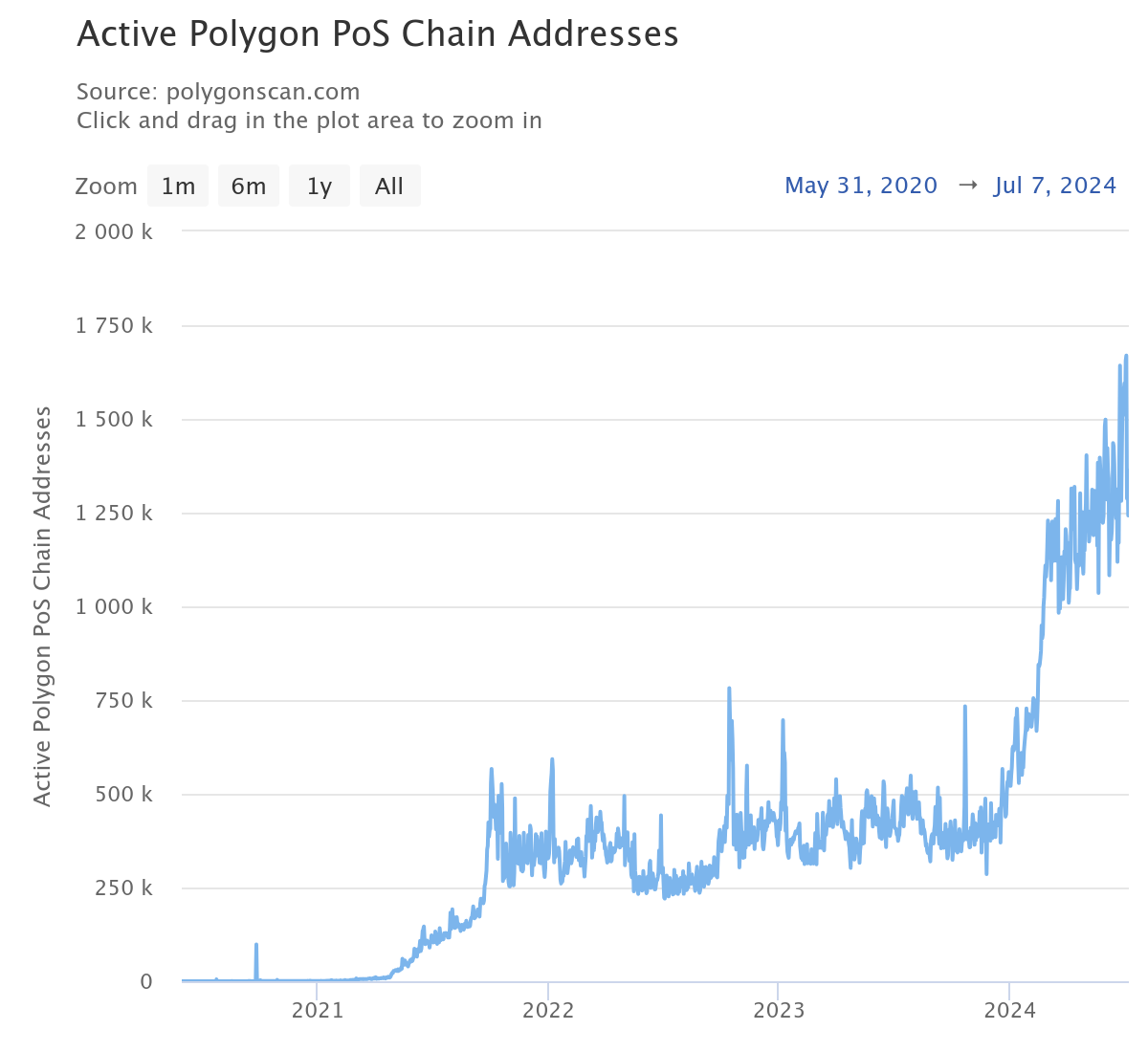

Polygon’s daily active users hit 1.67 million, an increase of 227% this year. The Total Volume Locked (TVL) decreased by 4.8% to $818.88 million. The Polygon PoS chain has been performing very well in the past few weeks, hitting new highs in daily active users and transactions. As reported by PolygonScan, the daily active address [...]

- Polygon’s daily active users hit 1.67 million, an increase of 227% this year.

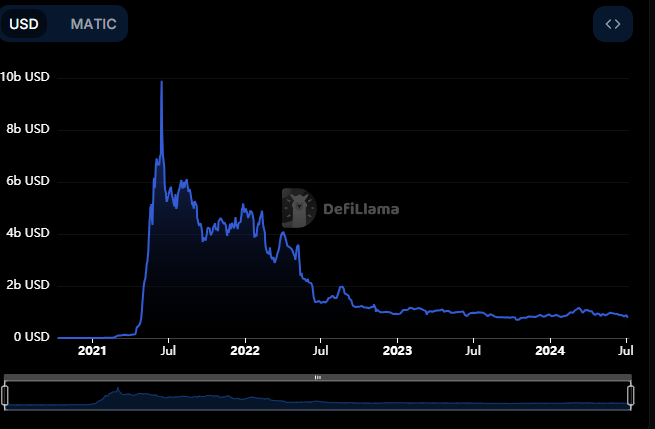

- The Total Volume Locked (TVL) decreased by 4.8% to $818.88 million.

The Polygon PoS chain has been performing very well in the past few weeks, hitting new highs in daily active users and transactions. As reported by PolygonScan, the daily active address count on the Polygon network is also skyrocketing.

The addresses reached 1.669 million, which is 227%, and has doubled since the beginning of the year. This significant rise in user activity indicates the network’s growing importance in the blockchain sector.

This growth highlights the continued growth of the platform due to new developments and enhanced innovation. In addition, Polygon had the most active users on all blockchain platforms, according to Dune data from cryptokoryo. This only shows that more and more people are using the platform, and it also points to the increasing attention that Polygon is getting.

Other metrics include the active user count, which stood at 2.4 million, and the daily transactions on Polygon, which were 3.78 million, although this was a 14.1% drop from the previous week. This change in the number of transactions signifies the active usage of the platform by users, capturing the short-term as well as the long-term trends. The increase in unique active addresses from 356,000 a year ago shows the network’s growth.

Decline in Total Volume Locked (TVL) and Rise in NFT Sales

Despite the records in daily active users and transactions this week, Polygon’s Total Value Locked dropped by 4.8% to $818.88 million within the past week. This decline in the TVL points towards the fact that there is a short-term change in user behavior and investment planning, which can be due to global market fluctuations.

Although there was a decrease in TVL, the sale volume of NFTs on Polygon in a week went up by 29.6% to $25.1 million. This jump in NFT sales is indicative of the increasing demand for digital assets and the increasing demand of NFTs on the Polygon network.

The top three NFT collections in sales were “Base Ape Polygon” with $3.6 million, “Poker NFT” with $2.2 million, and “Sea Dragon” with $1.9 million. These figures illustrate the variety of NFT products available on the platform and the continued interest in one-of-a-kind digital collectibles.

MATIC Token Experiences Volatility After Reaching Yearly High

Polygon’s MATIC token has had quite a ride this year, hitting its yearly peak of $1.27 in March. This surge offered a brief ray of hope for its holders. However, since the peak, MATIC’s price has been on a downward trend, and it has reversed most of the gains that it made during the bull run.

As of this writing, MATIC is currently trading at $0.502, registering a 1.22% surge in the past 24 hours. Additionally, the trading volume has gone up by 45% to $250 million, and the market capitalization is currently at $4.9 billion.

With the current trends of increased active addresses and user interaction on Polygon, it is crucial for developers and new users in the blockchain industry. Therefore, the network’s growing user base provides an appealing target for developers to create and launch new applications.

What's Your Reaction?