October Saw 17% Boost in Spot Trading Volume on Top Exchanges: What It Means?

Spot and derivatives trading volumes rose significantly across major crypto exchanges in October. Binance enhanced its Proof of Reserves with zk-SNARKs for improved privacy and transparency. Trading activity on major cryptocurrency exchanges changed noticeably in October, with both spot and futures trading volumes increasing month on month (MoM). Spot trade volumes climbed by 17%, indicating [...]

- Spot and derivatives trading volumes rose significantly across major crypto exchanges in October.

- Binance enhanced its Proof of Reserves with zk-SNARKs for improved privacy and transparency.

Trading activity on major cryptocurrency exchanges changed noticeably in October, with both spot and futures trading volumes increasing month on month (MoM). Spot trade volumes climbed by 17%, indicating good momentum at multiple top exchanges, according to Wu Blockchain.

Coinbase led the way with an incredible 61% increase, Gate came in second with 36%, and Binance came in third with 24%.

These rises pointed to a rising user confidence in the digital asset markets and interest. On the other hand, other exchanges—Bitfinex (-19%), HTX (-5%), and Bitget (0.5%)—faced slower or negative growth rates, showing that competition among exchanges remained fierce and results varied greatly.

Exchanges See Varied Growth in Trading Volumes and User Engagement

With volumes jumping by 25% month over month, derivatives trading saw even more amazing expansion. Leading this area, Bybit noted a clear 61% rise in futures trading; Bitget and Mex followed at 30% and 25%, respectively.

Not all exchanges, meanwhile, saw such expansion; HTX reported a tiny decline of -4%, while Crypto.com and KuCoin managed meager gains of just 3% and 5%. This unequal performance implied a dynamic trade environment in which user tastes and market conditions were always changing.

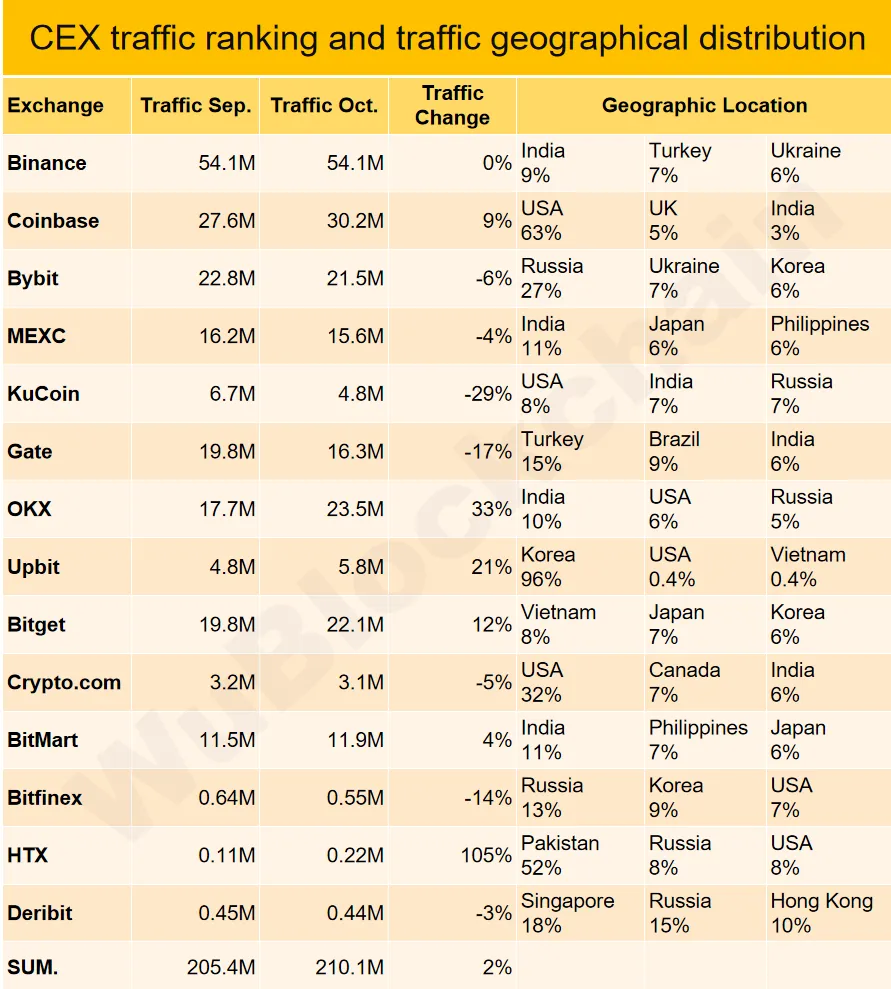

Data on website traffic adds still another level of complexity to the study since overall traffic to important exchanges rose by 2% in the same period. With a noteworthy 105%, HTX indicated a likely comeback in user interaction or a strong marketing campaign.

Traffic at 33% and 21%, respectively, experienced a steady increase as well from OKX and Upbit. By contrast, traffic dropped for KuCoin, Gate, and Bitfinex; KuCoin suffered the most at -29%.

What It Means?

These variations in user involvement and trade volumes expose a dynamic and competitive scene in the crypto market. Especially on exchanges like Coinbase, Bybit, and Binance, the significant rises in October’s spot and futures volumes point to increasing user activity and maybe revived interest in digital assets.

On the other hand, as we previously highlighted, Binance had lately finished its 24th Proof of Reserves, covering user assets spread over 34 coins. This audit confirmed Binance’s dedication to fully supporting user assets, which is a crucial comfort in a sector where security still takes front stage.

To further customer privacy and security, Binance also included zk-SNARKs technology into its Proof of Reserves checking system. With zk-SNARKs, Binance sought to increase the openness of their proof system while protecting private data, therefore establishing a benchmark for the sector in guaranteeing both security and openness.

What's Your Reaction?