NFT vs SFT: Everything You Need to Know

Explore the key differences between NFTs and SFTs, their unique use cases, and the advantages and disadvantages of each.

NFTs are unique and non-fungible, ideal for representing individual assets like art and collectibles. SFTs are flexible, starting as fungible tokens and transitioning to non-fungible, suited for gaming and hybrid use cases.

While NFTs have existed for over 10 years, it was the comparatively recent NFT craze that brought them widespread popularity. However, non-fungible tokens have certain limitations. This is where SFTs come into the picture, as semi-fungible tokens were made to address these limitations. Both serve different purposes and offer distinct functionality. Understanding these differences is essential for anyone who is seriously involved in blockchain, cryptocurrency, or digital assets.

In this article, we’ll break down the main use cases for NFTs and SFTs, their key differences, and their main advantages and disadvantages to better help you understand what role each type of token plays in the evolving landscape of blockchain technology.

Key highlights:

- Fungibility refers to the ability of an asset to be exchanged on a one-to-one basis with another asset of the same value and type.

- Non-fungible tokens (NFTs) are ideal for representing unique digital or physical assets such as art, collectibles, and in-game items.

- Semi-fungible tokens (SFTs) combine the characteristics of fungible and non-fungible tokens.

- While NFTs are more widely adopted due to their role in art and collectibles, SFTs offer greater flexibility and cost-efficiency, with batch transfers and hybrid functionality.

What is fungibility?

Before we dive into the differences between NFTs vs SFTs, it’s important to first understand the concept of fungibility.

Simply put, fungibility refers to the interchangeability of assets. That means that any fungible asset can be exchanged for another of the same type and value. For example, a 1 dollar bill is fungible because it’s of equal value to other 1 dollar bills, and they can be easily exchanged.

In the context of blockchain, the same concept can be applied to cryptocurrencies. Bitcoin and Ethereum are both fungible, since each Bitcoin and Ethereum are identical to another, which makes them easily tradeable. This means that these cryptocurrencies are fungible tokens (FTs).

What are NFTs (non-fungible tokens)?

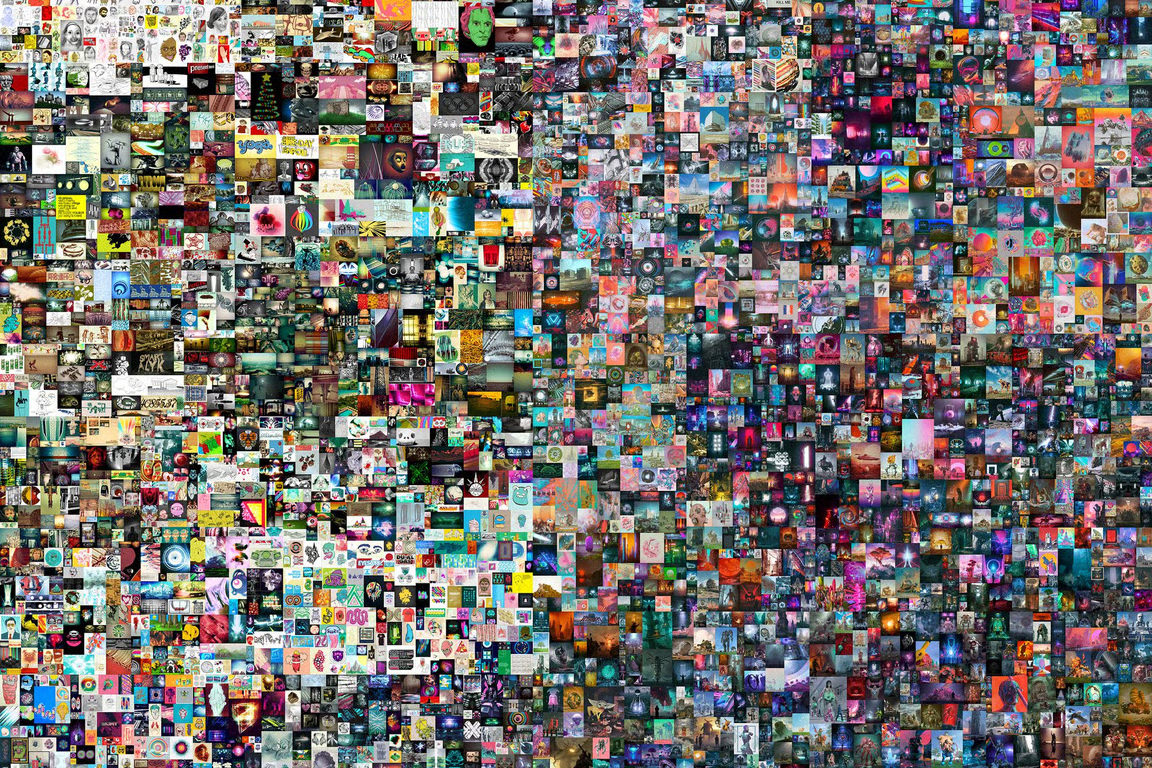

“Everydays: the First 5000 Days” by Beeple, one of the top NFT artists

Non-fungible tokens (NFTs) are unique digital assets that exist on a given blockchain. As their name implies, these assets cannot be exchanged on a one-to-one basis like Bitcoins can. This makes NFTs one-of-a-kind, which is also what makes them valuable and desirable.

NFTs utilize smart contracts that define the ownership, transferability, and the token’s other aspects. As such, NFTs can represent many digital assets, like music (MP3s), images (JPEGs), videos (MP4s), and blockchain in-game assets, just to name a few. Their nature makes them convenient to store, as many cryptocurrency wallets can also act as NFT wallets.

NFTs serve as a digital certificate of ownership, existing either purely digitally or tied to a physical counterpart. Due to them being cryptographically secured, NFTs cannot be duplicated, making them valuable in industries that value authenticity, such as art and entertainment.

The Merge is the most valuable NFT ever sold, netting over $91.8 million during its 48-hour sale. This should put into perspective how much people are willing to pay for a unique piece of art, digital or not.

Token standard – ERC-721

While most NFTs are built on the Ethereum blockchain, other blockchains like BNB Chain and Solana also support the creation and transfer of NFTs. The Ethereum blockchain uses the ERC-721 token standard, designed specifically for non-fungible tokens. One of the key differences between ERC-721 and ERC-20, which is used for fungible tokens, is that ERC-721 are non-divisible, while ERC-20 tokens can be split into smaller parts (similar to Bitcoin, which can be divided into satoshis).

Pros:

- NFTs provide proof of ownership, ensuring that each token is unique and cannot be duplicated

- Transactions of NFTs are traceable, secure, and transparent

- NFTs opened up new markets for digital art and gaming assets

- Artist and musicians can monetize their work without the need for intermediaries

Cons:

- High gas fees for NFT transfers on the Ethereum network

- NFTs cannot be divisible, meaning there is no way for users to trade smaller portions of high-value assets

What are SFTs (semi-fungible tokens)

Semi-fungible tokens (SFTs) combine characteristics of both fungible and non-fungible tokens. They start as fungible tokens, like cryptocurrencies, meaning they can be exchanged on a one-to-one basis. However, they can transition into non-fungible tokens after certain conditions are met, such as being redeemed, used in a game, or simply existing for a certain amount of time.

As you might guess, their main advantage over NFTs is their flexibility. They are particularly useful in gaming and digital platforms where assets have both fungible and non-fungible properties at different stages, and the majority of use cases so far have been tied to video games.

Let's take a look at a possible real-world use case for SFTs: in the ticketing industry, SFTs could represent concert tickets, that are redeemable for a certain event. After the event has passed, these tickets could become NFTs that behave as collectibles.

Token standard – ERC-1155

ERC-1155 is the most used token standard for creating SFTs as a more efficient and flexible alternative to both ERC-721 and ERC-20. The ERC-1155 standard allows developers to create both fungible and non-fungible tokens under a single smart contract, which dramatically reduces the complexity and fees associated with creating multiple token types.

Compared to ERC-721, ERC-1155 allows batch transactions, meaning that multiple tokens can be minted or transferred in a single operation. As alluded to before, this is particularly useful in gaming and could be useful for ticket platforms.

Pros:

- SFTs can transition from fungible to non-fungible, making them useful in gaming

- Unlike ERC-721, the ERC-1155 token standard allows batch minting and transfers, reducing transaction fees

- SFTs can be fractionalized, meaning users can own pieces of SFTs

Cons:

- SFTs are more technically complex due to developers needing to account for both fungible and non-fungible states

- They are not yet as widely adopted compared to NFTs, limiting usability

NFT vs SFT: What are their key differences?

While both NFTs and SFTs have uniquely impacted the digitalization of unique assets, there are some key differences to consider when it comes to their approach, purpose, and execution.

1. Fungibility

NFTs are non-fungible, meaning that each NFT is unique and cannot be exchanged one-to-one. SFTs, however, start as fungible tokens and become non-fungible later, making them more flexible.

2. Divisibility

NFTs are not divisible, meaning you must own the entire token to trade it. In contrast, SFTs are divisible as long as they are still fungible, meaning that portions of an asset could be traded instead of the whole token.

3. Transferability

NFTs require individual transactions for each token, meaning that transferring multiple NFTs are costly. SFTs enable batch transfers, making them much more cost-efficient.

The bottom line – NFTs are more widespread, but SFTs are more flexible

Both NFTs and SFTs bring unique strengths to the blockchain ecosystem, each suited to different purposes. NFTs are ideal for proving ownership and authenticity, making them widely adopted in art, entertainment, and digital collectibles. On the other hand, SFTs provide the versatility of transitioning between fungible and non-fungible states, making them particularly useful in gaming, ticketing, and other scenarios where assets need to serve multiple functions over time. Ultimately, the choice between NFTs and SFTs depends on the specific requirements of your use case.

When it comes to rewards, both NFTs and SFTs are ideal for play-to-earn crypto games, which in part took off due to the existence of NFTs. Additionally, you can see our list of the most expensive NFTs to explore the world of digital art.

What's Your Reaction?