Nexo Levels Up to Become Your One-Stop Shop for Digital Asset Wealth

Nexo levels up with a major rebrand, unveiling refined branding and a renewed focus on personalized services for retail and institutional investors.

Key highlights:

- Nexo has evolved beyond basic crypto lending with a rebrand reflecting its full-service digital asset wealth platform.

- Nexo presents itself as a sophisticated digital asset manager catering to both retail and institutional investors with personalized services and flexible options.

- Having already processed over $320B with licenses worldwide, Nexo is the trusted platform to steward the next generation's growing digital wealth.

Leading cryptocurrency lender Nexo recently unveiled a major rebrand to position itself as more than just another crypto lending company. After over six years in business, Nexo believes it has evolved beyond basic crypto loans and is launching a refreshed strategy to match. Let's take a look at what's new with Nexo following its transition into a full-fledged digital asset wealth platform.

A new look and refined focus

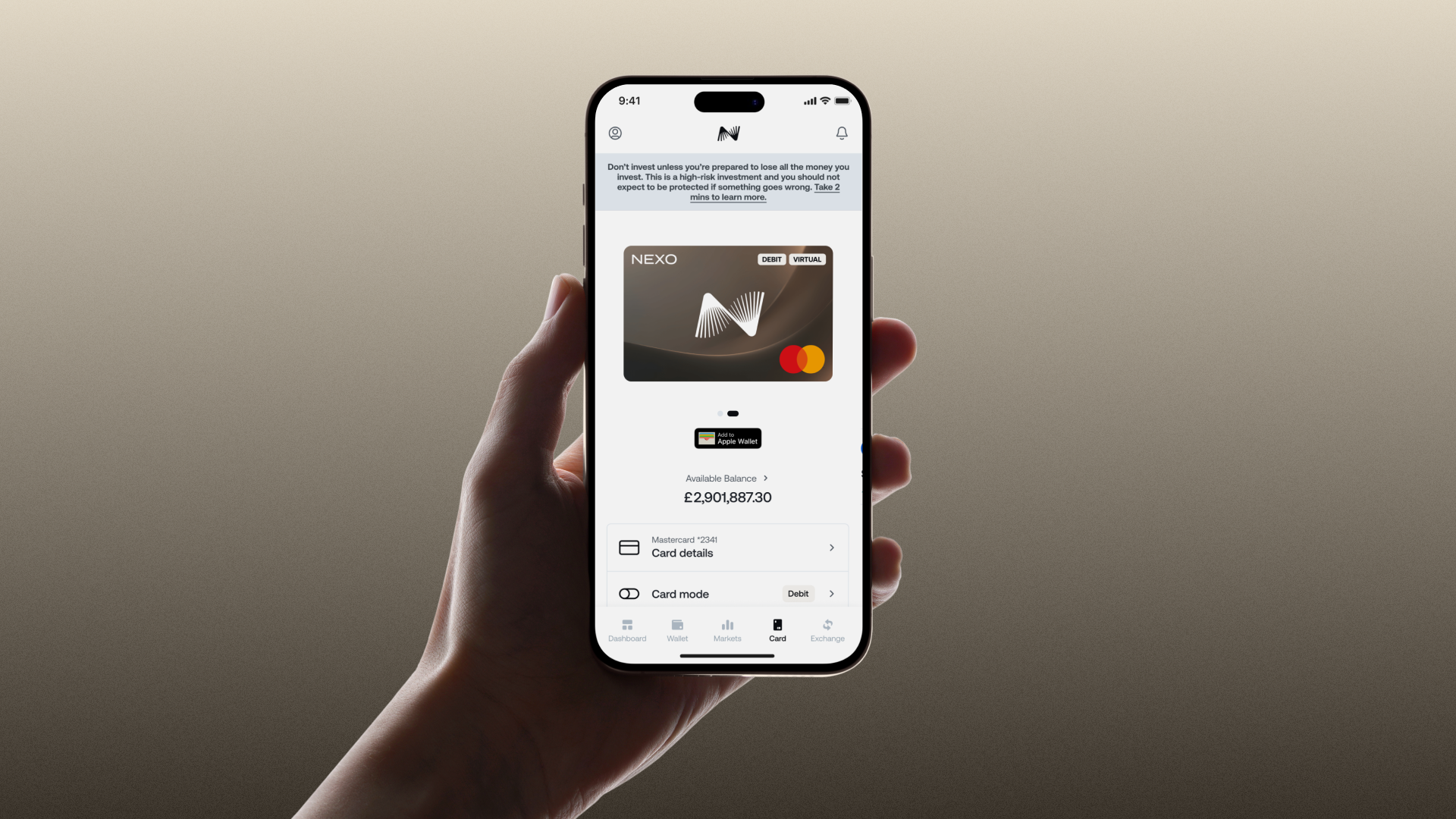

Gone are the bold colors and financial jargon of Nexo's past marketing. The company's website and branding materials now exude a sleek, sophisticated aesthetic with muted grays and greens. Along with a visual overhaul, Nexo's rebrand comes with a refined focus on personalized client services and flexibility.

Nexo has grown far beyond its origins as a basic interest-earning crypto bank. Today, the company prides itself on white-glove client care with options for both retail and institutional investors. Users can now grow their wealth on Nexo through interest accounts, exchange trading, stablecoin credit lines and more - making it more like a full-service digital asset manager.

Evolving to meet demand from sophisticated users

So what prompted Nexo's makeover? Through surveys of 5,000 clients across 23 countries, Nexo learned that high-net-worth individuals increasingly view digital assets as long-term investments rather than speculative gambles. As such, Nexo redesigned its platform with a 360-degree suite befitting wealth managers, not amateur traders. Features like fixed-term certificates, trading with leverage, and advanced analytics cater to pros' demands while retaining usability for newcomers.

Evolution of a crypto lending pioneer

Nexo's evolution is no surprise considering it has been in business longer than most other cryptocurrency lenders. Founded in 2018, Nexo helped pioneer the crypto interest account model and has since issued over $8 billion in loans. It now boasts serving over 7 million users generating nearly $1 billion in total interest paid out. The rebrand reflects this renewed global focus.

A wealth platform beyond basic loans

So in what ways has Nexo truly evolved beyond basic lending? For one, the company now offers robust trading capabilities on its exchange. Users can swap between 100+ assets with perks like 0.5% crypto cashback. Nexo also provides savings products like flexible interest accounts and fixed-term deposits earning yields up to 16%.

Another advantage is Nexo's wide array of credit lines. Borrowers can use assets like Bitcoin, Ethereum, and Tether as collateral at loan-to-value ratios up to 50% for instant cash. Paying expenses with the Nexo Card in crypto also earns ongoing asset-backed interest.

Simply put, Nexo has transformed into a true one-stop shop. Whether you're looking to grow savings, unlock liquidity, or get flexible access to your crypto wealth, Nexo's full platform has you covered in a holistic manner. It certainly matches its new "digital asset wealth manager" title.

Nexo's clever rebranding successfully revamps its image from that of a niche crypto lender into a sophisticated wealth platform for the digital assets age. With a refreshed strategy and feature-rich offerings, Nexo is well-positioned to keep evolving alongside industry maturation.

What's Your Reaction?