Navigating the new era of digital scarcity with Bitcoin’s latest halving

The halving of Bitcoin, an essential phenomenon in the cryptocurrency market, signifies Bitcoin scarcity and deems it an asset of modern times, probably treasured as real estate and the yellow metal. The latest halving that occurred on April 19th, both Bitcoin and the crypto market at large, has stimulated the interest of investors and analysts, […]

The halving of Bitcoin, an essential phenomenon in the cryptocurrency market, signifies Bitcoin scarcity and deems it an asset of modern times, probably treasured as real estate and the yellow metal. The latest halving that occurred on April 19th, both Bitcoin and the crypto market at large, has stimulated the interest of investors and analysts, leading them to discuss its implications for the market and Bitcoin’s future.

Understanding Bitcoin halving

Roughly every four years or after the blockchain has witnessed 210 thousand new blocks mined, the Bitcoin network faces a halving event, reducing the reward to about half for a miner who mines new blocks. This results from block reward reductions that effectively decrease the amount of new bitcoins generated every time. The system now has its deflationary mechanism. Bitcoin has experienced 4 halvings since that moment, with the last one lowering the reward per block from 6.25 Bitcoin to 3.125.

Source:coinmetrics

Analyzing the Influence of the Bitcoin Reduction on Its Scarcity

Fearlessness in the hard census is considered a significant argument that Bitcoin directly competes with the limited nature of precious metals. It is directly built on the principle of halving, which creates more deficits.

Because of the limited amount of BTC that reaches the market, Bitcoin has become more interesting as a store of value. There are only 21 million Bitcoins that can be put into circulation. Suppose 50 percent of them are mined. Each progressive halving makes the cryptocurrency closer to the ultimate amount of Bitcoins.

Market trends post-halving

As observed from the historical data, the price of Bitcoin has demonstrated a constant pattern of increase after each halving. Bitcoin’s price more than doubled compared to gold’s gains of only 19%, showcasing the outperformance.

Bitcoin price charts post halving source: Trading view

The dynamics of the gold and crypto-currency markets in 2024 remain striking: Bitcoin has grown 51% more year-to-date (YTD) than gold, whose value, judging by TradingView figures, has improved by 15%. The punctuation of this performance clearly indicates that the market is becoming more trusting of Bitcoin not only as a means of payment but also as a store of value.

Price of Gold source: Trading view

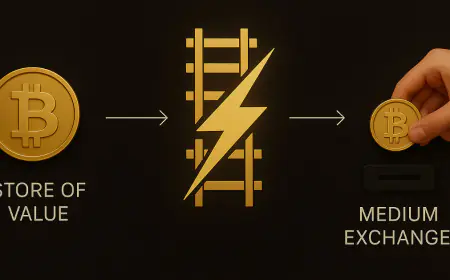

Classic physical assets, such as precious metals and every estate, have been the favorite assets for investors hoping for a place to store value. While the digital era does well with more liquid assets to sharpen the pace of transactions, others face challenges due to their limited capacity to grow. Bitcoin tends to fit this bill as a virtual asset since it makes the physical process of transactions speedy and cheaper while the cost of physical movement is too high.

Bitcoin: Long-term potential as a haven asset

Through the halving principle, the number of coins produced over time and entered into circulation will keep decreasing, and mining will finally disappear after 21.000.000 bitcoins are produced, which is likely in the year 2140.

With the supply being more limited at a heightened level, Bitcoin’s intrinsic deflation characteristic is expected to be exhibited largely, thereby increasing its value and attractiveness as a long-term investment.

Indeed, bitcoin’s scarcity is not only enhanced but pronounced in the context of the halving cycle, which clearly outlines the possibility of embracing bitcoin as a digital unit of store value.

Every halving of Bitcoin further solidifies its bidding against classical assets. It gets more and more capital from investors willing to acquire the assets with both value-retention features and the benefits of instantaneous transfers and quick liquidity of digital assets. As the world becomes more and more digital, the planned rarity of Bitcoin and the effect of this and the outcome of it will remain an important part of the financial world.

What's Your Reaction?