Interest rates relief by 2025? Here’s what the numbers say

Are we finally seeing signs of an interest rate reprieve? The latest data from the NAB Business Survey may hold the answer.

Are we finally seeing signs of an interest rate reprieve? The latest data from the NAB Business Survey may hold the answer.

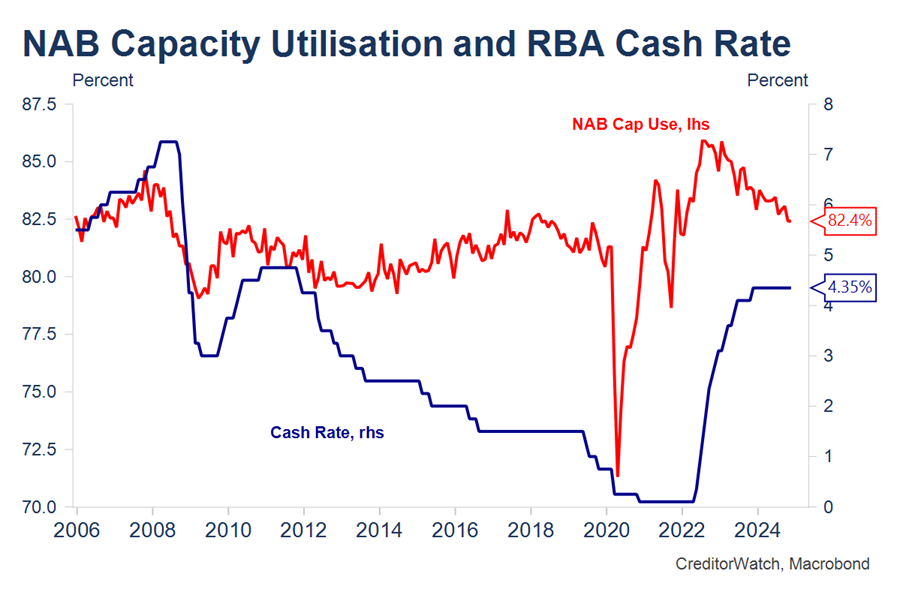

The Reserve Bank has decided to keep interest rates on hold at 4.35 per cent, with the bank indicating inflation remained too high to warrant an easing of monetary policy right now.

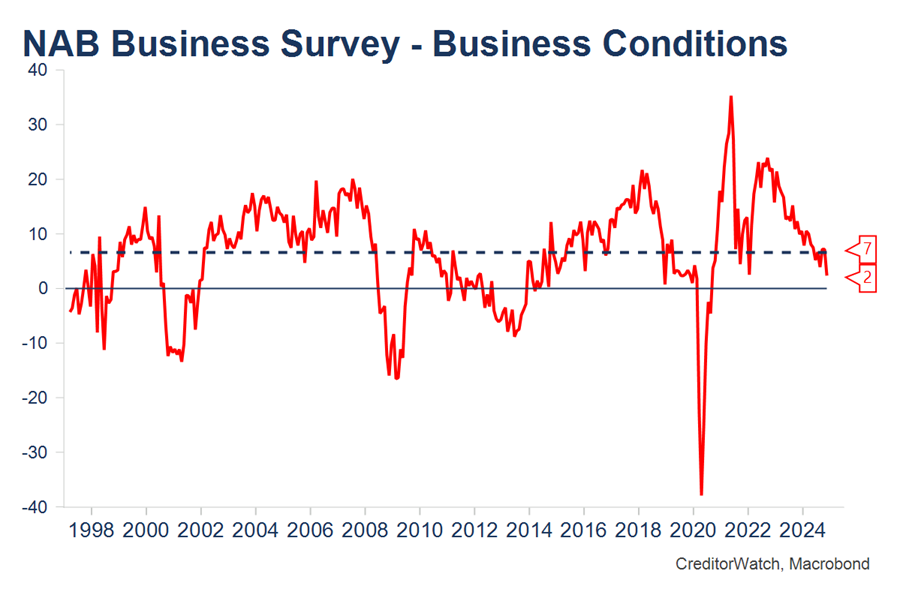

While encouraging signs of moderating inflation suggest potential interest rate cuts in the coming months, a notable decline in business conditions raises concerns about the overall economic outlook. These findings will likely influence the Reserve Bank of Australia’s monetary policy decisions in the near future.

Ivan Colhoun, Chief Economist at CreditorWatch, described the results as significant, particularly the moderation in retail and service prices, which serve as vital indicators of inflation trends. Encouragingly, these developments support market expectations of potential interest rate relief by the second quarter of 2025—a prospect that could ease borrowing costs for many SMEs.

Business confidence takes a dip

Business confidence dropped sharply from +5 to -3, reversing last month’s unexpected surge. For SMEs, this dip signals growing caution among businesses about future prospects, likely fueled by uncertainties in consumer demand, cost pressures, and global economic headwinds.

Even more telling is the decline in business conditions, which fell from +7 to +2. This metric, closely tied to real-world operations like trading, profitability, and employment, provides a direct reflection of what businesses are experiencing. “While not yet indicative of severe weakness, the result is a key print to watch,” Colhoun noted. SMEs may find this particularly significant, as a softening in business conditions often translates into challenges in cash flow and demand.

Who’s thriving, who’s struggling?

The survey revealed a clear divide between sectors. Service-oriented industries such as Recreation and Personal Services, Transport and Utilities, and Financial and Property Services are outperforming, thanks to steady demand for experiences and professional services. For SMEs in these sectors, the outlook remains positive, with opportunities to leverage consumer and business spending.

On the flip side, goods-producing sectors are struggling. Manufacturing emerged as the weakest sector, possibly influenced by uncertainty surrounding former President Trump’s proposed tariff policies, which could disrupt global supply chains. Retail is also facing headwinds, reflecting cautious consumer spending. SMEs in these sectors may need to focus on efficiency and innovation to weather the downturn.

Mining, another traditionally robust sector, showed significant declines. This is attributed to weaker forward orders from China—a critical market. However, Colhoun warned that mining data can be volatile, and SMEs tied to the sector should stay agile and prepared for shifts in demand.

A mixed bag for SMEs Across Australia

Geographically, the survey highlights sharp differences in business conditions across states.

- South Australia, Tasmania, and Victoria reported the weakest conditions. Factors such as Tasmania’s slower population growth and Victoria’s reliance on manufacturing, coupled with state tax policies, may partly explain the challenges. SMEs in these areas should be cautious and explore diversification or niche markets to maintain resilience.

- Queensland continues to lead in business conditions, bolstered by robust population growth, despite a slight dip this month. SMEs in Queensland can leverage this momentum to expand and attract customers in growth-focused sectors.

- Western Australia and New South Wales are performing close to the national average, providing a stable environment for SMEs. However, vigilance is key, given the broader economic uncertainties.

Colhoun also noted that data from smaller states like Tasmania and South Australia can be volatile, but the weaker trends have persisted for months, warranting attention from local businesses.

Inflation and interest rates

Perhaps the most encouraging takeaway from the survey is the progress on inflation. Input costs and retail prices have shown further moderation, with retail price increases slowing to a manageable monthly rate of 0.2-0.3%. This aligns with the Reserve Bank of Australia’s (RBA) goals for core inflation to return to the 2-3% target range.

For SMEs, this could mean relief from escalating costs, particularly in retail and service-based businesses. Lower inflationary pressures, combined with potential interest rate cuts by mid-2025, could create a more favorable operating environment.

However, Colhoun warned that elevated capacity utilization, driven by tight labor markets, remains a constraint. This means wage pressures may persist, and SMEs should plan for the ongoing challenge of recruiting and retaining skilled workers.

What’s next for SMEs?

“This month’s survey provides valuable insights into evolving economic conditions,” Colhoun emphasized, noting the importance of confirming these trends in next month’s data. For SMEs, the message is clear: stay informed, adapt to sectoral and regional nuances, and prepare for both challenges and opportunities.

While the results point to areas of concern, particularly in manufacturing and retail, they also highlight opportunities in services and regions like Queensland. For SMEs, the key to navigating the current landscape will be resilience, innovation, and strategic planning. As the prospect of interest rate relief looms, businesses that position themselves effectively now could be well-placed to benefit when conditions improve.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

What's Your Reaction?