Hedera DeFi Deep Dive: TVL Shows Impressive 146% YTD Growth, USDC Integration Flourishes – Is HBAR Getting Ready for ATHs?

Since the turn of the year, Hedera has recorded a 146% growth in DeFi total value locked (TVL), with SaucerSwap leading the push following the launch of its V2 protocol last November. Meanwhile, HBAR price has shot up from $0.085 at the start of the year to $0.116 at press time, and with DeFi and [...]

- Since the turn of the year, Hedera has recorded a 146% growth in DeFi total value locked (TVL), with SaucerSwap leading the push following the launch of its V2 protocol last November.

- Meanwhile, HBAR price has shot up from $0.085 at the start of the year to $0.116 at press time, and with DeFi and USDC integration on Hedera thriving, the token is set for bigger gains this year.

It has been a year in which crypto ecosystems have thrived, with most top cryptos now boasting some of the fastest-growing decentralized applications. While the spotlight has been on Solana, Polygon, Polkadot, XRPL and others, Hedera has made major moves. As a new report reveals, its DeFi has more than doubled, and stablecoin integration is thriving, setting the native HBAR token for a monster year.

The report was published Tuesday by New York-based crypto research firm Messari. It explored DeFi on Hedera, staking, NFTs and more.

.@hedera's DeFi ecosystem is off to a big start in 2024.

This success is primarily attributed to the launch of SaucerSwap V2, which introduced concentrated liquidity, important tokenomic changes, and more.

Explore the deep dive

https://t.co/2afrsm48xN pic.twitter.com/UDgXdvhmV4

— Messari (@MessariCrypto) March 26, 2024

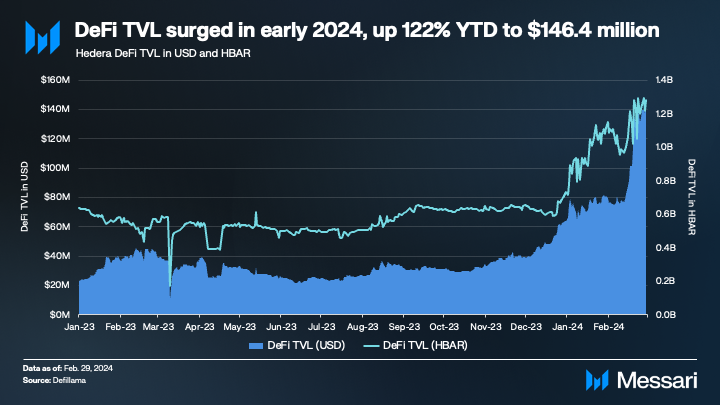

In the first two months of the year, the TVL in Hedera shot up from $63.9 million at the end of Q4 last year to $157.1 million, a 146% surge. As the graph below shows, a sudden spike in February aligns with growth in the broader crypto market.

DeFi on Hedera is dominated by SaucerSwap, an automated market maker protocol forked from Uniswap. In mid-November, SuacerSwap launched the second version of its protocol, V2. Forked from Uniswap V3, it reinvigorated its community and led to a surge in TVL from $60.4 million to $143.8 million year-to-date, a 138% jump. This accounts for over 98% of the entire ecosystem’s TVL.

It’s not just the TVL that’s skyrocketing. According to Messari, the average daily trading volume on Hedera DEXes is up 308% to $5.2 million.

This growth has been reflected in the price of SAUCE, the native token of the SaucerSwap ecosystem. The token shot up from $0.05684 at the turn of the year to an all-time high of $0.222 three weeks ago.

Hedera Records Massive Growth—Is an HBAR Surge Looming?

Besides DeFi, other aspects of the Hedera ecosystem have also seen massive growth, as Crypto News Flash has reported. Stablecoins remain a critical part of any ecosystem, and on Hedera, USDC is king. The second-largest stablecoin has a circulation of $8.3 million, a 35% increase YTD, Messari notes.

Additionally, users can bridge their Tether and DAI stablecoins to Hedera using the Hashport bridge. So far, users have leveraged the bridge to transfer $282,200 in USDT and $104,900 in DAI to the network.

Liquid staking remains the sector that has declined in what has otherwise been a stellar year for Hedera. After peaking in Q1 last year, it has been on a decline, and since the start of 2024, it has been down 25% to 338 million HBAR tokens.

Messari’s report concludes:

…the progress made over the past year for Hedera’s DeFi ecosystem cannot be ignored, and the ecosystem looks to continue to grow entering the next stage of the crypto bull run.

However, the report noted that the ecosystem needs a lending protocol to offer users leverage on their trades.

Meanwhile, the HBAR token has surged since the beginning of the year. Having started at $0.08593, HBAR is trading at $0.1161 at press time, a 35% increase in that time. The token is still way below its all-time high, set in September 2021 at $0.567.

What's Your Reaction?