Google Trends Suggests Decreasing Bitcoin Interest—Could This Point to Upcoming Market Volatility?

Global search interest in Bitcoin has dropped significantly from 57 to 32 out of 100 since January 2024. El Salvador, Nigeria, Switzerland, Austria, and the Netherlands are leading in Bitcoin search interest. Global interest in Bitcoin (BTC) has witnessed a noticeable decline, reflecting a shift in public sentiment despite ongoing market activity. The data from [...]

- Global search interest in Bitcoin has dropped significantly from 57 to 32 out of 100 since January 2024.

- El Salvador, Nigeria, Switzerland, Austria, and the Netherlands are leading in Bitcoin search interest.

Global interest in Bitcoin (BTC) has witnessed a noticeable decline, reflecting a shift in public sentiment despite ongoing market activity. The data from Google Trends indicates that the interest that was initially seen among the retail investors in cryptocurrencies has reduced both in the short-term and the long-term analysis.

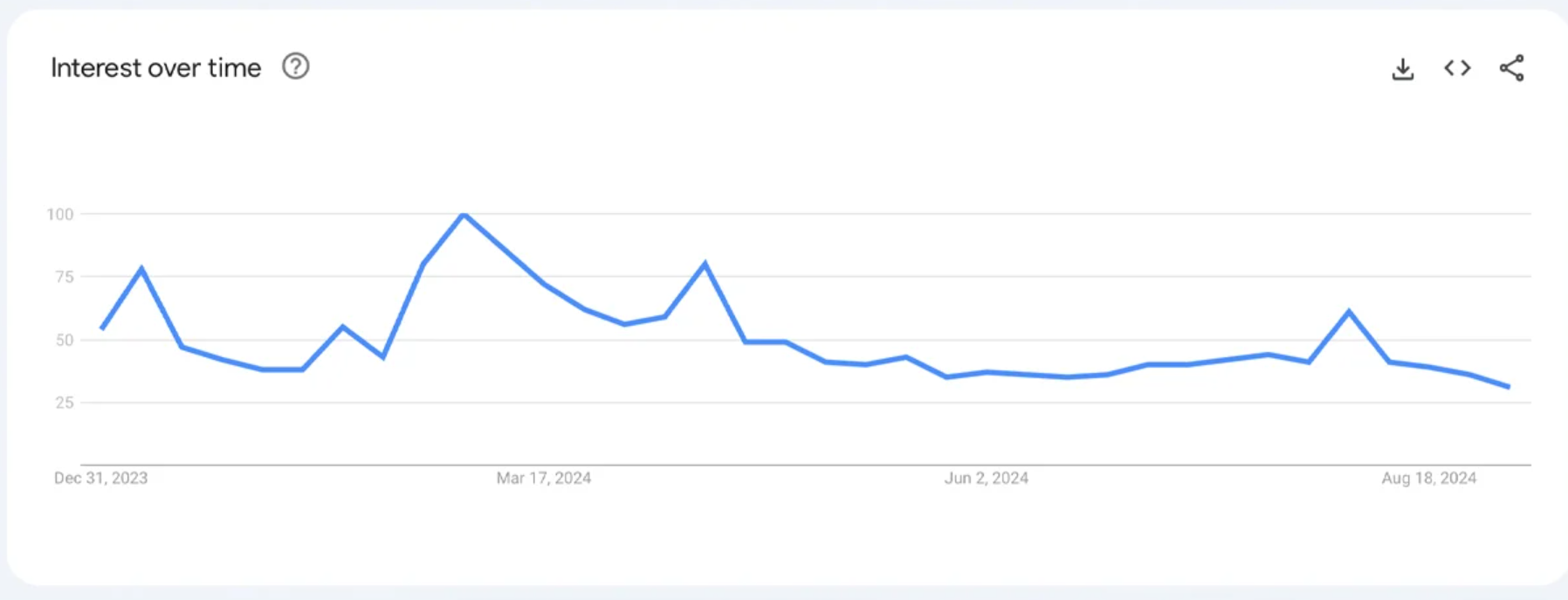

Google Trends analysis indicates that the search interest for ‘bitcoin’ has declined since the start of 2024. As of January 1, 2024, the search term had a score of 57 out of 100, but as of early September, it stands at 32. This indicates a drop in the global search interest in retail by 43. 85%, meaning that the retail interest is diminishing even as the prices of Bitcoin remain a subject of debate in the financial markets.

The search interest was at its highest during the week of March 3-9, 2024, when Bitcoin had its record high of over $73,000. However, this increase in interest was not long-lasting and soon faded away. As the market has become more and more unpredictable, interest in the matter has decreased dramatically.

Global Bitcoin Hotspots Defy Worldwide Trend

However, some countries remain highly interested in Bitcoin, even if the numbers are generally decreasing. According to the latest data, El Salvador is the country with the highest search interest in cryptocurrency, followed by Nigeria, Switzerland, Austria, and the Netherlands. These countries have been dominating the Google Trends data throughout 2024, which suggests that the interest in Bitcoin is stronger than the worldwide trend.

It is not surprising that El Salvador is the leading country in Bitcoin interest, as the government made it a legal tender in 2021. This has ensured that the cryptocurrency remains relevant and Trending in the public eye, hence, continuous search. Likewise, Nigeria’s high ranking can be explained by the fact that it has a young and technologically-minded population that is turning to digital currencies as an alternative to conventional banking.

When analyzing the data from Google Trends for five years, the decline in interest can be seen even more clearly. The last time Bitcoin search interest reached a peak score of 100 was during the week of May 16-22, 2021, and this was during a week that saw a lot of trading and news events.

Bitcoin’s Novelty Fades as Market Volatility Persists

However, search interest has gradually decreased over the years. For instance, in March 2024, when Bitcoin was on the rise, the search term scored 51 out of 100, but by September, it had deteriorated to only 16. This long-term trend indicates that people are losing interest in Bitcoin as the novelty factor of the digital currency has faded due to the volatility of the crypto market.

Additionally, TechDev, an analyst on X, has posted charts that point to similarities between the current Bitcoin trend and the surge of the Japanese stock market several years ago. According to TechDev’s analysis, the value of Bitcoin could soar in the near future, thus providing a strong argument for it.

— TechDev (@TechDev_52) September 1, 2024

From the charts, he noted that the price action of Bitcoin since 2010 resembles the Nikkei 225 of Japan between the years 1950 and 2000. According to TechDev’s model, Bitcoin could surge to $760,000 between 2028 and 2029 and then enter a bear market.

What's Your Reaction?