Ethereum Staking Gains Institutional Confidence as Nearly 70% of Investors Commit – Is ETH Eyeing an ATH?

A recent report has disclosed a growing interest in ETH staking among institutional investors, as almost 70% of them get involved. According to 22% of the respondents, more than 60% of their portfolio has been allocated to ETH or staked ETH. In a recent survey conducted by Blockworks Research, the majority of the respondents (69.2%) [...]

- A recent report has disclosed a growing interest in ETH staking among institutional investors, as almost 70% of them get involved.

- According to 22% of the respondents, more than 60% of their portfolio has been allocated to ETH or staked ETH.

In a recent survey conducted by Blockworks Research, the majority of the respondents (69.2%) admitted that they currently stake in Ethereum (ETH). Out of this, 78.8% were institutional investors with a background in asset management.

Analyzing the research report, we also observed that 60.6% of the respondents make use of a third-party staking platform. For 48.6% of the respondents, one integrated platform like Coinbase and Binance is where they prefer to stake their ETH. Fascinatingly, five factors were indicated as their common requirements in choosing a staking provider. These are – reputation, range of networks supported, price, simple onboarding, competitive costs, and expertise and scalability.

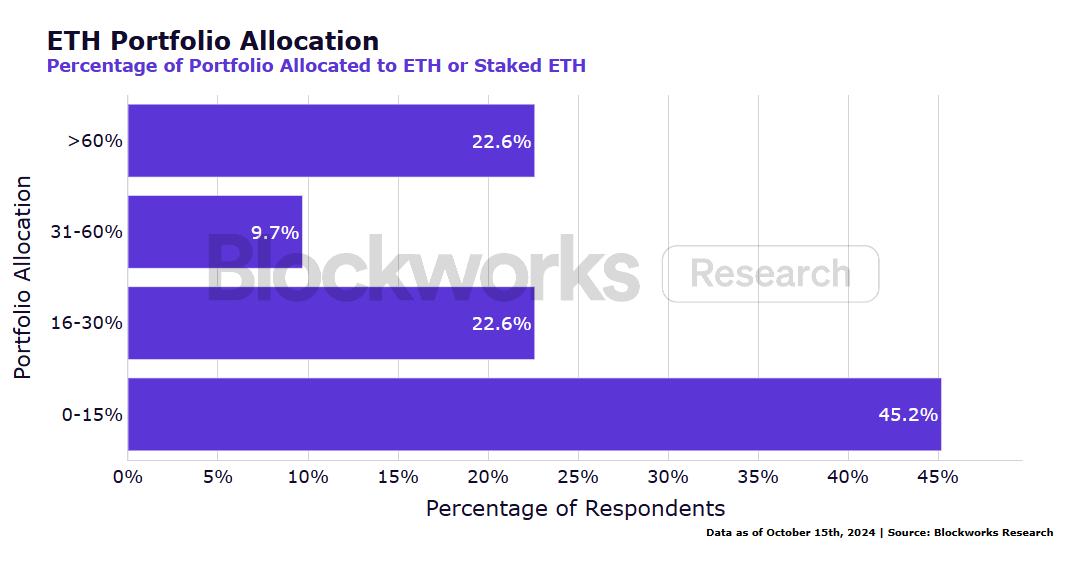

Amount of Portfolio Allocated to ETH

In another section of the research findings, 22.6% of the respondents disclosed they had allocated more than 60% of their portfolio to ETH or staked ETH. 9.7% also indicated to have allocated between 31% to 60% of their portfolio to ETH. 22.6% stated to have put between 16% to 30% of their allocation into the asset, and 45.2% also indicated that up to 15% of their portfolios are in ETH or staked ETH.

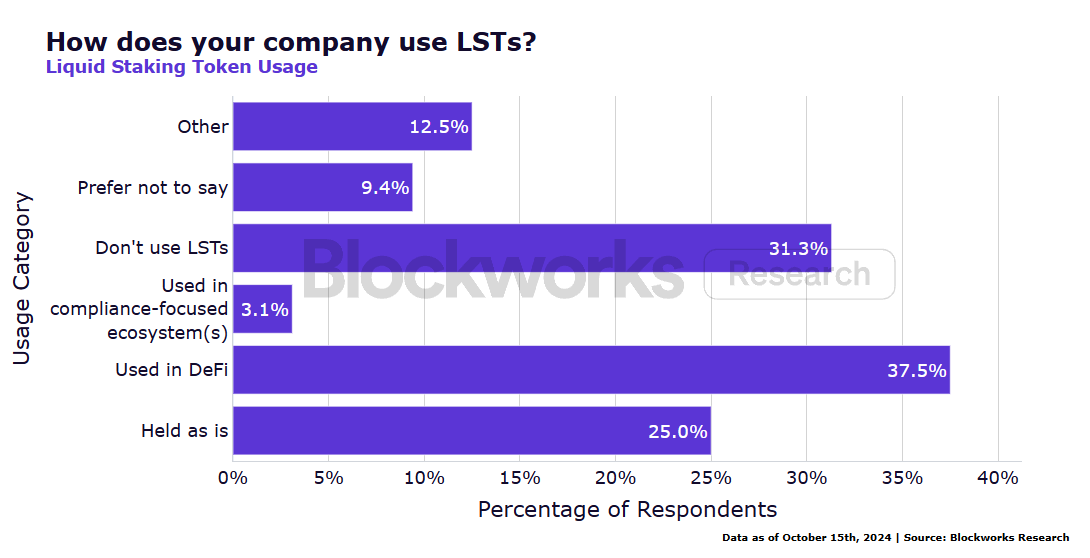

In terms of Liquid Staking Tokens (LSTs), 52.6% of the respondents claim to hold them, while 75.7% of them admitted to having ETH with a decentralized protocol.

A section of the report reads:

Once an LST has substantial liquidity such that its price is expected to remain generally tethered to ETH, it can be adopted by a DeFi money market, further enhancing its utility. Leading DeFi money markets, including Aave and Sky (previously MakerDAO), have integrated LSTs to enable users to borrow other assets without having to sell their staked ETH. This enables higher yields because users can compound Ethereum PoS rewards while earning additional yields from their LSTs deployed in DeFi strategies.

Key Trend Spotted in the Report

One of the key observations in this report outlined by Blockworks Research is that institutional investors are actively participating in Ethereum staking. However, this is done in different levels of exposure and methods. Another important observation is the growing interest in advanced staking technologies such as Distributed Validators (DV) and Restaking. Most importantly, there is a high level of awareness in terms of associated operational risks.

The report also mentioned that restaking – a technological unlock that creates a new revenue stream for stakers was an integral part of the survey. Based on the data, 55.3% of the respondents admitted that they are interested in restaking Ethereum. Meanwhile, 74.4% also stated that they are aware of the associated risks.

At press time, ETH was trading at $2,628 after surging by 0.55% in the last 24 hours. According to market analysts, the strong institutional interest could fuel a significant price growth above the ETH’s all-time high price of $4,092.

What's Your Reaction?