Ethena Labs Welcomes BlackRock Partner for Reserve Fund Allocation

Ethena Labs introduces reward-bearing asset proposals, inviting issuers to pitch for allocations from its liquid cash backing. ENA governance launches with a professional Risk Committee to manage and evaluate risks within the Ethena ecosystem. Ethena Labs has announced the launch of Ethena reward-bearing asset proposals, which let companies compete for an allocation of Ethena’s liquid [...]

- Ethena Labs introduces reward-bearing asset proposals, inviting issuers to pitch for allocations from its liquid cash backing.

- ENA governance launches with a professional Risk Committee to manage and evaluate risks within the Ethena ecosystem.

Ethena Labs has announced the launch of Ethena reward-bearing asset proposals, which let companies compete for an allocation of Ethena’s liquid cash backing. This project is a key milestone in Ethena’s attempts to improve its ecosystem and provide prospects for issuers and investors alike.

Introducing the Ethena reward-bearing asset proposals, with entities pitching for an allocation from Ethena's liquid cash backing

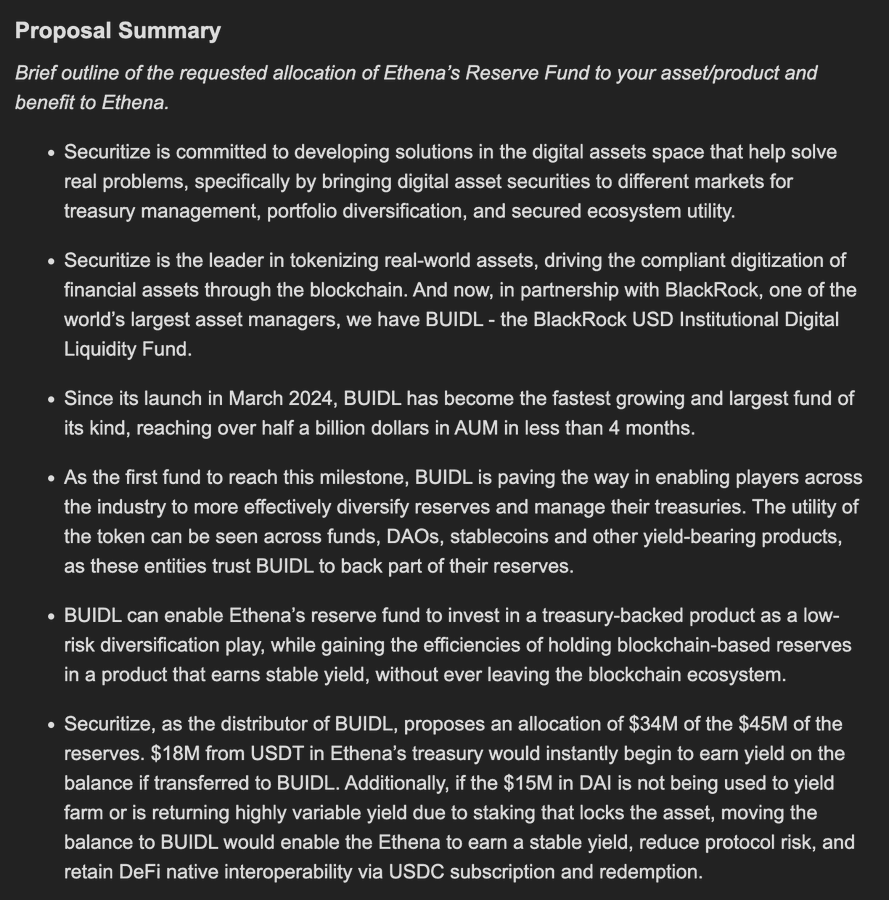

One of the early applications is from Securitize, the distributors of @BlackRock's BUIDL, for an allocation from Ethena's Reserve Fund

Details below pic.twitter.com/YZIhWqBEQE

— Ethena Labs (@ethena_labs) July 23, 2024

Early Applications from Securitize and Steakhouse Financial for Ethena’s Reserve Fund

One of the earliest petitions for this allocation came from Securitize, the distributors of BlackRock’s BUIDL, who requested a share of Ethena’s reserve fund.

Issuers are invited to pitch Ethena for an allocation of reward-bearing assets (RWA), with Securitize submitting the second significant proposal for BlackRock BUIDL. In addition to Securitize, Steakhouse Financial has filed an early application, proposing an allocation to Steakhouse USDC.

Furthermore, today marks the start of ENA governance by committee. With this new governance structure, a group of industry-leading, professional risk consulting firms will now make important Ethena protocol risk decisions. ENA token holders will run these businesses, giving the community a say in the protocol’s future.

The Risk Committee’s mandate includes detecting, assessing, and managing risk in the Ethena ecosystem. The committee will provide input and oversight on a variety of areas, including diversification across hedging venues, accepting different types of backing assets, evaluating and approving new delta hedging sites, approving new custody providers, and sizing and allocating reserve funds.

Meanwhile, the price of Ethena’s native token, ENA, is currently about $0.4782. This represents an astounding 10.90% growth over the last 24 hours, putting it in the top five gainers among major cryptocurrencies on CoinMarketCap. This jump demonstrates increased investor confidence and interest in Ethena’s recent activities.

Previously, Ethena Labs launched a new Pendle pool with higher restrictions and the greatest USDe multiplication. This new pool enables users to borrow against fixed interest-rate collateral, giving investors more flexibility and options.

Furthermore, CNF reports that Lyra Finance has teamed with Ethena Labs to provide leveraged ETH exposure with no upfront capital risk.

What's Your Reaction?