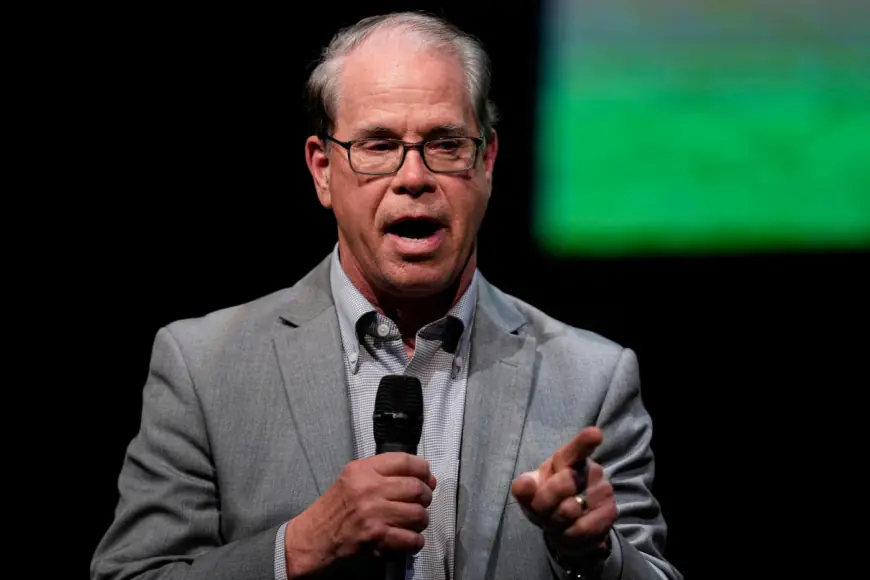

Braun’s tax plan takes millions from schools

The growing public school districts of Crown Point and Lake Central stand to lose the most money in Lake and Porter counties from Republican Gov. Mike Braun’s property tax reform plan now before the state Senate.

The growing public school districts of Crown Point and Lake Central stand to lose the most money in Lake and Porter counties from Republican Gov. Mike Braun’s property tax reform plan now before the state Senate.

Senate Bill 1 would slice off $31 million in property tax funding from the Crown Point Community School Corp. from 2026-28, according to a fiscal analysis by the state’s Legislative Services Agency.

It estimated Braun’s plan would cost Indiana school districts about $1.9 billion over the three-year period. Cutting budgets would be one of few options for the districts, many of which already rely on operating fund referendums to be taxpayer-approved to continue transportation and other student services.

In Porter County, Duneland School Corp. could lose $20 million, if Senate Bill 1 passes in its current form.

The bill, however, is likely to face vigorous debate as it moves through the legislature.

School districts are dependent on property taxes to fund bus transportation, capital projects, and debt service funds.

Braun told reporters Tuesday school districts need to be more efficient with funding.

“Almost all of them are saying that they can’t do without what they’re having now, I would say, prove it,” Braun said.

Braun, a former school board member, didn’t single out any districts but seemed to criticize their decisions.

“Prove it that you didn’t salt away a lot, that you didn’t overburden the taxpayer by maybe making investments in buildings that weren’t needed or other things that weren’t essential.”

State Sen. Rodney Pol, D-Chesterton, said Braun’s comments are frustrating as many school districts have convinced voters to pass referendums in order to maintain staffing levels and fund bus service.

“When I heard the administration insult the local governments by telling them to ‘prove it’ and accuse them of ‘using scare tactics,’ I was very disappointed,” Pol said. “The locals have been proving it, essentially living paycheck to paycheck, yet remaining fiscally responsible and delivering well before the new administration came in.

“Duneland Schools, in particular, has done so well, they have had a community value of their performance and invested into its schools with a referendum. Now, the Governor’s Office is proposing to arbitrarily pull the rug from under them once again. Local counties and cities are in the same boat. The legislature continues proposes to cut their autonomy to fix their own issues and forcing police to become evictions judges and ICE agents while cutting their funding. It’s wholly unacceptable and irresponsible.”

Senate Bill 1 also impacts local and country governments with the same tax caps as municipal officials worry about providing services and maintaining operations if their funding is slashed.

Lake County Commissioner Michael Repay, D-Hammond, said Friday that he wonders how state officials expect counties to fully fund core services under the proposed cuts.

“There are an awful lot of functions that county government does on behalf of the state of Indiana, and I think that people that are contemplating reductions to county government revenues should contemplate the idea that maybe the state will have to pick up the slack,” Repay said. “You name it — the judiciary. Does the state want to operate 92 courthouses?”

“They tend to use the federal government as the bad guy, but in this scenario, the state government is being unfair to the people that local government serves,” Repay said.

Lake County is proposed to lose $25.4 million over the three-year span.

The bill could undergo some changes as early as Tuesday, if the Senate’s Tax and Fiscal Policy Committee moves the bill forward with an amended plan.

Braun’s plan would cap tax increases at 3%, while increasing the homestead exemption. Senior citizens would see caps of 2%.

Hamilton Southeastern Schools would lose more funding than any other school district at $82 million over the three-year span. Gary Superintendent Yvonne Stokes headed the district from 2021 to 2023.

Carole Carlson is a freelance reporter for the Post-Tribune.

2026-2028 estimated revenue loss*

Lake districts

Hanover Community: $12.6 million

River Forest: $3.81 million

Merrillville: $15.18 million

Lake Central: $28.92 million

Tri-Creek: $9.61 million

Lake Ridge: $2.4 million

Crown Point: $31 million

East Chicago: $2 million

Lake Station: $2.5 million

Gary: $11.5 million

Griffith: $9.6 million

Hammond: $24.9 million

Highland: $8.4 million

Hobart: $9.3 million

Munster: $18.3 million

Whiting: $645,500

Porter districts

Duneland: $20.06 million

East Porter: $3.6 million

Porter Township: $3.57 million

Union Township: $5.73 million

Portage Township: $8.45 million

Valparaiso: $12.7 million

*Indiana Legislative Services Agency

What's Your Reaction?