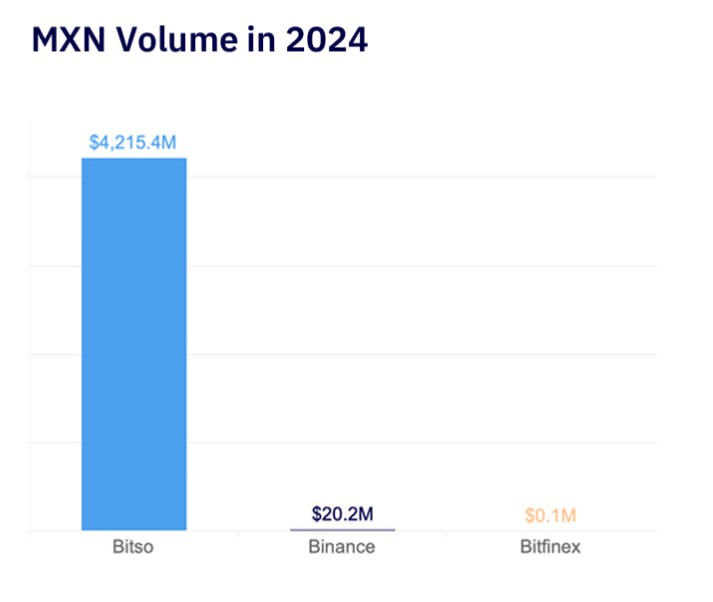

Bitso Leads Mexican Crypto Market with 99.5% Trading Dominance

Bitso dominates Mexican crypto trading with 99.5% market share, handling MXN 4,215.4 million in 2024 transactions. Lower fees on BTC markets contribute to Bitso’s popularity compared to competitors like Binance and Bitfinex. In Mexico, Bitso commands a staggering 99.5% market share in cryptocurrency trading volume, as revealed by Kaiko’s “The State of LATAM Crypto Markets” [...]

- Bitso dominates Mexican crypto trading with 99.5% market share, handling MXN 4,215.4 million in 2024 transactions.

- Lower fees on BTC markets contribute to Bitso’s popularity compared to competitors like Binance and Bitfinex.

In Mexico, Bitso commands a staggering 99.5% market share in cryptocurrency trading volume, as revealed by Kaiko’s “The State of LATAM Crypto Markets” report. Throughout 2024, Bitso facilitated transactions totaling MXN 4,215.4 million, underscoring its dominance over competitors like Binance and Bitfinex, which reported significantly lower trading volumes in the country.

As in other studies we have covered at CNF, the report attributes Bitso’s appeal to its competitive fee structure, with maker and taker fees set at 0.075% and 0.098% respectively for BTC markets, compared to 0.5% and 0.65% for MXN-denominated markets. Monthly trading volumes in Mexican pesos have shown consistent growth since September 2023, albeit below early 2023 levels.

Kaiko’s analysis points to favorable political and monetary conditions propelling cryptocurrency adoption across Latin America. The region has already witnessed cryptocurrencies being leveraged to combat inflation, particularly notable in Argentina, as we have previously written on CNF.

This trend could potentially drive broader adoption across the region, with stablecoins currently dominating exchanges, while Bitcoin gains traction as a store of value against volatile local currencies.

So following our previous news in Crypto News Flash about LaTam, The research team underscores Latin America’s crypto market as a nascent but promising segment, buoyed by economic conditions ripe for expansion.

What's Your Reaction?