Bitcoin Seller Appetite Running Out? Profit-Taking Down 42% Since Top

On-chain data shows that Bitcoin investors’ profit-taking has observed a huge decline since last month’s top, a sign that could be positive for BTC. Bitcoin Realized Profit To Exchanges Now Down To $277 Million Per Day According to data from the on-chain analytics firm Glassnode, trader profit-taking in the Bitcoin market has cooled off significantly […]

On-chain data shows that Bitcoin investors’ profit-taking has observed a huge decline since last month’s top, a sign that could be positive for BTC.

Bitcoin Realized Profit To Exchanges Now Down To $277 Million Per Day

According to data from the on-chain analytics firm Glassnode, trader profit-taking in the Bitcoin market has cooled off significantly during the last couple of weeks.

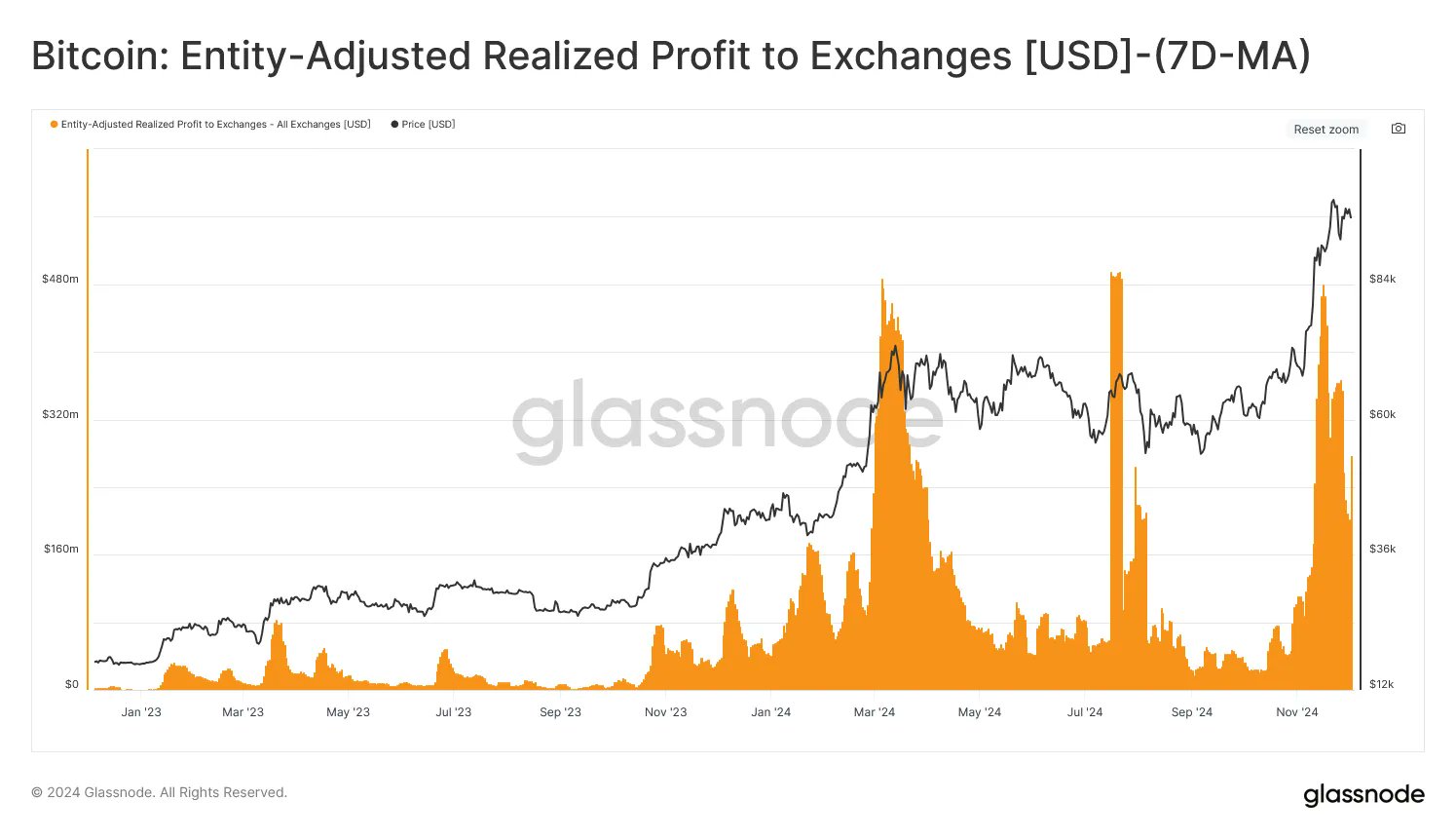

For the purpose of tracking profit-taking, the analytics firm has made use of the “Realized Profit to Exchanges” indicator. This metric, as its name suggests, measures the total amount of profit that the investors are harvesting or ‘realizing’ through transactions to centralized exchanges.

Profit is said to be realized on the blockchain when a token with a previous transaction price less than the current spot value is moved. Not all transfers on the network correspond to a trade, however, which is why Glassnode has specifically restricted the metric to exchange inflow transfers.

Holders generally transfer their coins to these platforms when they want to participate in selling-related activities, so the amount of profit realized by exchange inflows is more likely to give an accurate picture of the profit-taking situation in the sector.

Now, here is the chart for the indicator shared by the analytics firm that shows the trend in the 7-day moving average (MA) of the Bitcoin Realized Profit to Exchanges over the last couple of years:

As displayed in the above graph, the 7-day MA Bitcoin Realized Profit to Exchanges registered a sharp surge last month as BTC exploded to new highs. This suggests that the investors were harvesting a large amount of profits at the rally highs.

Note that the version of the indicator used here is the “Entity-Adjusted” one, meaning that it only tracks transactions happening between two entities. An ‘entity’ refers to a cluster of addresses that Glassnode has determined to belong to the same investor.

Since BTC has achieved a peak above $99,000, its price has been stuck in a phase of consolidation. From the chart, it’s apparent that this slowdown in the bull run has led to a notable drop in profit-taking in the market.

“Daily realized profits to exchanges have cooled off significantly, now at $277M/day,” notes the analytics firm. “This represents a 42% drop from the peak of $481M/day on Nov 16.”

This year, Bitcoin also saw two other mass profit-taking events of comparable scale, with both of them leading to tops in the cryptocurrency market. As such, the fact that profit realization has calmed down for the asset recently despite the price continuing to sustain at relatively high levels could be a positive sign for this rally to go on.

BTC Price

Bitcoin is currently right in the middle of its recent consolidation range, as its price is floating around $95,900.

What's Your Reaction?