Bitcoin Sell-Off Likely When This Metric Reaches 4%, Analyst Explains

While Bitcoin (BTC) fluctuates around the critical $100,000 price level, some investors may seek the ideal opportunity to take profits and exit the market. In this context, a CryptoQuant analysis highlights a key BTC metric that can serve as a valuable tool for crafting an exit strategy. Have Profits In Bitcoin? Keep An Eye On This Indicator In a Quicktake blog post published today, CryptoQuant contributor Onchain Edge shared insights into timing the sale of BTC during the current bull market. The analyst emphasized the importance of the Bitcoin supply in loss metric, noting its potential to signal when to start exiting the market to preserve profits. Related Reading: Bitcoin May Face ‘Demand Shocks’ In 2025 Due To Growing Institutional Interest: Report For those unfamiliar with Bitcoin, the supply in loss measures the percentage of BTC held at a loss based on its last moved price. A low percentage of supply in loss typically indicates peak market euphoria and serves as a warning to secure profits before a bear market correction begins. According to the CryptoQuant analysis, when BTC supply in loss drops below 4%, it signals a good time for investors to consider dollar-cost averaging (DCA) out of their BTC holdings and wait for the next bear market lows. Currently, the BTC supply in loss sits at 8.14%. DCA is an investment strategy where investors allocate a fixed amount of money to an asset at regular intervals, regardless of its price. This method helps reduce the impact of market volatility and lowers the average cost per unit over time. The analyst adds: Why? Below 4% means a lot of people are in a profit this is the peak bullrun phase. Trust me you don’t want to be bagholding because you thought we will never see a bear market again. Be fearful when others are greedy. Analysts Confident Of Further Upside In BTC Price While tracking the BTC supply in loss metric can help investors safeguard their profits, recent forecasts from crypto analysts suggest there might still be room for further upside before this indicator becomes crucial. Related Reading: Bitcoin Exchange Reserves Plunge To Multi-Year Lows: Will BTC Gain From Supply Crunch? According to crypto analyst Ali Martinez, BTC forms a classic cup and handle pattern on the weekly chart. The premier cryptocurrency looks poised to break out of the bullish formation, with targets as high as $275,000. Similarly, Donald Trump’s victory has brought fresh optimism in the crypto industry. In the recently concluded Bitcoin MENA conference in Abu Dhabi, Trump’s former campaign chairman, Paul Manafort, noted that BTC investors can “expect more than $100,000” during the ongoing market cycle. Other forecasts remain equally bullish. Tom Dunleavy, Chief Investment Officer at MV Global, projects BTC to reach $250,000, while Ethereum (ETH) might climb to $12,000 during this market cycle. BTC trades at $100,983 at press time, up a modest 0.1% in the past 24 hours. Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

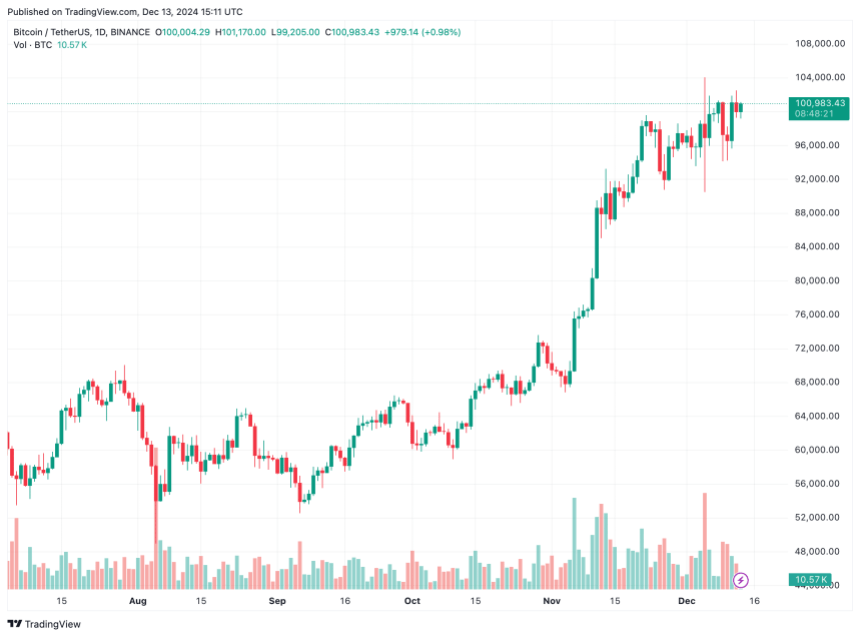

While Bitcoin (BTC) fluctuates around the critical $100,000 price level, some investors may seek the ideal opportunity to take profits and exit the market. In this context, a CryptoQuant analysis highlights a key BTC metric that can serve as a valuable tool for crafting an exit strategy.

Have Profits In Bitcoin? Keep An Eye On This Indicator

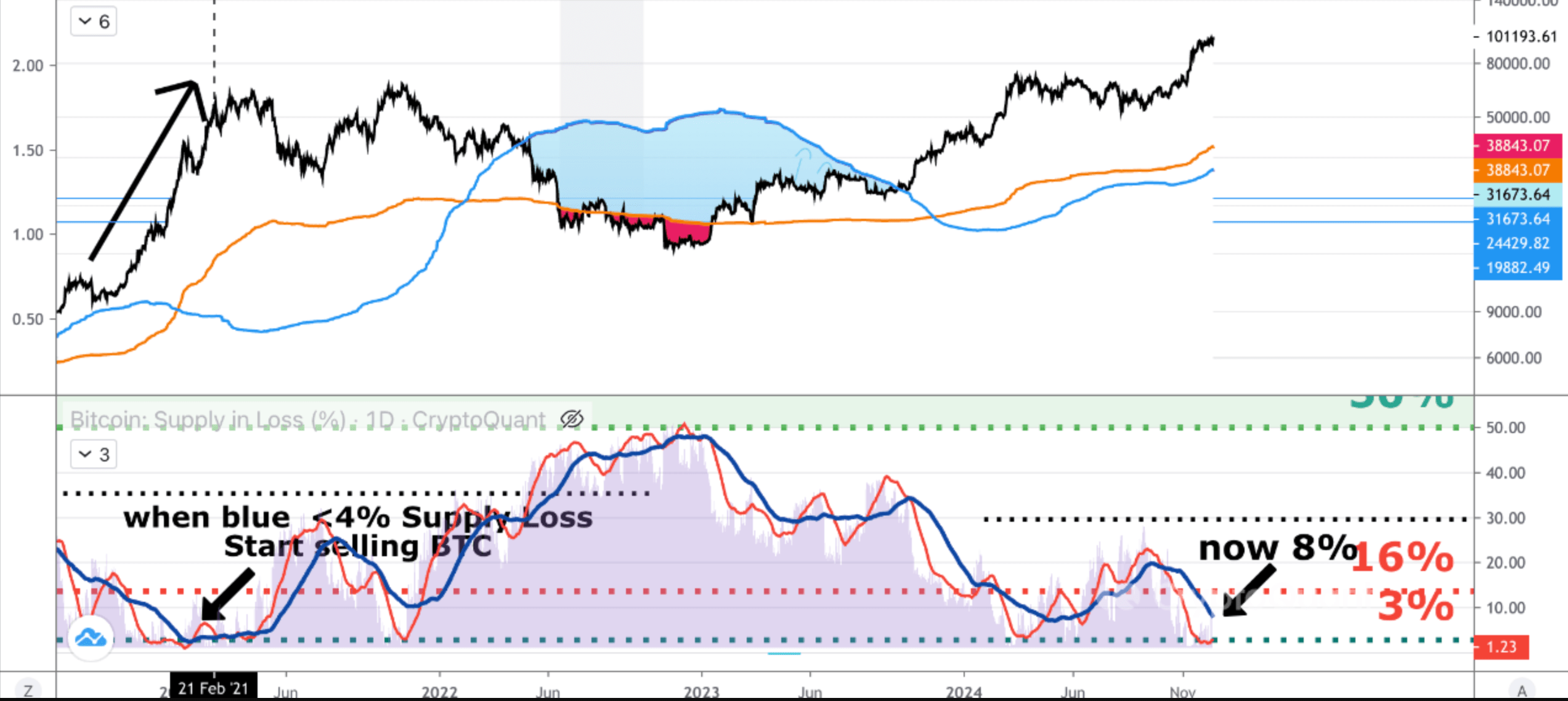

In a Quicktake blog post published today, CryptoQuant contributor Onchain Edge shared insights into timing the sale of BTC during the current bull market. The analyst emphasized the importance of the Bitcoin supply in loss metric, noting its potential to signal when to start exiting the market to preserve profits.

For those unfamiliar with Bitcoin, the supply in loss measures the percentage of BTC held at a loss based on its last moved price. A low percentage of supply in loss typically indicates peak market euphoria and serves as a warning to secure profits before a bear market correction begins.

According to the CryptoQuant analysis, when BTC supply in loss drops below 4%, it signals a good time for investors to consider dollar-cost averaging (DCA) out of their BTC holdings and wait for the next bear market lows. Currently, the BTC supply in loss sits at 8.14%.

DCA is an investment strategy where investors allocate a fixed amount of money to an asset at regular intervals, regardless of its price. This method helps reduce the impact of market volatility and lowers the average cost per unit over time. The analyst adds:

Why? Below 4% means a lot of people are in a profit this is the peak bullrun phase. Trust me you don’t want to be bagholding because you thought we will never see a bear market again. Be fearful when others are greedy.

Analysts Confident Of Further Upside In BTC Price

While tracking the BTC supply in loss metric can help investors safeguard their profits, recent forecasts from crypto analysts suggest there might still be room for further upside before this indicator becomes crucial.

According to crypto analyst Ali Martinez, BTC forms a classic cup and handle pattern on the weekly chart. The premier cryptocurrency looks poised to break out of the bullish formation, with targets as high as $275,000.

Similarly, Donald Trump’s victory has brought fresh optimism in the crypto industry. In the recently concluded Bitcoin MENA conference in Abu Dhabi, Trump’s former campaign chairman, Paul Manafort, noted that BTC investors can “expect more than $100,000” during the ongoing market cycle.

Other forecasts remain equally bullish. Tom Dunleavy, Chief Investment Officer at MV Global, projects BTC to reach $250,000, while Ethereum (ETH) might climb to $12,000 during this market cycle. BTC trades at $100,983 at press time, up a modest 0.1% in the past 24 hours.

What's Your Reaction?