Bitcoin Retail Is Finally Back: These Metrics Point To An Explosion In Interest

Data from several on-chain indicators suggests demand from retail investors has finally returned following the latest Bitcoin rally. Bitcoin Retail Interest Has Returned In Explosive Fashion Bitcoin has witnessed a massive surge recently and has come closer to the $100,000 dream target than many had expected. Investor interest in the asset had cooled off during the cryptocurrency’s endless consolidation, but with a rally like this, it has naturally made a return. In the context of the current discussion, the investor focus segment is retail, which includes the smallest of the holders. The first metric that would hint at a return of these investors in the market is the New Addresses, which keeps track of the total amount of BTC addresses coming online for the first time. Related Reading: Dogecoin & Co. Take Over Social Media: Why Memecoin Frenzy Is Bad For Bitcoin As the market intelligence platform IntoTheBlock has pointed out in an X post, the Bitcoin New Addresses have witnessed a sharp increase recently, suggesting a large amount of address creation. The New Addresses can register an uptick when new investors join the network or when old ones who had sold earlier come back to the asset. The metric also goes up when existing users create multiple wallets for privacy. However, when a surge occurs at a scale like the recent one, the former is more likely to be the reason. Thus, the latest trend in the indicator could imply a high amount of fresh adoption for the cryptocurrency. As is visible in the above graph, the Bitcoin New Addresses recently hit a high of 442,000, the highest daily value since March of this year. Large investors are also likely joining the network right now, but their number certainly wouldn’t be too high, so this adoption must come from retail investors. Another indicator, the Retail Investor Demand 30D Change, provides us with information about the activity of existing and newcomer retail investors right now. As CryptoQuant community analyst Maartunn has explained in an X post, this indicator has also recently shot up. This metric tracks retail investor demand through transaction volume. Since the members of this cohort carry balance amounts that aren’t too significant, their transfers tend to involve small values as well. As such, their volume can be measured by only involving data of the transfers valued at less than $10,000. From the chart, it’s apparent that the 30-day change in the volume of retail investors has recently seen a large positive spike to levels not seen in more than four years. Related Reading: Bitcoin Sets Record $93,000 High As Extreme Greed Level Hits 84 “It’s impossible to ignore that retail trading is fully back, with Dogecoin surging, high funding rates, and a spike in Google searches for Bitcoin,” notes the analyst. BTC Price Bitcoin has seen a bit of a setback in the past day as its price has now dropped to the $88,300 level. Featured image from Dall-E, IntoTheBlock.com, CryptoQuant.com, chart from TradingView.com

Data from several on-chain indicators suggests demand from retail investors has finally returned following the latest Bitcoin rally.

Bitcoin Retail Interest Has Returned In Explosive Fashion

Bitcoin has witnessed a massive surge recently and has come closer to the $100,000 dream target than many had expected. Investor interest in the asset had cooled off during the cryptocurrency’s endless consolidation, but with a rally like this, it has naturally made a return.

In the context of the current discussion, the investor focus segment is retail, which includes the smallest of the holders. The first metric that would hint at a return of these investors in the market is the New Addresses, which keeps track of the total amount of BTC addresses coming online for the first time.

As the market intelligence platform IntoTheBlock has pointed out in an X post, the Bitcoin New Addresses have witnessed a sharp increase recently, suggesting a large amount of address creation.

The New Addresses can register an uptick when new investors join the network or when old ones who had sold earlier come back to the asset. The metric also goes up when existing users create multiple wallets for privacy.

However, when a surge occurs at a scale like the recent one, the former is more likely to be the reason. Thus, the latest trend in the indicator could imply a high amount of fresh adoption for the cryptocurrency.

As is visible in the above graph, the Bitcoin New Addresses recently hit a high of 442,000, the highest daily value since March of this year. Large investors are also likely joining the network right now, but their number certainly wouldn’t be too high, so this adoption must come from retail investors.

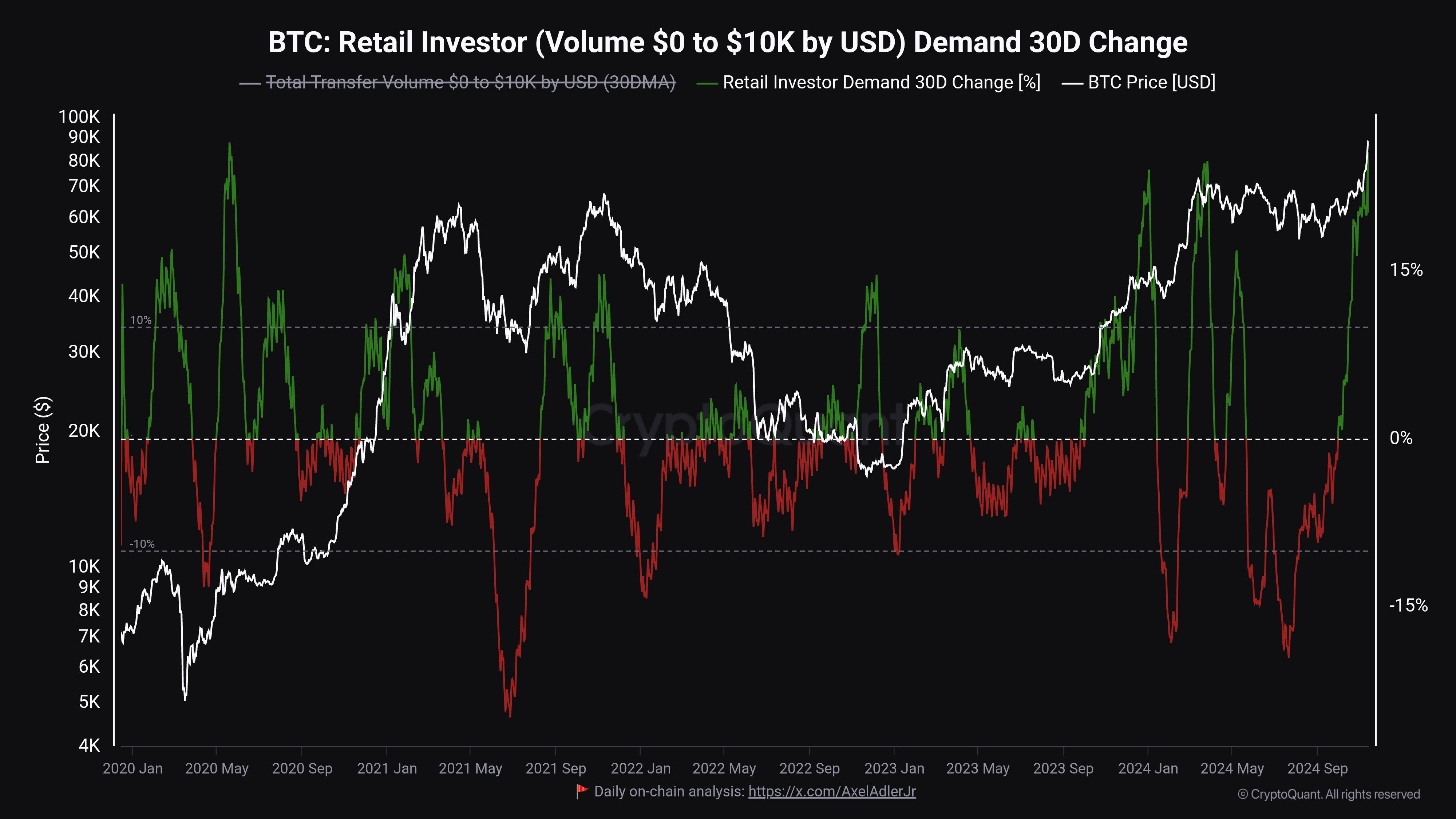

Another indicator, the Retail Investor Demand 30D Change, provides us with information about the activity of existing and newcomer retail investors right now. As CryptoQuant community analyst Maartunn has explained in an X post, this indicator has also recently shot up.

This metric tracks retail investor demand through transaction volume. Since the members of this cohort carry balance amounts that aren’t too significant, their transfers tend to involve small values as well. As such, their volume can be measured by only involving data of the transfers valued at less than $10,000.

From the chart, it’s apparent that the 30-day change in the volume of retail investors has recently seen a large positive spike to levels not seen in more than four years.

“It’s impossible to ignore that retail trading is fully back, with Dogecoin surging, high funding rates, and a spike in Google searches for Bitcoin,” notes the analyst.

BTC Price

Bitcoin has seen a bit of a setback in the past day as its price has now dropped to the $88,300 level.

What's Your Reaction?