Bitcoin ETFs accumulate 346,456 BTC amidst market rally

During Bitcoin’s recent surge, data from HODL15Capital, a respected asset allocator, indicates a consistent acquisition of Bitcoin across all nine active spots of Bitcoin Exchange-Traded Funds (ETFs) over the past eight weeks. This accumulation trend has coincided with Bitcoin’s remarkable rally, reflecting a significant correlation between ETF activity and the flagship cryptocurrency’s price movement. BTC […]

During Bitcoin’s recent surge, data from HODL15Capital, a respected asset allocator, indicates a consistent acquisition of Bitcoin across all nine active spots of Bitcoin Exchange-Traded Funds (ETFs) over the past eight weeks.

This accumulation trend has coincided with Bitcoin’s remarkable rally, reflecting a significant correlation between ETF activity and the flagship cryptocurrency’s price movement.

BTC acquisition trends

According to HODL15Capital’s data, all nine active spot Bitcoin ETFs have been engaged in continuous Bitcoin acquisition over the past two months. Notably, the highest acquisition volume occurred in week 6, highlighting a robust interest in Bitcoin investment products despite market fluctuations.

However, amidst this general accumulation trend, Grayscale’s GBTC and Invesco Galaxy’s BTCO have experienced losses in their Bitcoin holdings, shedding 12,331 units and 1,466 BTC, respectively. GBTC, in particular, has consistently released portions of its BTC holdings, with week 2 marking its most significant decline of 64,398 units.

Conversely, BlackRock’s IBIT emerged as the leading gainer in accumulated Bitcoins, boasting a portfolio of 164,500 BTC. Week 8 saw IBIT’s peak performance, acquiring an impressive 34,270 Bitcoins.

Net BTC acquisition and market performance

Altogether, the net amount of Bitcoins acquired by all active ETFs since the SEC’s approval totals 147,913 BTC. Excluding the Bitcoins withdrawn from Grayscale’s GBTC, which amounted to 198,543 BTC over this period, leaves a cumulative total of 346,456 Bitcoins accumulated by the nine newly launched ETFs in the past eight weeks.

This surge in ETF activity coincides with Bitcoin’s recent rally, which commenced eight weeks ago with a minor pullback attributed to capital rebalancing. Since then, Bitcoin has exhibited remarkable resilience, bouncing back from a low of $38,505 to its current price of $65,583, per TradingView data. This eight-week rally reflects a substantial 70% gain for the cryptocurrency.

Future outlook

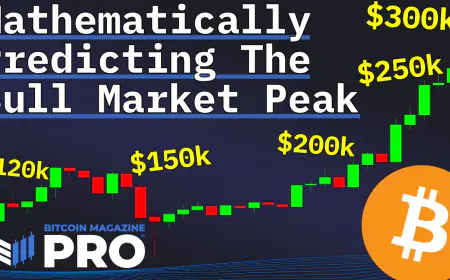

Analysts anticipate a continued influx of funds into ETFs, predicting that these investment vehicles will play a pivotal role in sustaining the ongoing bull run. With the potential impact of the next Bitcoin halving event, which historically has catalyzed significant price appreciation, ETFs are expected to further amplify the momentum of Bitcoin’s upward trajectory.

In conclusion, the past eight weeks have witnessed a remarkable accumulation of Bitcoins by active spot Bitcoin ETFs, totaling 346,456 BTC. Despite minor setbacks experienced by some ETFs, the overall trend underscores growing investor confidence in Bitcoin as a viable asset class. As Bitcoin’s price soar and institutional interest intensifies, ETFs are poised to drive the cryptocurrency market’s upward momentum.

With Bitcoin’s rally showing no signs of slowing down, the role of ETFs in facilitating broader participation in the digital asset space is becoming increasingly pronounced. As investors seek exposure to Bitcoin’s potential upside, ETFs offer a regulated and accessible avenue for capital deployment, further fueling the ongoing bull run.

What's Your Reaction?