Bitcoin continues to outperform Ethereum – Is an ETF enough of a catalyst?

Bitcoin, Bitcoin, Bitcoin. But what about Ethereum? No one can deny that 2024 has been extremely bullish for the overall market, especially after the long, painful crypto winter we had in 2022 and 2023, courtesy of Samuel Bankman-Fried and Hyung Do Kwon. Then came 2024, the year that started with a bang. Right off the […]

Bitcoin, Bitcoin, Bitcoin. But what about Ethereum?

No one can deny that 2024 has been extremely bullish for the overall market, especially after the long, painful crypto winter we had in 2022 and 2023, courtesy of Samuel Bankman-Fried and Hyung Do Kwon.

Then came 2024, the year that started with a bang. Right off the bat, America’s SEC triggered a bull run by approving Bitcoin’s spot ETF. Bitcoin went completely ballistic after that, breaking all-time highs like they’re nothing.

And even though it has been in consolidation for the past many weeks, it is still standing strong, thanks to the insane rate of institutional adoption from banks, asset managers, countries, and governments all over the world.

Ethereum’s all-time high was $4,878. At press time, it was worth $3,065. That’s over 37% decrease from the ATH.

What’s holding Ether back?

For some reason, the bullish bug seems to elude Ethereum completely. Ethereum’s price has a 0.93 correlation with Bitcoin, so their market sentiments and movements are heavily interconnected.

So you can see how one can expect Ether to break its 2021 all-time high since Bitcoin made a whole new one earlier. On-chain signals are mostly bullish too, but Ether remains unmoved.

Curiously enough, however, it hasn’t corrected/consolidated nearly as much as Bitcoin. Ethereum has managed to maintain the modest gains it has gotten.

On-chain data shows that 75% of holders are currently in profit, 6% are breaking even, and only 19% are at a loss. This motivates traders and investors to remain bullish on ETH.

Exchange inflows have fallen a little short of the outflows, per weekly data. Analysts believe this to be a bullish signal because it means people are accumulating and moving their holdings to private wallets for long-term holding.

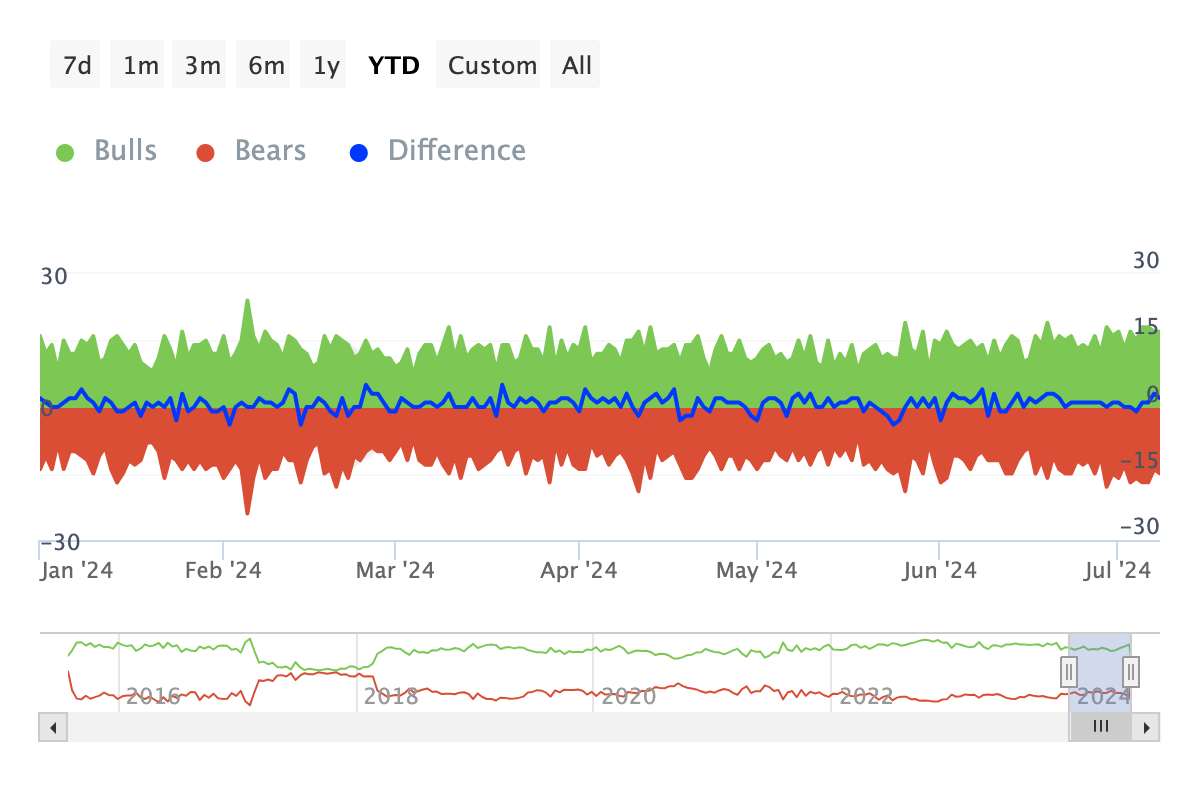

Ethereum bulls have been consistently on top, but still can’t find the strength to surge high enough for an ATH.

Technical analysis and short-term predictions

Ethereum has managed to hold its ground above $3,000, all things considered. The immediate support level is around $2,997. Its 50-hour MA is currently above the 200-hour MA, so there is a little short-term bullish outlook.

But the price crossing below the 50-hour MA could be because the bulls are slowly losing their strength. The RSI, however, shows that neither the bulls nor the bears actually have a dominant control.

Buying activity has reduced a little and we could see a minor pullback before the week closes. Though going by the MACD, there is a slight bearish crossover.

The bears might have much more underlying strength than the bulls. But the bears’ strength has also been weakening. It is a very odd and complex situation.

Bullish

If the price breaks above the immediate resistance level at $3,220 and sustains above it, we could see renewed bullish sentiment.

The next target will then be around $3,390, where more resistance might happen. Sustained buying pressure could push ETH towards higher levels, testing $3,500 and beyond.

Bearish

If the price fails to break above the resistance and drops below the 50-hour MA, a decline towards $2,997 is likely gonna happen. Breaking below this support level could lead to a full-blown tumble, with potential targets at $2,900 and $2,800.

Reporting and analysis by Jai Hamid

What's Your Reaction?