Bearish Signals for Toncoin: Why Traders Are Selling Now

Toncoin downtrend is confirmed by a high bearish volume, suggesting further potential for new lows. Technical indicators point to selling before further drops, with traders advised to re-enter at lower levels. Recently, Toncoin (TON) has been under close examination as several analysts—including Alan Santana of TradingView—have offered thorough observations on its present direction. Popular crypto [...]

- Toncoin downtrend is confirmed by a high bearish volume, suggesting further potential for new lows.

- Technical indicators point to selling before further drops, with traders advised to re-enter at lower levels.

Recently, Toncoin (TON) has been under close examination as several analysts—including Alan Santana of TradingView—have offered thorough observations on its present direction.

Popular crypto analyst Santana has been unambiguous in his opinion that Toncoin is in a downtrend, thereby supporting the belief that the coin is probably going to suffer more falls.

Santana says there is no need to guess the TON price trajectory, where the technical indications and signs already point to a bearish inclination depending on current market fluctuations.

Bearish Volume Spike Confirms Toncoin Downtrend

Santana underlined that TON lately showed a volume breakout with the most bearish volume in more than three weeks. This notable selling activity validates the declining trend and suggests more Toncoin price depreciation.

“Even if I were a long-term holder, I would sell as much as possible with the intention of buying again when prices are lower,” Santana said. Given Toncoin’s expected protracted recovery time, he counsels selling when prices are high, especially.

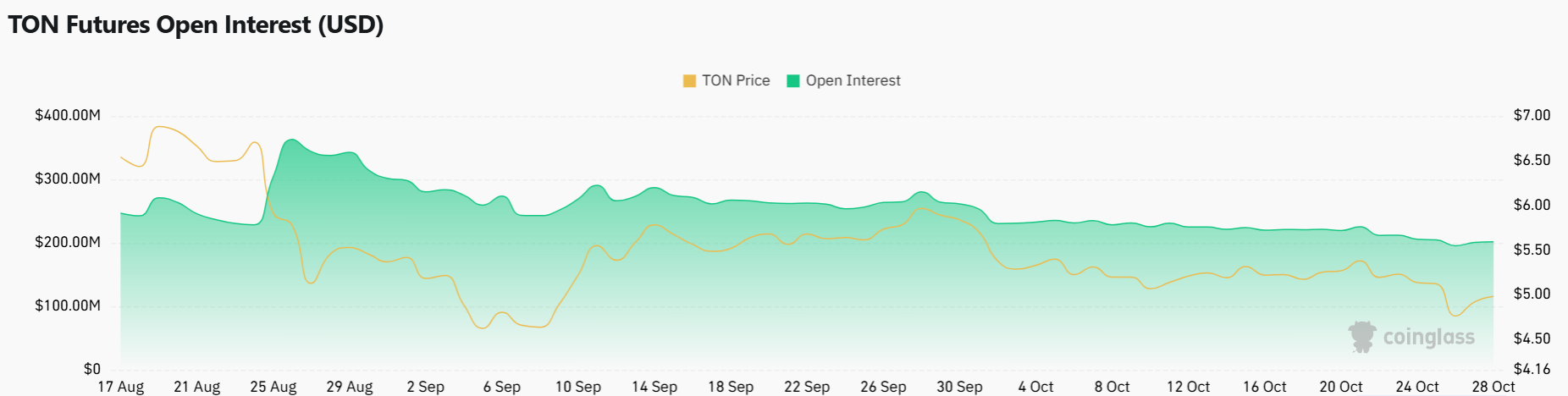

This analysis conforms with the more general market statistics. CoinGlass reveals that while the Binance TON/USDT Long/Short Ratio is recorded at 2.9339, suggesting a higher number of long positions than shorts, Toncoin’s Open Interest dropped by 0.54%. Standing at $199.49 million.

Furthermore, highlighting the declining momentum in the market is Toncoin’s trading volume, which has plummeted by 28.72%, equal to $63.98 million.

Toncoin holds a sizable portion of active blockchain addresses despite these adverse signals—14.38% according to CNF. This captures the coin’s potential for blockchain acceptance as well as its expanding significance in decentralized finance (DeFi).

Still, this encouraging sign has not been sufficient to protect it from the more general negative mood. Toncoin has steadily dropped since June 2024; Santana speculates that it would soon trade at $2, which would mark over a 50% drop from its present price levels.

Meanwhile, TON is swapped hands at about $4.95 at the time of writing, suggesting a slight increase of 0.44% over the last 24 hours. On a weekly basis, the token stays in a bearish structure, and nonetheless, there is still a great chance of more losses.

What's Your Reaction?