Are you eligible for student loan forgiveness in latest announcement? How to tell

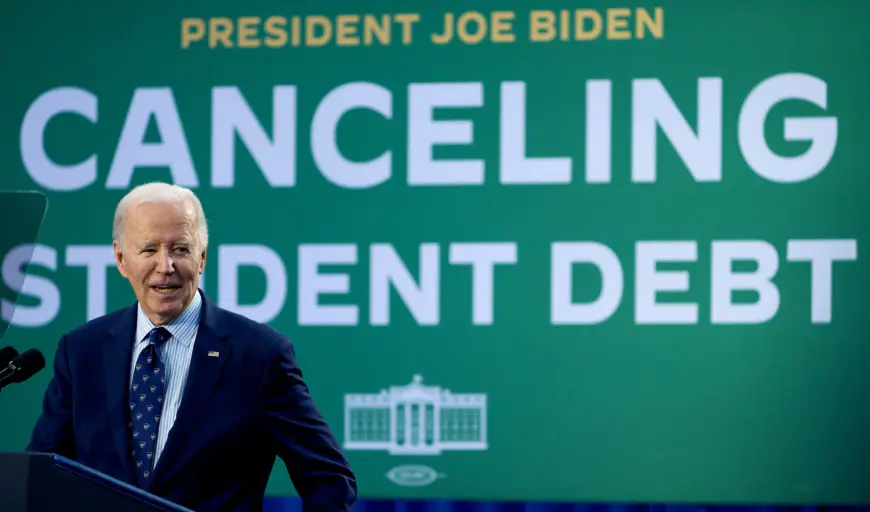

The Education Department announced Friday that it was clearing loans for another 55,000 borrowers, but are you one of them? The Biden Administration said it approved $4.28 billion in additional student loan relief for 54,900 borrowers across the country. The announcement brings to the total loan forgiveness from the administration to an estimated $180 billion, according to the education department. Here’s what to know: Are you eligible for student loan relief in latest announcement? The announcement includes those who reached eligibility through a program known as Public Service Loan Forgiveness, which was created by Congress in 2007 and expanded by the Biden administration. That means only those who work in public service are included in the latest round of relief. “Four years ago, the Biden-Harris Administration made a pledge to America’s teachers, service members, nurses, first responders, and other public servants that we would fix the broken Public Service Loan Forgiveness Program, and I’m proud to say that we delivered,” U.S. Secretary of Education Miguel Cardona said in a statement. The program aims to provide incentives for people to “pursue and remain in careers in education, public health, law enforcement, emergency response, and other critical public service fields,” according to the department. It forgives student loan balances after those who work and remain in those fields make a required 120 qualifying monthly payments. “The relief announced today includes both borrowers who have benefitted from the Administration’s limited PSLF waiver, a temporary opportunity that ended in October 2022, as well as from regulatory improvements made to the program during this Administration,” the department said in its announcement. What else to know Outside of Friday’s announcement, President Joe Biden is abandoning his effort to cancel student loans for more than 38 million Americans, the first step in an administration-wide plan to jettison pending regulations to prevent President-elect Donald Trump from retooling them to achieve his own aims. The White House expects to pull back unfinished rules across several agencies if there isn’t enough time to finalize them before Trump takes office. If the proposed regulations were left in their current state, the next administration would be able to rewrite them and advance its agenda more quickly. As the pending Biden regulations are withdrawn, nothing prevents Trump from pursuing his own regulations on the same issues when he returns to the White House, but he would have to start from scratch in a process that can take months or even years. In documents withdrawing the student loan proposals, the Education Department insisted it has the authority to cancel the debt but sought to focus on other priorities in the administration’s final weeks. It said the administration will focus on helping borrowers get back on track with payments following the coronavirus pandemic, when payments were paused. “The department at this time intends to commit its limited operational resources to helping at-risk borrowers return to repayment successfully,” the agency wrote.

The Education Department announced Friday that it was clearing loans for another 55,000 borrowers, but are you one of them?

The Biden Administration said it approved $4.28 billion in additional student loan relief for 54,900 borrowers across the country. The announcement brings to the total loan forgiveness from the administration to an estimated $180 billion, according to the education department.

Here’s what to know:

Are you eligible for student loan relief in latest announcement?

The announcement includes those who reached eligibility through a program known as Public Service Loan Forgiveness, which was created by Congress in 2007 and expanded by the Biden administration.

That means only those who work in public service are included in the latest round of relief.

“Four years ago, the Biden-Harris Administration made a pledge to America’s teachers, service members, nurses, first responders, and other public servants that we would fix the broken Public Service Loan Forgiveness Program, and I’m proud to say that we delivered,” U.S. Secretary of Education Miguel Cardona said in a statement.

The program aims to provide incentives for people to “pursue and remain in careers in education, public health, law enforcement, emergency response, and other critical public service fields,” according to the department. It forgives student loan balances after those who work and remain in those fields make a required 120 qualifying monthly payments.

“The relief announced today includes both borrowers who have benefitted from the Administration’s limited PSLF waiver, a temporary opportunity that ended in October 2022, as well as from regulatory improvements made to the program during this Administration,” the department said in its announcement.

What else to know

Outside of Friday’s announcement, President Joe Biden is abandoning his effort to cancel student loans for more than 38 million Americans, the first step in an administration-wide plan to jettison pending regulations to prevent President-elect Donald Trump from retooling them to achieve his own aims.

The White House expects to pull back unfinished rules across several agencies if there isn’t enough time to finalize them before Trump takes office. If the proposed regulations were left in their current state, the next administration would be able to rewrite them and advance its agenda more quickly.

As the pending Biden regulations are withdrawn, nothing prevents Trump from pursuing his own regulations on the same issues when he returns to the White House, but he would have to start from scratch in a process that can take months or even years.

In documents withdrawing the student loan proposals, the Education Department insisted it has the authority to cancel the debt but sought to focus on other priorities in the administration’s final weeks. It said the administration will focus on helping borrowers get back on track with payments following the coronavirus pandemic, when payments were paused.

“The department at this time intends to commit its limited operational resources to helping at-risk borrowers return to repayment successfully,” the agency wrote.

What's Your Reaction?