Animoca Brands plans stock market comeback for next year

Web3 gaming giant Animoca Brands is setting its sights on a 2025 public listing. Since getting booted from the Australian Securities Exchange back in 2020 due to compliance issues, the company is now vetting more accommodating markets for its comeback. Top choices include Hong Kong and the Middle East, places that could potentially embrace the […]

Web3 gaming giant Animoca Brands is setting its sights on a 2025 public listing. Since getting booted from the Australian Securities Exchange back in 2020 due to compliance issues, the company is now vetting more accommodating markets for its comeback.

Top choices include Hong Kong and the Middle East, places that could potentially embrace the $5.9 billion giant’s innovative business model.

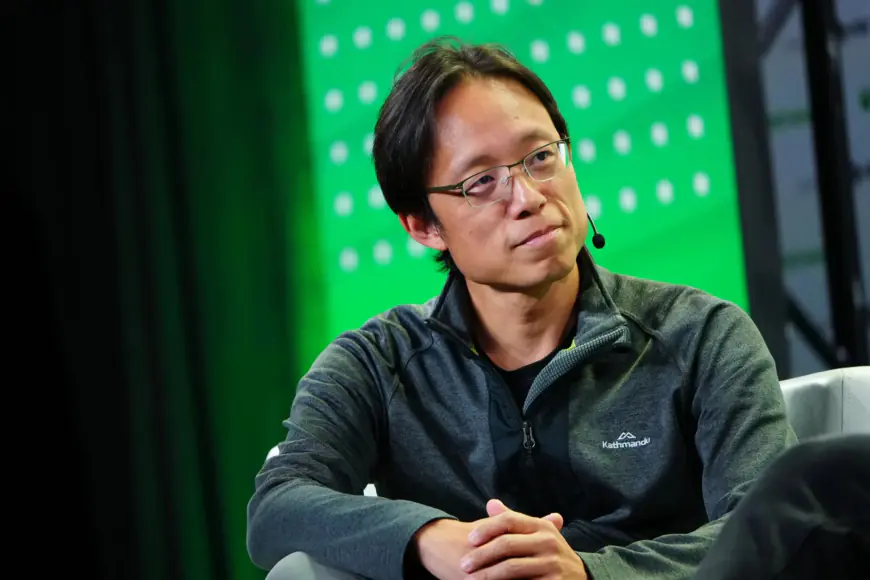

Yat Siu, the co-founder of Animoca Brands, shared that the firm has been actively engaging with investment banks to chart a path back to the stock market. However, they haven’t yet locked down a specific location or appointed an advisory partner.

Animoca’s financial maneuvers

Earlier this month, Animoca Brands took a unique approach by tokenizing a historical artifact—a Stradivarius violin dating back to 1708.

This rare violin, which once graced the collection of Russian Empress Catherine the Great, was transformed into a non-fungible token (NFT) to secure a multimillion-dollar loan from Galaxy Digital. The specifics of the financial deal remain under wraps.

After peaking nearly at $6 billion in early 2022, thanks to the booming crypto and gaming markets, Animoca’s worth took a sharp dive below $2 billion in 2023.

This decline was driven by broader industry downturns, like the FTX collapse and the failure of several crypto lenders, prompting the firm to adjust its fundraising goals for a metaverse fund from $2 billion down to $800 million.

In a candid interview with Cryptopolitan at TOKEN2049 in Dubai, Yat Siu expressed that Animoca doesn’t “invest selectively” but rather “very broadly.”

“We also do a lot of partnership investing. We invest together with many other partners. We have a very, very, collaborative mindset. You know, some investors, when they see a good deal, they want to take the whole deal and they exclude everyone else. We’re not like that.”

Yat Siu

He emphasized that Animoca operates differently from traditional investors. They don’t face the typical pressures of timed returns. Whether it takes three, four, or even ten years for an investment to pay off, it’s all the same to them.

Siu highlighted their commitment to movements they believe in, like Web3 gaming, which he credits with reshaping the gaming industry and opening up new opportunities.

Jai Hamid

What's Your Reaction?