Analytics Firm Reveals Why Dogecoin & Apecoin Hit Tops

The on-chain analytics firm Santiment has revealed the potential reason behind the corrections that Dogecoin and Apecoin have faced recently. Dogecoin & Apecoin Are Among Memecoins That Fell Prey To FOMO Recently As explained by Santiment in a new post on X, the Positive Sentiment vs. Negative Sentiment Ratio has seen a spike for Dogecoin and other memecoins recently. The “Positive Sentiment vs. Negative Sentiment Ratio” here refers to an indicator that tells us whether major social media platforms are leaning towards positive or negative comments right now. Related Reading: Bitcoin Profitability Index Hits 202%: Is This Enough For A Top? This indicator makes use of a machine-learning model designed by the analytics firm to separate between comments pertaining to negative and positive sentiments. When the value of the metric is greater than zero, it means the total number of positive posts/threads/messages is outweighing that of the negative ones. On the other hand, the indicator being under this threshold suggests the dominance of bearish sentiment on social media. Now, here is the chart shared by Santiment that shows the trend in this indicator for four assets over the past few months: As displayed in the above graph, Dogecoin and Apecoin both witnessed spikes in the Positive Sentiment vs. Negative Sentiment Ratio recently, implying a large amount of positive comments related to these coins were made on social media. Interestingly, as the analytics firm has pointed out, these spikes coincided with tops in the DOGE and APE prices. The other two memecoins listed in the chart, GIGA and GOAT, also witnessed a similar pattern, although their tops came before that of the former two. While positive sentiment can suggest belief in the market, a large amount of it can be an indication of excessive hype, which is something that has historically led to tops for not just memecoins but cryptocurrencies in general. “Prices typically always go the opposite direction of the crowd’s expectations, and when the crowd gets extreme on either the bullish or bearish end, it becomes highly predictable to buy or sell,” explains Santiment. Given the timing of the recent positive spikes in the indicator, it would appear possible that the Fear Of Missing Out (FOMO) that developed among the investors was the reason behind the corrections that Dogecoin and others have faced. Related Reading: Ethereum Leverage Ratio Reaches Extreme Levels, What It Means The Positive Sentiment vs. Negative Sentiment Ratio could now be to watch in the coming days, as any cooldowns in its value could pave way for bullish momentum to restart for these coins. DOGE Price Dogecoin had neared the $0.150 level a few days ago, but with the correction that has followed since then, its price has retraced back to the $0.136 mark. Featured image from Dall-E, Santiment.net, chart from TradingView.com

The on-chain analytics firm Santiment has revealed the potential reason behind the corrections that Dogecoin and Apecoin have faced recently.

Dogecoin & Apecoin Are Among Memecoins That Fell Prey To FOMO Recently

As explained by Santiment in a new post on X, the Positive Sentiment vs. Negative Sentiment Ratio has seen a spike for Dogecoin and other memecoins recently.

The “Positive Sentiment vs. Negative Sentiment Ratio” here refers to an indicator that tells us whether major social media platforms are leaning towards positive or negative comments right now.

This indicator makes use of a machine-learning model designed by the analytics firm to separate between comments pertaining to negative and positive sentiments.

When the value of the metric is greater than zero, it means the total number of positive posts/threads/messages is outweighing that of the negative ones. On the other hand, the indicator being under this threshold suggests the dominance of bearish sentiment on social media.

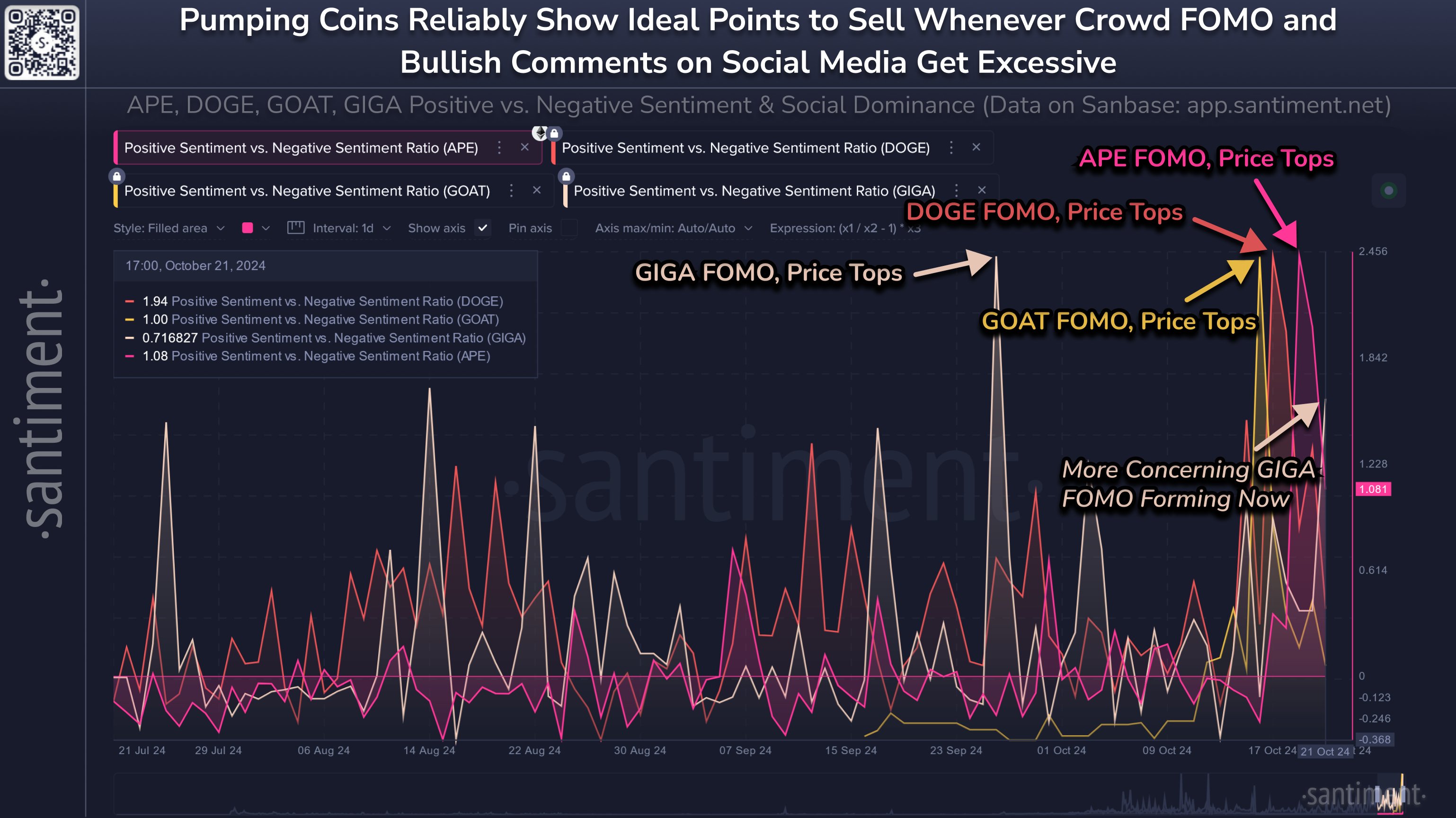

Now, here is the chart shared by Santiment that shows the trend in this indicator for four assets over the past few months:

As displayed in the above graph, Dogecoin and Apecoin both witnessed spikes in the Positive Sentiment vs. Negative Sentiment Ratio recently, implying a large amount of positive comments related to these coins were made on social media.

Interestingly, as the analytics firm has pointed out, these spikes coincided with tops in the DOGE and APE prices. The other two memecoins listed in the chart, GIGA and GOAT, also witnessed a similar pattern, although their tops came before that of the former two.

While positive sentiment can suggest belief in the market, a large amount of it can be an indication of excessive hype, which is something that has historically led to tops for not just memecoins but cryptocurrencies in general.

“Prices typically always go the opposite direction of the crowd’s expectations, and when the crowd gets extreme on either the bullish or bearish end, it becomes highly predictable to buy or sell,” explains Santiment.

Given the timing of the recent positive spikes in the indicator, it would appear possible that the Fear Of Missing Out (FOMO) that developed among the investors was the reason behind the corrections that Dogecoin and others have faced.

The Positive Sentiment vs. Negative Sentiment Ratio could now be to watch in the coming days, as any cooldowns in its value could pave way for bullish momentum to restart for these coins.

DOGE Price

Dogecoin had neared the $0.150 level a few days ago, but with the correction that has followed since then, its price has retraced back to the $0.136 mark.

What's Your Reaction?