Analysts touts Bitcoin reserve bill as solution to rising US debt

Simon Dixon, a financial analyst, has described the Strategic Bitcoin Reserve Bill as the only solution to the US debt problem. He shared this opinion in light of Senator Cynthia Lummis’s decision to introduce the Bill to the Senate floor a few days after presenting it at the Bitcoin Conference. The Bill, officially named the […]

Simon Dixon, a financial analyst, has described the Strategic Bitcoin Reserve Bill as the only solution to the US debt problem. He shared this opinion in light of Senator Cynthia Lummis’s decision to introduce the Bill to the Senate floor a few days after presenting it at the Bitcoin Conference.

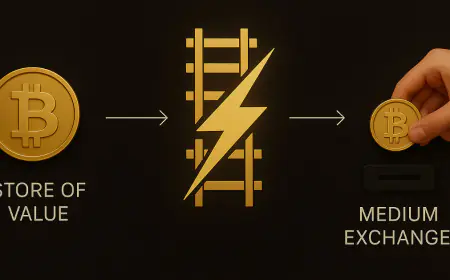

The Bill, officially named the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act, seeks to create a Bitcoin reserve for the US. It has been attracting considerable attention from the crypto community in recent days.

Crypto advocate calls for the community to support the Bitcoin ACT

According to Dixon, the Bill will permanently solve the US debt problem by gradually reducing the powers of the Federal Reserve. This suggests that the privately owned Fed is responsible for the country’s current debt crisis. He wrote that the Bill will:

“Slowly make the #Fed irrelevant. Less #Fed power = less military industrial complex power.”

Meanwhile, Dennis Porter, the CEO of Satoshi Act Fund, has called on the crypto community to message their Senators and ask them to support the Bill. He noted that the Bill requires a cosponsor in the Senate to move forward.

The Bill proposes that the US buy 200,000 BTC under a five-year Bitcoin purchase program. It intends to fund that purchase by setting aside $6 billion from the Fed’s net earnings, reducing the Fed discretionary surplus funds, and revaluing the Fed gold certificates to reflect their current value.

Talks of making Bitcoin a reserve asset gained momentum after Donald Trump endorsed the idea at the recent Bitcoin Conference. Lummis also presented the Bill to attendees at the event. The US national debt is currently $35.04 trillion and is projected to reach $54 trillion within the next decade, according to the Congressional Budget Office (CBO).

With the Government expected to spend $892 billion on interest payments for the debt in 2024, concerns about the country’s debt crisis have grown. Elon Musk recently said that the country is heading towards bankruptcy. Many now believe Bitcoin could be the solution to that problem.

Government adoption of Bitcoin could end Satoshi’s ethos

Meanwhile, not everyone thinks a Bitcoin reserve is a good idea. Macro investment researcher Jim Bianco argued that government reserves have historically caused more harm than good. Therefore, the Bitcoin community should be opposing it. He stated:

“All government reserves, whether the dollar, oil, cheese, or even cars (remember “cash for clunkers”), usually cause more harm than good. Why would Government interference in Bitcoin via a “reserve” be any different?”

He added that even the adoption of Gold as a reserve asset affected its price for 100 years before the US government eventually jettisoned it. In his opinion, Bitcoiners who support the reserve only do so for profit. The US government’s adoption of Bitcoin could send the price of BTC soaring

This is similar to the views of Bloomberg columnist John Authers, who believes that Trump’s endorsement of crypto could end the Bitcoin libertarian ethos. He noted that Bitcoin is already losing some of its fundamental principles, and an official embrace by the Government could make it one with the traditional financial system it was created to supplant.

What's Your Reaction?