Altcoins In The Spotlight As Bitcoin Dominance Flashes Sell Signal

The biggest cryptocurrency in the world, Bitcoin is losing its hold on market supremacy, therefore changing the crypto scene. Analysts believe cryptocurrencies may soon take the spotlight as their market share drops to 55.80% and a confirmed sell signal flashes for the first time since 2020. As Bitcoin’s price battles to sustain its momentum and falls below important trendline support, this sentiment picks traction. Related Reading: XRP Still Below Its All-Time High As Crypto Explodes 107%, Psychologist Says Bearish Signals Trigger Altseason Conjecture The relative strength index (RSI) indicating Bitcoin’s dominance is trading below its midline, therefore reinforcing negative expectations. Such situations have historically cleared the path for what is known as “altseason”—a time when other cryptocurrencies shine above Bitcoin. Experts contend that capital from Bitcoin could move into altcoins, generating instability and fresh investing prospects. The sell signal has just flashed on the Bitcoin dominance for the first time since 2020 Let the real fun of #ALTSEASON begins pic.twitter.com/R9QeCO69YH — Mikybull ????Crypto (@MikybullCrypto) December 3, 2024 This trend corresponds with the lowered holdings among long-term Bitcoin investors, hence it is not only theoretical. Recent data from IntoTheBlock shows that wallets containing Bitcoin for more than 155 days currently only possess about 12.45 million BTC, the lowest number since mid-2022. These balances, declining almost 10%, point to some individuals cashing in gains or shifting their money to cold wallets. Bitcoin: Decline In Long-Term Holdings As the anticipated $100,000 goal for the alpha coin gets closer, Bitcoin’s price has run into strong resistance. Multiple failures at $97,500 have led to big drops. Bitcoin fell even more on Tuesday, selling around $93,940. This volatility is matched by a clear drop in long-term assets, which makes it hard to tell where the market is going. Bitcoin long-term holders are gradually reducing their balances, now holding 12.45 million BTC—the lowest level since July 2022. So far, this decline is less severe than in past cycles. Long-term holder balances have fallen by 9.8% this cycle, compared to 15% in 2021 and 26% in… pic.twitter.com/eA5Cckrgs4 — IntoTheBlock (@intotheblock) December 3, 2024 Although the present drop in holdings is less significant than those in 2021 or 2017, it draws attention to shifting market attitude. Some observers say this conduct shows purposeful repositioning by experienced investors trying to fit changing market conditions. Rare Bullish Signal Provides Hope Among Bearish Mood Even with the negative undertones, a rare bullish indication gives some hope. Recently in line with moving averages, the Spent Output Profit Ratio (SOPR) indicates that Bitcoin might rally in the next one to two months. Such signs are rare, only once or twice during an upward market cycle. Related Reading: Cardano To Hit $10? Analyst Thinks It’s Happening This Cycle Although the bearish pressure is still evident, experts note that these positive signals provide risk-tolerant investors some good possibilities. Consistent with past patterns following halving events, market observers are also preparing for a possible slump as January 2025 draws near. For now, the declining dominance and increasing volatility of Bitcoin highlight the need of a careful yet strategic approach. Whether it’s Altseason or a fresh Bitcoin surge, the next months could change the scene of cryptocurrencies. Featured image from DALL-E, chart from TradingView

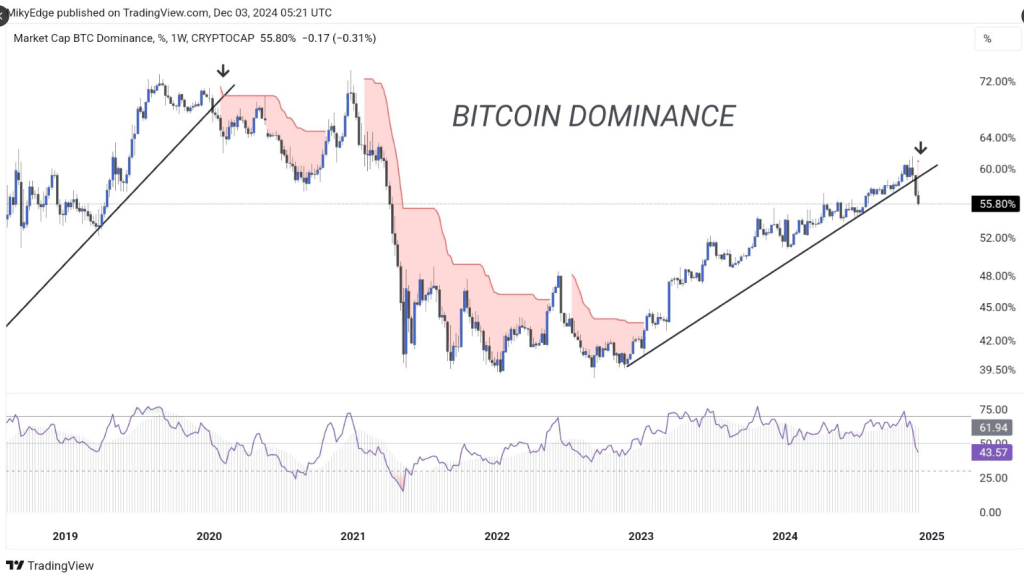

The biggest cryptocurrency in the world, Bitcoin is losing its hold on market supremacy, therefore changing the crypto scene. Analysts believe cryptocurrencies may soon take the spotlight as their market share drops to 55.80% and a confirmed sell signal flashes for the first time since 2020. As Bitcoin’s price battles to sustain its momentum and falls below important trendline support, this sentiment picks traction.

Bearish Signals Trigger Altseason Conjecture

The relative strength index (RSI) indicating Bitcoin’s dominance is trading below its midline, therefore reinforcing negative expectations. Such situations have historically cleared the path for what is known as “altseason”—a time when other cryptocurrencies shine above Bitcoin. Experts contend that capital from Bitcoin could move into altcoins, generating instability and fresh investing prospects.

The sell signal has just flashed on the Bitcoin dominance for the first time since 2020

Let the real fun of #ALTSEASON begins pic.twitter.com/R9QeCO69YH

— Mikybull

Crypto (@MikybullCrypto) December 3, 2024

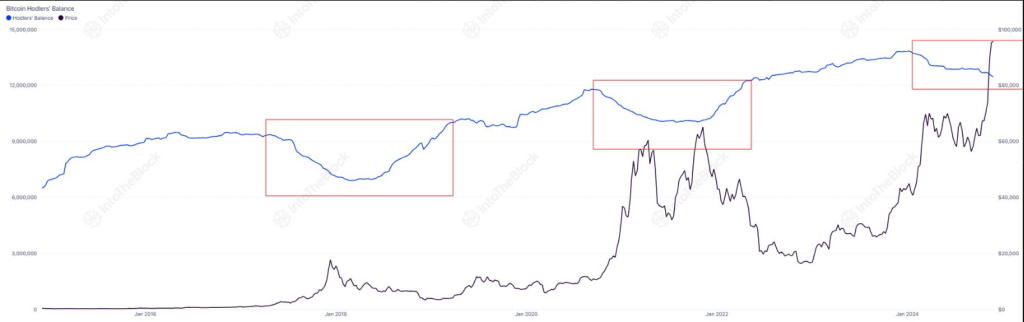

This trend corresponds with the lowered holdings among long-term Bitcoin investors, hence it is not only theoretical. Recent data from IntoTheBlock shows that wallets containing Bitcoin for more than 155 days currently only possess about 12.45 million BTC, the lowest number since mid-2022. These balances, declining almost 10%, point to some individuals cashing in gains or shifting their money to cold wallets.

Bitcoin: Decline In Long-Term Holdings

As the anticipated $100,000 goal for the alpha coin gets closer, Bitcoin’s price has run into strong resistance. Multiple failures at $97,500 have led to big drops. Bitcoin fell even more on Tuesday, selling around $93,940. This volatility is matched by a clear drop in long-term assets, which makes it hard to tell where the market is going.

Bitcoin long-term holders are gradually reducing their balances, now holding 12.45 million BTC—the lowest level since July 2022.

So far, this decline is less severe than in past cycles. Long-term holder balances have fallen by 9.8% this cycle, compared to 15% in 2021 and 26% in… pic.twitter.com/eA5Cckrgs4

— IntoTheBlock (@intotheblock) December 3, 2024

Although the present drop in holdings is less significant than those in 2021 or 2017, it draws attention to shifting market attitude. Some observers say this conduct shows purposeful repositioning by experienced investors trying to fit changing market conditions.

Rare Bullish Signal Provides Hope Among Bearish Mood

Rare Bullish Signal Provides Hope Among Bearish Mood

Even with the negative undertones, a rare bullish indication gives some hope. Recently in line with moving averages, the Spent Output Profit Ratio (SOPR) indicates that Bitcoin might rally in the next one to two months. Such signs are rare, only once or twice during an upward market cycle.

Although the bearish pressure is still evident, experts note that these positive signals provide risk-tolerant investors some good possibilities. Consistent with past patterns following halving events, market observers are also preparing for a possible slump as January 2025 draws near.

For now, the declining dominance and increasing volatility of Bitcoin highlight the need of a careful yet strategic approach. Whether it’s Altseason or a fresh Bitcoin surge, the next months could change the scene of cryptocurrencies.

Featured image from DALL-E, chart from TradingView

What's Your Reaction?