$6.2M in Crypto for a Banana? Welcome to the Attention Economy

A banana taped to a wall sold for over $6 million at Sotheby’s auction house. The payment was made in crypto by Justin Sun, an entrepreneur most notable for founding the Tron blockchain network in 2017. The value isn’t in the banana or even the art. It’'s in the concept, the absurdity, and the sheer*notoriety* of it all.

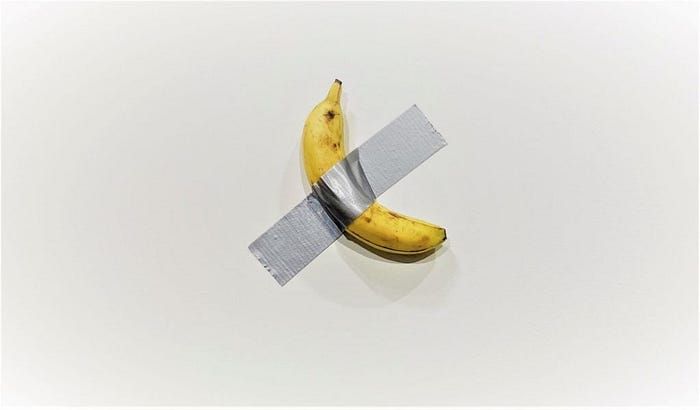

Artist Maurizio Cattelan displayed Comedian at Art Basel Miami in 2019. It was, quite simply, a banana taped to a wall. That banana — or more precisely, the concept behind it — just sold for over $6 million at Sotheby’s auction house. The payment was made in crypto by Justin Sun, an entrepreneur most notable for founding the Tron blockchain network in 2017. The fruit was auctioned off on November 20, 2024.

https://youtu.be/E7pPomFdpLY?feature=shared&embedable=true

\

Wait — sorry, my mistake — it wasn’t the same banana that was displayed in 2019. The banana had actually been replaced because, as we all know, bananas typically don’t last for several years. Instead, Justin Sun was given a Certificate of Authenticity for the purchase, along with the right to replace the banana with a new one whenever he chooses.

\

\ So, what’s the value here? Of course, most people will note the absurdity of buying a banana for $6 million.

\ If the banana itself will rot within days, how can this work of art retain any resale value? Even the most simplistic or controversial works of art that have sold for millions — whether they’re splashes of paint or conceptual sculptures — are tangible objects that can endure and be traded. A banana that can be replaced by another banana? How is that any fun or worthwhile for a collector?

\ This moment, no matter how absurd it may seem, is emblematic of a shift toward a full-fledged attention economy where the digital and physical worlds increasingly merge. A simple banana taped to a wall — destined to be replaced — purchased with invisible cryptocurrency, isn’t really a purchase of the banana itself. It’s what I call “proof of attention.” In this attention economy, the Certificate of Authenticity is the true token of value in this transaction. The banana itself becomes a mere prop in a broader performance art piece. The certificate, a physical document proving ownership and authenticity, is a testament to the fact that, at this specific point in time, someone valued this ephemeral concept at over $6 million.

\ Could it be that, in the future, more moments will be “tagged” with price tags — not because of the beauty or inherent quality of the work, but because of the absurdity of the concept? Perhaps the more absurd a moment, the more attention it garners, and the more its value is derived from this attention rather than the object itself. The disposability of the artwork — its inevitable decay — steers the spotlight away from the piece itself. The value isn’t in the banana or even the art. It’s in the concept, the absurdity, and the sheer notoriety of it all.

\ This work has indeed been crystallized as a meme. And, as we speak, it’s being traded digitally on the Solana blockchain under the ticker $BAN, with a market cap of $143.68 million.

\ There is no actual banana on the blockchain, yet people are trading this token as a digital parallel to the physical piece. One trader reportedly bought $10,000 worth of $BAN and later sold it for over $270,000. This relationship between online bidding and real-world transactions, facilitated by cryptocurrency, is shaping how we assign value — not just to art, but to moments, memes, and cultural icons.

\ In the physical world, transactions like this come with more friction. Perhaps Sotheby’s is one of the few institutions capable of orchestrating such a singularity event. Watch closely — more is coming. You could consider investing in $BAN.

\

:::info Disclaimer: This is not financial advice. Cryptocurrencies are considered high-risk investments.

:::

\

What's Your Reaction?